New financial year – some thoughts for 2012/13

Welcome back from winter holidays, and strap yourself in for a no doubt eventful new financial year in wealth management.

The holidays coincided with young Tom Baker turning 18, which caused me to think about the wealth management industry in 1994, and what we can learn. It’s strikingly similarity in terms of prevailing business conditions; and for the amount of change in the industry structure. This week we look at business conditions.

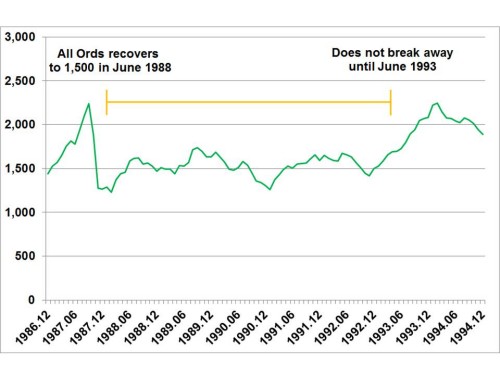

It’s often forgotten how long it took for positive conditions to be restored in the Australian sharemarket after the 1987 crash, as today’s chart shows. After an initial recovery in early 1988, the market was little changed 5 years later. In 1993/4 a bull market commenced which would run to 2000, but by 1994 investors had endured 5 years of directionless, volatile markets. Official interest rates hit 18% as part of the “recession we had to have” as the RBA sought to rein in what it saw as an overheating economy.

Sound familiar?

It was pretty difficult marketing equity investments in those conditions too, certainly to retail investors. Although there was some support for imputation funds, many retail investors ran for the safety of cash. The most popular products for retail investors were cash funds, both CMTs and the cash units of super / rollover funds.

One response was innovation, and three big new product categories emerged during this period, raising billions of dollars from mostly retail investors.

– Capital guaranteed funds, which were super or insurance policies issued by major life offices, including AMP, National Mutual (which became AXA), Colonial Mutual, Prudential, offered investors returns of up to 15% pa – plus a capital guarantee.

– Unlisted property trusts, which promised a growth investment without the volatility of shares – a collective investment in real estate assets plus daily liquidity at NTA. The stars of the unlisted property trust industry were mostly fringe names which are now long gone – Aust-Wide, Growth Equities Mutual, and Armstrong Jones for example, but also some major retailers of the day, notably Advance.

– Mortgage trusts, which offered returns superior to cash management funds – up to 18-19% pa – together with a guarantee and short term liquidity. Supported by mainstream print and TV media advertising, Estate Mortgage in particular became a widely known brand.

None of these innovations ended very happily, particularly for the investors.

The life offices blew their reserves, closed their guaranteed products to new business, slashed crediting rates, and introduced exit fees. Unlisted property trusts suffered a run as doubts grew about valuations. Most were frozen and became AREITs, inflicting tremendous losses as unit prices traded at huge discounts to NTA. Estate Mortgage (like other high yield investments since) made high risk property loans which went bad. It collapsed with investors having to wait many years before recouping even partial returns from liquidation.

Innovation is important in current conditions. We need to break the cycle of gloom, it can be a great competitive strategy, and if done well, it delivers real value for investors. For each disaster above, we could nominate a quiet success. But it reinforces that innovation is not just about a hit new product – it must be about delivering a robust idea and structure which can stand the test of time and deliver on its promise to investors.

So here we are in July 2012, and if 1994 is any guide, there could be a couple more difficult years still ahead. Have we lifted our game sufficiently? Not enough is the short answer.

– Investors have fled the sharemarket again and the most popular product is – wait for it – term deposits. If TDs at 4.5% is the best story we can come up with in 2012, as an industry we clearly need to work on our value proposition.

– Ironically the simplest investments have delivered since 1994 – not just bank deposits, but also high quality shares, and blue chip ungeared real estate. This is especially true in terms of income production, but in general we do a really bad job of selling the income story.

– Communication needs as much work as the experience – this is about useful content and thought leadership, and using technology to restore a direct relationship with your most valuable customers.

– There’s still plenty of room to innovate – so long as investors’ best interests are front of mind.