Portfolio holdings disclosure – yes you do need to know

Portfolio holdings disclosure (PHD) is coming. Sounds boring? Well you need to know about PHD, because it is going to radically change how funds will communicate their investments and exposures to members going forward.

The origins of PHD are now part of industry legend. This holds that the ASIC chairman was unable to get a satisfactory answer about AustralianSuper’s exposure to BHP from an unfortunate team member in the call centre (this may be apocryphal of course). Whatever the facts, the PHD seeds were sown.

As a result, AustralianSuper became the whipping boy for improved portfolio disclosure, which was rather unfair given that their disclosure is near market best-practice, and most of their members are supposed to be disengaged, according to Jeremy Cooper.

So where are we up to?

The legislation is up to exposure draft stage, in the Superannuation Legislation Amendment (Further MySuper and Transparency Measures) Bill 2012, to be exact. It requires trustees to publish data sufficient to identify “each financial product or other property in which assets, or assets derived from assets, of the entity are invested”. This translates to a look-through of holdings on a half-yearly basis with a 60 day lag.

It’s actually more draconian than it sounds. Under the proposals, flows of assets from super funds – through both the custodian and any managed investment schemes – must be “tagged” to identify the flow as being super related. This is regardless of how many layers the flows go through, and indeed whether a vehicle has a relationship with the super fund itself. For example:

– Assume a super fund invests into a multi-manager fund.

– The multi-manager fund invests into a fund-of-hedge funds.

– The fund-of-hedge funds then invests into a range of single manager hedge funds.

Perhaps not the most efficient structure in the world, but not exactly a remote possibility.

In the above scenario, the PHD requirements reach right through to the single manager hedge funds. They have an obligation to disclose all their holdings in respect of the super-related assets, not just to the fund-of-hedge funds, but also directly to the super fund.

This is even though the single manager hedge fund has no legal relationship with the super fund. Creating a reporting obligation to an entity you have no legal relationship with, and perhaps no knowledge of, seems like over-reach to us.

In practice, at least initially, there will be a number of exemptions. PHD will apply only to new arrangements that super funds enter into, and won’t (can’t) apply to offshore assets and interests given limits to the reach of Corporations Act. This means that PHD is likely to be incomplete for at least some time, and perhaps permanently given the inability to apply it to offshore arrangements.

This could be another disincentive to institutional managers creating Australian domiciled vehicles (for say global portfolios) targeted at super funds. All things equal, asset managers generally prefer not to disclose holdings to protect their IP, so why not just use an offshore vehicle to which PHD will not apply? There’s a long history of global asset classes being domiciled offshore for tax or pooling purposes (eg in the Cayman Islands), and now there may be a further incentive to use such structures.

The other challenge for super funds will be to turn PHD into useful information for members, whatever their level of engagement. The benefit of being able to see every line in a portfolio is the exposure of potentially inappropriate assets or structures. The problem is that with potentially thousands of lines of securities, how do you see the forest for the trees?

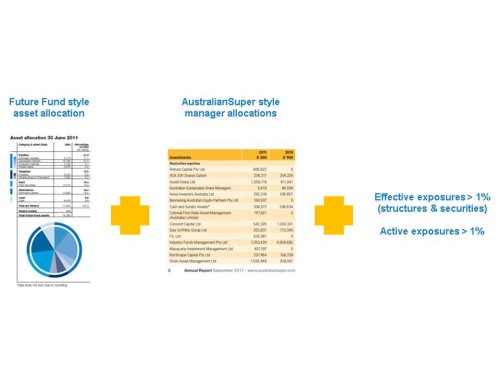

Our proposal appears in today’s diagram:

– Detailed asset allocation (such as that provided by the Future Fund), plus

– Detailed manager allocations (as per AustraliaSuper), plus

– Identification of material effective and active exposures.

But in reality, PHD should really just be one part of a standard disclosure package provided by super funds. It would be far more desirable to have a defined set of readily available key information, including investments, key business indicators, key people, financials, and annual report.