Disrupted days: practical strategies for incumbents

Our recent look at Kodak and FujiFilm was so popular that we thought we would look at some practical strategies for responding in disrupted situations.

Disruptive situations do not occur often in financial services. The industry’s dominant business model tends to be stable for long periods of time – about 20 years for the most recent wealth model – which means that few people now in senior executive roles have had much exposure to such situations.

Coming on top of the usual reasons why incumbents find it hard to respond effectively to disruptive situations, this puts wealth incumbents in a tough place.

Or does it?

There’s no doubt that in disruptive situations, the attackers have most of the aces:

– The prize is huge, and success requires winning only a small slice of market share, so many attackers are encouraged to have a go.

– Attackers have the initiative – they are usually small, fast and flexible, and can choose the time and place where they take on the incumbents.

– They are usually much better at innovation, whether that is new technology or processes.

– They have little to lose (if your new venture fails, you just get a job) and therefore cannot be easily discouraged.

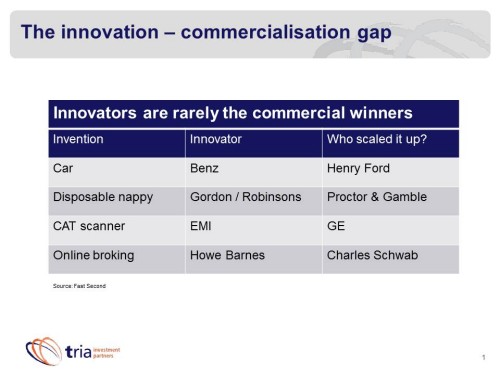

Sounds like a one-way bet. But in fact it’s not the case. One of the most interesting findings of research into disruptive change* (of which today’s table provides a few examples) is that the innovators are rarely the winners in the long term.

In reality, for all their advantages, the innovative first movers are usually overwhelmed by another type of competitor – the incumbents which figure out how to respond.

The first part of a successful incumbent response is to be alert and responsive.

Incumbents often fail to identify threats because they are unfamiliar, seem minor, appear far off, or come from an unexpected direction. So they don’t respond until the threat is obvious – by which time the attacker may have penetrated their core markets and it is too late.

Inaction can be fatal. Being on the front foot in responding to threats does mean you can box at shadows, spending budget on potential threats which turn out to be nothing. But from a cost-benefit point of view, it’s a no-brainer.

The second part of a successful response is to understand the relative strengths and weaknesses of attackers and incumbents. No-one can be strong everywhere, and that is true of attackers as well.

Attackers are great at innovation, creating new markets, and disrupting existing markets. What they’re not good at is scaling up the opportunities which they create – and subsequently capturing the commercial returns. This is because attackers usually lack assets which are critical to achieving these goals:

– Cash

– Brands and awareness

– Distribution channels and marketing and sales capabilities

– Industrial scale and quality operational processes

– Experienced managers

It’s not easy to turn a promising idea into a major business. It needs a huge amount of capital, not to say time, to build the organizational capabilities which attackers usually lack and which are essential for scaling up.

Who has these assets? Incumbents, of course.

And therein lies the message for incumbents. Not only is a successful defence against disruptive attackers possible, you can also eat their lunch. Attackers can be copied, acquired, collaborated with – or crushed – and in doing so, incumbents can capture the commercial returns of the opportunity.

In disrupted days, you can definitely win by moving second, so long as you move quickly.

*see Markides & Geroskis’s “Fast Second”, 2005