CSS – Australia’s strangest super scheme

Australia has some pretty interesting super funds. In Tria’s new edition of the Super Funds Review, the large fund universe ranges from AMP at the top with $68bn, to little AMIST at the bottom with $1bn. In between there are funds of virtually every type imaginable.

But one of the strangest has to be the Commonwealth Super Scheme (CSS).

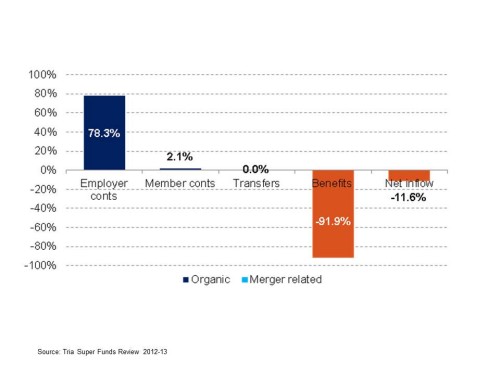

CSS has a redemption rate of 92%, as today’s chart shows. That means that nearly all of its assets were paid out last year to members in benefits. Yet it struggles on with one of the most extreme cashflow profiles imaginable.

CSS is a special case. It’s one of the defined benefit funds for Commonwealth public servants, the other main schemes being the Public Sector Super Scheme (PSS, also defined benefit) and PSS Accumulation scheme (defined contribution).

Long closed to new members, CSS still has over 130,000 members (mostly pension members) drawing benefits from a pool of assets which is now down to $4bn. The number of members fell by 3,000 last year (much via mortality, presumably), but at that rate it’s still going to be many years before the flow of benefits tails off substantially.

As is obvious, CSS is chronically underfunded and stays afloat only because the Federal Government pours in employer contributions of over $3bn pa. This is vastly more than it contributes for the 238,000 members of the PSS scheme ($700m) or the 121,000 members of the PSS Accumulation scheme ($800m).

Whether the CSS scheme is solvent or not is a technicality of course. When a DB scheme is backed by government, it is ultimately backed by its tax revenues. When that government is the AAA rated Australian Federal Government, it could be 100% underfunded and it wouldn’t matter.

In Australia’s case, the Commonwealth super schemes are also backstopped by the Future Fund, which is intended to be drawn on from 2020 onwards to fill in the funding holes.

What CSS shows nicely is the end-game of the overly generous defined benefit schemes designed for public servants. Defined benefits are easy to promise, but hugely expensive to fund, even without the huge improvements in life expectancy of recent decades. The contribution burden is all too often kicked down the road. Now it’s landing, with 2013’s taxpayers picking up the bill for past generations of public servants. The same thing is happening with state and local government.

That bill, as noted above, is now $3bn pa for the CSS alone, and rising. That’s $3bn which cannot be spent elsewhere in the Federal Budget, and $3bn which the Treasurer must be desperately wanting back in the quest for a budget surplus. He must be wishing CSS members would experience some adverse mortality trends.

The other way of looking at it is that in the absence of the defined benefits burden, the $80bn in the Future Fund could have been spent on future national projects, rather than the future retirement benefits of publlic servants.

Like battleships, defined benefit super schemes like the CSS will never be seen again. Magnificent but unaffordable; but unlike a battleship a defined benefit scheme cannot be sunk off the coast as a new playground for divers. It’s a careless promise which hangs around to haunt following generations for future decades to come.