All I want for Christmas is sustainable group life

Earlier this year we looked at how group life had become a hot topic, thanks to large premium increases being communicated to members (First State Super has just issued a Significant Event Notice in one of the latest examples) and the prospect of more to come. What is causing this dynamic, and what are the broader implications?

Historically group life is not the glamour end of the industry. Group schemes are designed to offer a low cost, minimum level of default cover, priced for the group as a whole without underwriting of individual members. Benefit levels are designed to be too low to attract non-members to switch into the group, reducing selection risk.

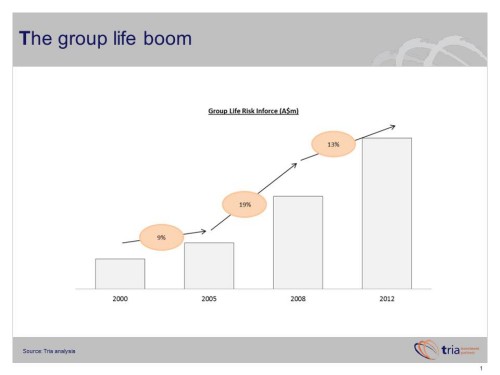

Margins in group life tend to be volatile, but over the cycle the average insurer expected to beat their hurdle rate (12–15%) while top players would do significantly better. That has broken down. What we are seeing now is not just cyclical – it’s a result of an industry structure fundamentally changed by a period of rapid growth from 2005-9.

So what changed? Simple really:

– Large not-for-profit funds used their scale to increase cover, improving member benefits and creating a source of differentiation.

– Insurers and reinsurers saw an opportunity to rapidly grow premiums without much additional cost or investment.

Underlying this was a core assumption that Australians were massively underinsured. Quantum growth was to be expected. In fact, it should have been ringing alarm bells.

Pricing and risk assessment standards suffered in the chase for growth. But the real problem was that the industry moved from offering a minimum level of default cover, to benefit structures and amounts that would internationally only be available with full medical underwriting.

On our numbers, the standalone group segment will generate returns on capital of –10% in 2013; from 2010-14 the cumulative figure is also likely to be negative. Gross returns (ie before reinsurance) are even worse; reinsurers have in the past 2 years alone reported losses of more than $500m on group business.

So prices will keep increasing, and potentially by more than what we have seen in 2013. Massively higher insurance prices have implications for keeping members in the group, and could lead some to opt out altogether.

But this is more than cyclical forces playing out, and price increases alone won’t be enough to restore stability. There is a need to re-assess the role of group insurance (whether as default minimum cover, or something more), and adjust benefit structures and risk assessment / claims practices accordingly.

There is also a lesson here about what happens when the industry is too willing to believe a growth story, and too slow to assess the implicit trade-offs and risks.

The underinsurance gap is an example. Ideally Australian households should buy more insurance. By the same token, they should also settle for a smaller dwelling in a less attractive area, take out smaller mortgages, pay it off faster, and take fewer overseas holidays. They should be more realistic about the lifestyle they can afford while working, and in retirement. They should spend less and save more – then they might not need 10x death cover, or $1.5m on retirement.

There are many “shoulds” when it comes to household finances. But households don’t necessarily make rational decisions, and they probably won’t choose to spend more of their finite budgets on insurance. They haven’t in the past few years despite once-in-a-lifetime pricing, a relatively favourable economic environment, tax incentives and education campaigns.

There is a valuable role for research and advocacy, even if the impact is incremental. But as an industry we should question whether such objective research (whether relating to underinsurance, the retirement savings gap, or longevity risk) provides a realistic basis for growth. And even if it does, we need to be more disciplined in asking what structural changes are required to realise and support such growth, and whether these are sustainable for customers and providers.