Wealth’s Kodak moment?

As it gradually sinks in that we are working in a disrupted industry, it’s becoming increasingly common to hear the Kodak case study being brought up in discussions.

Kodak (strictly speaking Eastman Kodak) was the dominant player in the photographic film and supplies industry for pretty much 100 years from the 1890s when the combination of cameras and film revolutionized the taking of images. That’s one hell of a long S curve. But within 15 years of the top of the curve in the late 1990s, Kodak was bankrupt.

Kodak is a good study of the problems that incumbents encounter in responding successfully to disruptive change. It’s not like Kodak didn’t see the digital challenge coming. Studies had been undertaken within Kodak since around 1980 that accurately predicted the switch from film to digital, and it started developing digital cameras in the mid-1990s.

In the end, and despite having the world’s best known brand in imaging, none of it made any difference. Without doing a specific diagnosis on Kodak, there are a number of reasons why incumbents often fail in the face of disruptive change:

– Incumbents benefit from the status quo; the last thing they want to do is encourage change.

– The threat is unclear, comes from an unfamiliar direction, or looks like a small or low margin opportunity, leading many to dismiss it until it is too late.

– There is a (perfectly rational) desire to protect the existing business and maximize returns, rather than risk cannibalizing it.

– They can’t move quickly enough due to internal bureaucracy and slow processes.

The Kodak case study is ominous in that one might be tempted to draw parallels between the camera plus film business model, and the wealth industry’s platform plus fund. However we think this is too simplistic, and that they are different types of decisions (although definitely food for thought).

More importantly though, Kodak doesn’t offer too much in the way of positive lessons for those having to respond to disruptive change.

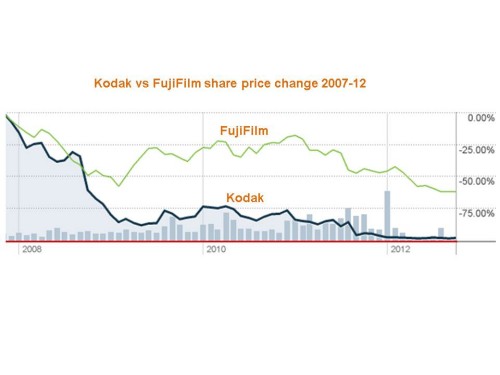

We think it is more instructive to look at Kodak’s main competitor, FujiFilm. After all they were in a similar place, yet FujiFilm escaped Kodak’s fate. As the chart suggests, it hasn’t been a cakewalk for them either, with the share price down 50% in 5 years. But at least it’s not down 100%, and they lived to fight another day.

How did they do it?

In a practical sense, what FujiFilm did well was find new, high value applications for its key knowledge and skills. Amongst its successes (there were plenty of failures as well), it became the dominant supplier of optical films required for flat screen panels. They survived because they found new customer segments, some experiencing rapid growth, which required specialist skills and inputs which could not be easily replicated by competitors.

But perhaps the real key to survival was that FujiFilm accepted that their core business – photographic film – was probably dead in the long term, and therefore that modest diversification measures were not enough. Rather, they had to find new core business lines for their skills, and harvest the declining core film business to fund them.

Sounds simple in theory. It’s actually a prettied-up description of what is often an ugly process of severely pruning the headcounts, products, and budgets of existing businesses, while acquiring new businesses and developing products with the potential for substantial growth. It’s anything but pretty in practice, but that is often the reality of responding to a disrupted industry.

The other lesson from disruptive change is that the competitor you really need to worry about is generally not the current adversary. After all, the real destroyer of Kodak’s business was not FujiFilm, but the smartphone.

Sources: for this Trialogue we’ve drawn on themes from Clayton Christensen’s work on disruptive innovation, Markides & Geroskis’s “Fast Second”, 2005, Andrew Hill’s Kodak series, Financial Times April 2-4 2012, and The Economist’s “The Last Kodak Moment” January 14, 2012.