Term Deposit rates: is the elephant leaving the room?

High term deposit rates have been the elephant in the room for income objective asset managers since 2008. The traditional retail mortgage fund category looks mortally wounded, and most fixed income funds (and other income funds for that matter) have suffered sustained outflows.

While high headline TD rates have been an important problem, from a fixed income perspective it is the premium that banks have been offering above cash that has been so devastating. This is because investors are only incentivised to take on credit risk via managed income funds if there is an appropriate reward above riskless deposits.

Evidence of this behaviour has been clear over the last four years. Despite strong recent fixed income fund returns, few investors have been coaxed out of the comfort zone offered by deposits. However, there are finally some pointers to a cracking in TD investors’ resolve.

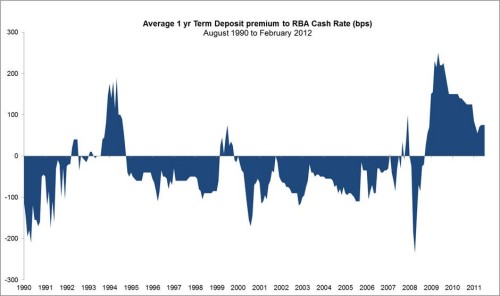

This week’s chart tracks the average premium of one year term deposits to the RBA cash rate, a ratio we have explored previously in our “Wall of Money” Dimensions white paper. As can be seen, one year term deposit rates are normally below the RBA cash rate.

The exceptions have been the early 1990s recession, the late 1990s Asian crisis, and of course the post 2008 financial crisis. Spikes occur, but they come to an end, and historically have ended quite suddenly. While the latest “premium period” has been higher and longer than previous events, there are signs that it could be running a similar course. From a high of 250bps above the RBA cash rate in December 2009, the average rate is now only 75bps over. This gives managed income funds a fighting chance.

Key stats:

– Average 1 year term deposit rate = 5.00%

– Current premium over RBA Cash Rate (4.25%) = 75bps

– 20 year average premium = – 25bps

– Average premium since April 2009 = 136bps

– Highest premium during all crises = 250bps (December 2009)

A quick scan of some of the major cash-benchmarked, fixed income products shows that liquid conservative funds, with high levels of investment grade assets, currently have a gross running yield of nearly 6.4%, or 140bps above the average one year term deposit rate of 5.0%.

Is this risk-return profile enough to justify a move out of term deposits, for the conservative retail investor? Only they and their financial planners can answer that question – however provided the fund fee is reasonable (which may or may not be the case )……it’s now certainly worth considering. And it’s not just a yield premium – many funds offer quarterly or monthly income distributions and daily liquidity – features that term deposits typically do not.

As discussed in a previous Trialogue (Basel III, TD’s, and reincarnation as an SMSF – December 2011): http://www.triapartners.com/triapartners-blogs.php?article=content/Blog-Basel%20III,%20TD’s,%20and%20reincarnation%20as%20an%20SMSF&type=MjI=

structural changes in the global banking system as a result of Basel III, which places increased value on stable retail deposit funding, may mean term deposit rates retain a premium above cash rates, rather than subsiding to a discount. If this is the case then we may not be far away from a new normal.

Therefore, waiting for relative rates to drop further may not be a good strategy for retail income fund managers. If the recent spate of retail targeted hybrid security issues, fixed income ETFs and other alternative income offerings are anything to go by – the competition is certainly not sitting on their hands.

Appropriately priced, diversified and high quality active fixed income investment propositions are now as well-placed as they have been since the onslaught of the financial crisis. In an increasingly disparate and competitive landscape – it’s time to get back on the front foot with quality products supported by intelligent and aggressive marketing.