Market consolidation – or not?

What’s wrong with this chart?

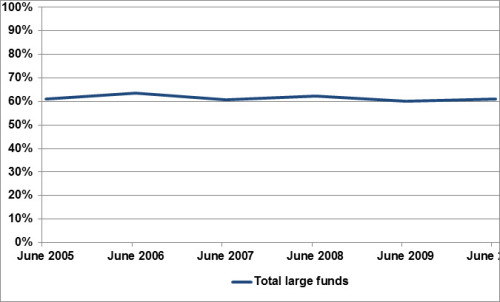

The chart shows the percentage of total super system assets accounted for by funds with greater than $1bn in assets – across all segments including industry funds, public sector funds, corporate funds, and retail (data sourced from annual reports, APRA, and Tria analysis).

As can be clearly seen, the share of large funds is essentially unchanged over the 5 years to June 2010. Given the amount of fund consolidation which has occurred in that time, and which continues to occur, this should come as a great surprise.

So what’s going on? Is consolidation really happening?

The answer is yes – and no. The large funds are indeed consolidating the small funds – the share of system assets accounted for by funds with less than $1bn has declined from about 9% to 5% over the timeframe covered by the chart. But at the same time, leakage from collective funds to SMSFs has seen the share of the latter rise from 24% to 31%.

In other words, 100% of the consolidation gains (and no doubt much of the potential efficiency gains) from small funds merging has been lost to fragmentation by SMSFs. As fast as the industry can merge small funds, the assets are flowing out the back door. In fact, the equivalent of a fund the size of Cbus disappears every year in transfers from collective funds to SMSFs .

Given that one of the key goals of the Cooper Review was to improve the overall scale and efficiency of the system, the lack of any substantive action on this issue must be considered one of its major failures.

This is a flavour of some of the analysis which will appear in Tria’s new all-segments super fund review at the end of the year. This will be a successor to the Tria Industry Fund Review, already established as the bible to the business metrics of the industry fund segment.