ASFA 2012: can funds provide viable alternatives to SMSFs?

At last week’s ASFA 2012 Conference in Sydney, Tria and SuperIQ presented a session titled “The Empire Strikes Back: can retail and industry funds provide a viable alternative to SMSFs”.

One of the oddities of the contest between collective funds and SMSFs is who has been cast as goodies and baddies. For the ASFA session topic, the collective industry was cast as the Empire. I was working on the presentation with one of the Tria team who was not that familiar with the Star Wars story, but knew enough to ask the obvious question. Isn’t the Empire the bad guys? How come the collective funds are the bad guys in this story?

It was a fair question, because in the contest and public debate between collective funds and SMSFs, somehow the collectives have indeed become the bad guys, with little distinction made between retail collective funds and not-for-profit.

Can collective funds of all stripes provide a viable alternative to SMSFs? Yes, and there could be worthwhile gains in terms of retention.

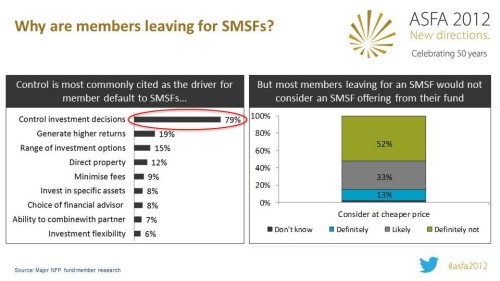

This is borne out in today’s charts exploring why members are leaving for SMSFs, kindly supplied by one of our not-for-profit fund clients. It’s a significant fund, with good investment results, which enjoys a strong reputation with its members. It’s coming from a position of strength.

The primary reason cited by members leaving for SMSFs is control, and that is what this research finds as well in the left hand chart. No surprise there. Other important reasons included a fifth of the sample which believed they can beat the fund in achieving investment returns, and an eighth which wanted to invest in property.

The really interesting part is depicted in the right hand chart. After being asked why they had left for an SMSF, these members were then asked in essence “If we had offered you a competitive SMSF solution, would you have stayed?”.

Nearly half of the members came back into contention, being likely or very likely to have stayed. Allowing for some response bias, this is encouraging, suggesting that there are worthwhile gains in retention to be had from an SMSF solution strategy – perhaps a third or more of SMSF destined outflows.

The other noteworthy aspect to understand is why the half responding “definitely not” felt that way. The “definitely nots” fell into a couple of main groups:

– A group which simply rejected dealing with institutions of any type.

– A group which intended to pursue a path with their super that they felt their fund would not approve of, even in an SMSF solution context– such as strategies involving exotic assets and gearing.

This suggests there is more going on than simply controlling investment decisions. That is a pretty fair summary of the two faces of SMSFs – a legitimate trend towards taking control and accountability, mixed with some more concerning practices.

In this context, should collectives seek to provide a viable alternative? The answer will vary with each fund and its members’ profile, but as a group, we believe so. There is a strong case for the SMSF segment to be:

– Cleaned up of its more concerning investment practices (think gearing, residential property, and personal use style assets).

– Civilised via introduction of better processes, governance, and regulation.

– Industrialised via technology to deliver a much lower cost structure.

It’s the collectives which have the resources to undertake these, with potentially a lot to gain in terms of reduced outflows. In the process of working through the issues, collective funds will also end up with a better, more competitive proposition for their members – even if they do not ultimately pursue a specific SMSF solution.