SMSF high tide? (has SMSF growth peaked, part 2)

Last week’s Trialogue questioning SMSF growth created a lot of interest – so to mark the SPAA conference we thought we’d follow up with some further analysis.

Let’s be clear – we are not suggesting that SMSF growth has ceased. We are suggesting that the growth rate may have peaked, with the SMSF segment coming back to the pack. While we are most interested in growth in net inflow terms, it can be seen in total growth terms as well.

This is a segment used to growing at an average of 500bps over the super system as a whole. In 2010, SMSF growth over system was down to +250bps, and in 2011 only around +50bps. A segment cannot grow at system +500bps forever. It’s the law of large numbers.

Here are some of the key issues:

– SMSF inflows from employer and member contributions have fallen, and outflows are rising. As last week’s chart showed, net inflows have slowed substantially. Part of the story is the fall in employer contributions to SMSFs due to the halving of concessional limits – although that’s only a 2010 story and the trend is longer than that – and the gradual rise in outflows as more members move into the pension phase.

– By comparison, net inflows to large collective funds have been broadly stable.

– The number of SMSFs does continue to grow and the net increase in SMSFs in 2011 of ~30,000 was similar to the long term average. But this means that the rate of growth of SMSFs is falling as the base increases – a 30,000 increase on a base of 400,000 funds is half the growth rate of a 30,000 increase on a 200,000 base. Furthermore, new SMSFs appear to be coming with smaller balances.

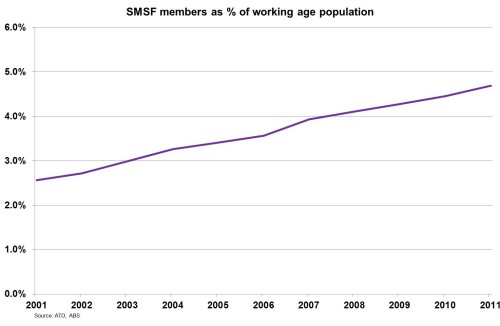

This week’s chart demonstrates that SMSF membership is approaching 5% of the working age population. In other words, you can think of SMSFs as a segment broadly representing the top 5% of the market, with the other 95% in collective funds, ranging from industry funds to wrap accounts.

The chart shows a steady increase in SMSF penetration of the population. So why are SMSF growth rates coming off – apart from the law of large numbers?

The combination of the steady rise in funds and members on one hand, and declining gains in market share on the other, suggests that the average size of new SMSFs is declining. In other words, SMSF providers are starting to fish in shallower parts of the pool, pushing down into the mass affluent market with smaller super balances.

So the slowdown in SMSF growth does not necessarily offer relief to the collective funds. It suggests the nature of the SMSF challenge is changing.

The data provides some support to anecdotal evidence of increasing numbers of small SMSFs being established via rollovers of modest balances. This trend should be of great concern to all collective funds. It poses the threat of SMSFs migrating downmarket – from simply cherry-picking a relatively small number of members with large balances, to invading segments much closer to the centre of growth for many funds.

Next week we’ll (finally) look at the forces which could bring that threat closer and drive the SMSF tide even higher.