Trio Capital fraud: all but certain to be repeated

The Government’s response last week to the report into the collapse of Trio Capital (that’s Trio, not Tria), and the associated Treasury Review of the Trio Capital Fraud and Assessment of the Regulatory Framework is unconvincing.

Attention has focused on the proposed further tightening of capital and PI requirements on advisers, and the decision to leave the door ajar on last resort compensation. Conflicted advice implicitly seems to get much of the blame for Trio, but other fundamental issues have been rather whitewashed.

The Treasury review sheds light on what actually happened, though the picture remains incomplete.

– Investors exposed to Trio through collective super funds were compensated

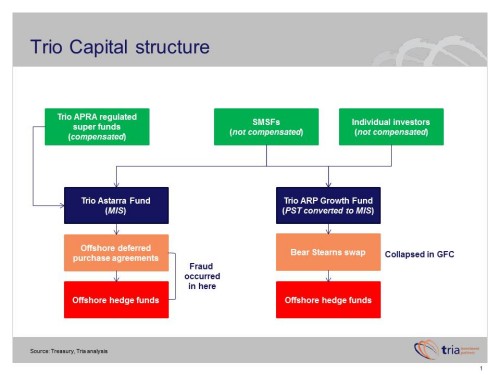

Members of super funds of which Trio was the responsible entity lost 20-25%, but being APRA regulated super funds, were compensated. The super funds were partly invested in the Astarra Strategic Fund, a Trio managed investment scheme (MIS). Astarra invested in offshore hedge funds via a complicated structure. A fraud within that structure saw the entire amount lost.

– Investors exposed to Trio funds through SMSFs or personally were basically hung out to dry

SMSFs and non-super investors who invested directly into Trio managed investment schemes (MIS) lost everything. Two Trio funds were involved – Astarra, and the ARP Growth Fund. ARP Growth Fund was a curious vehicle. It started life as a PST. Trio was appointed as its trustee in 2004, and in 2007 converted it from a PST to an MIS – something I’ve never heard of before.

– The regulators are (dubiously) absolved of blame

APRA and ASIC come out pretty well from the review, and half a page is spent listing reasons / excuses why APRA failed to detect a huge and long running fraud, despite concerns (albeit initially low level) dating back to 2005. APRA did not commence a formal investigation until late 2009, and only then because of a whistleblower in the investment community. By then it was all too late.

The reasons / excuses boil down to “we didn’t want to start a run on the fund on the basis of limited evidence”. But there were red flags over an extended period. When the Trio board and management team were unable to provide accurate valuation data in response to an APRA review in late 2008,that should have been the signal to send in the troops.

– It’s largely business as usual – SMSFs remain highly exposed to fraud

The response confirms there is no compensation for SMSFs, and that they cannot get inside the flags by investing via PSTs. As a result, there’s a strong case here for SMSFs offered by large financial institutions or investing in funds issued by large firms. It doesn’t guarantee against fraud, and there’s still no formal compensation, but you stand a much better chance of being made whole in such an event. A large financial institution simply couldn’t afford the brand damage.

– Although claiming a comprehensive response to combating super fraud, the Government seems pretty nonchalant.

The issue of investment fraud has been referred to “Heads of Commonwealth Operational Law Enforcement Agencies (HOCOLEA) for on-going consideration”. Not exactly sending for Elliott Ness and the Untouchables. The Government did accept recommendations to elevate warnings to SMSF trustees that they are not eligible for compensation in the event of fraud, stating that:

· The ATO has updated its website

· ASIC has updated its MoneySmart website

· The ATO may add additional warnings in its SMSF registration process

· ASIC will consult on requiring advisers to warn prospective SMSF trustees

However I couldn’t find any warnings at all on the ATO super or SMSF websites (send me the link if you know where it is). The ASIC warning is here – https://www.moneysmart.gov.au/superannuation-and-retirement/self-managed-super – about two thirds of the way down the page behind fees. Are these elevated warnings? You be the judge. For me, this is not being taken very seriously, and it certainly won’t dissuade any self-respecting fraudster.