Unstoppable – why the rise of SMSFs will continue

Over the past couple of weeks we’ve looked at some of the issues linked with the rise of SMSFs – in particular losses arising from incompetence and fraud. The rise of SMSFs is far from cost-free. In the quest for control and avoidance of collective fund fees, a whole new set of risks and costs – often higher – is incurred by members.

But today we’ll give you three reasons why the rise of SMSFs is unstoppable – for now at least.

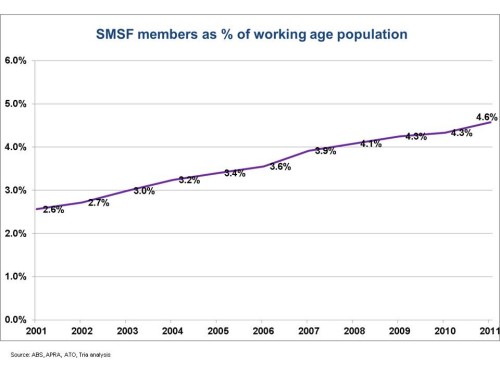

By this we mean that SMSFs will continue to increase their share of members and assets in the system. The SMSF asset growth rate is coming off as members start to retire, but the growth of member penetration continues largely unabated. Every year, another 0.2% of the working age population, roughly 50,000 people, is leaving the collective system for SMSFs. Here’s why we think that will continue;

1. Strong Demand, Unlimited Supply: SMSFs are legal, after all, and so flexible as to make them irresistible for many members with larger balances.

The scope for customized investment strategies, legitimate and not-so-legitimate, is almost unlimited, making SMSFs just as irresistible to suppliers, including the accountants who so often establish them, and capital gatherers of all kinds. Strong demand and unlimited supply means plenty of fuel for the SMSF fire.

2. Changing preferences plus technology: The rise of SMSFs is consistent with what we have seen in other industries – the rise of individual arrangements at the expense of collective approaches.

At the ASFA conference last year we put forward the hypothesis that the super industry could go the way of package holidays.

Think about how the travel industry was organized just a dozen years ago. Travel was booked via a travel agent, over the phone, or in person. Holidays were often sold as a package of flights, accommodation, meals, and other pleasures. Why? Because travel agents had monopoly access to the airline and accommodation booking systems! This made it difficult for all but determined individuals to make their own travel arrangements.

Changing preferences and the rise of the internet put paid to that. Suddenly individuals had access to the systems, could make their own arrangements, and build their own packages. The travel agent industry was decimated (as have been other types of intermediaries).

Collective super funds also sell a package – of asset management, tax, administration, and other services. And collective funds had a (near) monopoly over access to capital markets – particularly for shares and deposits. It has been possible to run an SMSF for a long time, but without easy, affordable access to the major capital markets, it’s not a mass-market proposition.

Sound familiar? Changing member preferences and the internet has changed all that too, fueled further by some loss of faith in professional management. Increasing numbers of engaged members – particularly those with large balances – now have direct access to their preferred capital markets at affordable rates thanks to online banking and broking. That takes SMSFs into the mainstream.

3. Risk Ownership: Finally, it’s hard to argue with the desire for direct control when you are part of a defined contribution (DC) system, such as Australia’s.

In a defined benefit fund, members generally receive a multiple of salary, and the employer bears all the investment risk involved in generating that benefit. The only thing that members really care about is solvency of the employer. They don’t care about the fund’s investment strategy – it’s not their problem.

In a defined contribution fund, it’s the contributions which are defined, not the end benefit. Members bear the investment risk, including if the trustee of a collective fund gets unlucky, or simply gets it wrong. The government backstops this via compensation in the event of fraud, and via the age pension in the event of investment catastrophe. But in general the member carries the risk. It doesn’t seem unreasonable they should take ownership of that risk.

Those are three powerful reasons why SMSFs will continue to rise.

It’s no justification for the largely unregulated free-for-all that we see at present in the SMSF segment. Rather it’s a strong case for the large established players in super – both retail and not-for-profit – to enter the segment in a manner which makes sense, to industrialise it and take costs out, and to clean up the current practices which prevail.