Super’s new normal – low single digit growth

New normal is a much overused term, but peculiarly applicable to the post-financial crisis world for super.

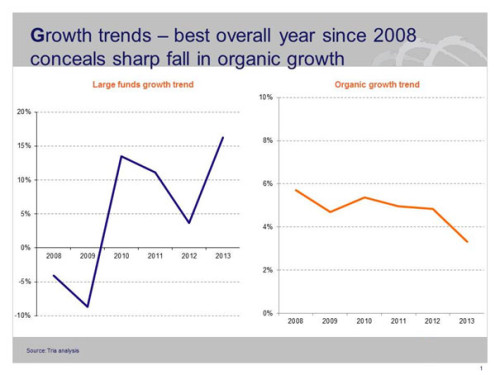

Australia has been used to a super industry of double-digit growth rates, with investment returns pepping things up further. Indeed, 2013 was like the good old days, with the system growing by 16% – the best annual growth since at least 2008. It was champagne all round with large collective funds growing just as fast as SMSFs.

But, and there’s always a but, as today’s chart from the 2013-14 Tria Super Funds Review illustrates, the heady growth of 2013 conceals an increasingly clear but awful truth – the underlying growth rate of super has fallen to low single digits. Sure, there are still investment returns to add to organic growth, but depending on your view of returns, we’re probably only talking high single digits on average.

The super system’s momentum is ebbing. And in the absence of helpful tax or regulatory change (hard to imagine), it is more likely to keep drifting towards zero than stage a significant recovery, unless the baby boomers panic and make a desperate last attempt to shovel money into super as they retire.

We shouldn’t really be surprised. Concessional contribution caps have not been lifted in years, discretionary contributions have only partly fully recovered from the beating they took in the financial crisis, while demographic forces are pushing up benefit payments.

Indeed a bull market actually makes things worse, at least initially. As the value of the fund rises, so too does the value of benefits being paid, all things equal. With no material corresponding gain on the inflow side, net cash flows get crunched.

What does low single digit growth mean? The issues are extensive, but here are three big ones:

– You can’t just surf the wave into shore anymore. What was a tidal wave is now more like a gentle swell. Success in super now requires more than simply turning up – this has major implications for owners of wealth businesses.

– Performance differentials become increasingly stark. It’s a little like the Warren Buffett saying “when the tide goes out you can see who has been swimming naked”. The tide may not have gone out yet on super, but it’s certainly not flooding in anymore. And although cash flows overall are becoming sparse, some competitors still have large inflows, while others have little or even negative flows. That will result in significant changes in market share and ranking positions.

– Competition will continue to intensify further, because achieving decent growth rates will require taking market share from others.

In other words, if you’re in super, you’d better have a good strategy, to attack or defend depending on your position. If you’re a supplier to super – such as asset managers – you’d better understand the implications for super products, portfolios, and costs,

That said, even with a more challenging macro view, super remains a huge market, and there are still plenty of trends which allow for above average rates of growth. Examples include the trend of some member segments towards self-direction (SMSFs being the main beneficiary so far), and the shift from accumulation to pension, where member numbers and assets are already growing rapidly. And that’s before you consider the impact of possible externally imposed changes such as a weakening of the links between super and industrial awards.

It is an exciting time in super, and as things get tougher, it is truly “game on” in terms of competition. Over the past ten years, you could pretty much mind your own business and focus on your particular client base, secure in the knowledge that the rising tide lifted all boats. The next ten years looks nothing like that.

All this – together with all the metrics that matter in super – and much more, are in the 2013-14 Tria Super Funds Review released next week. Make sure your business has subscribed!