Gearing and the missing SMSF taxes

Having established that the SMSF segment has not paid a decent amount of net taxes since 2009, we’ve drilled a bit down further into the SMSF tax return data.

The key drivers of the missing SMSF taxes are (a) around half the assets in the segment are in the (for now) tax exempt pension phase; and (b) the use of franking credits. Demographic drift means that ever increasing amounts of SMSF assets are becoming tax exempt. On our numbers, the SMSF segment is never likely to pay much (if any) tax, other than in years of bumper realized capital gains – and then only within those SMSFs still in the accumulation phase.

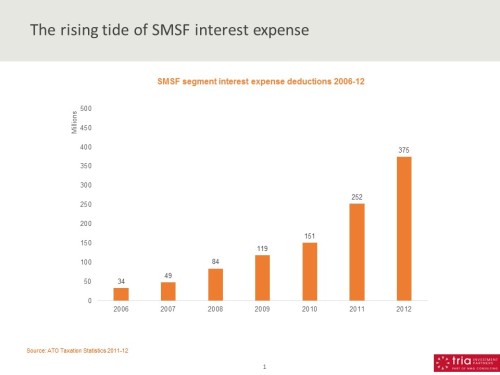

Even here strategies are spreading to reduce taxes in the accumulation phase. Interest expense may not be the biggest tax deduction for SMSFs just yet, but as today’s chart indicates, it’s the fastest growing. And how.

Previous ATO data has indicated SMSF borrowings of ~$6bn in 2012, and an interest expense bill of $375m pa is broadly consistent with that figure.

But this is not the whole picture in respect of SMSF gearing and interest expense deductions – the data covers only what appears on SMSF tax returns. It’s also common for SMSFs to achieve gearing outcomes by investing into internally geared unit trusts; such as private property trusts. Note to SMSF fans, yes APRA funds can use this strategy too, and sometimes do.

So it’s impossible to get a complete picture of SMSF gearing without a look-through to underlying trust holdings, which is beyond even Trialogue this week. But we’re probably looking at overall annual interest expense in the vicinity of half a billion dollars.

An increase of 10x in just 6 years is quick in anyone’s estimation. Why is SMSF gearing and related interest expense rising so fast?

– Part of it no doubt is simply because they can. The previous Coalition government, in its desire to clear the way for SMSFs to invest in Telstra privatisations via warrants, carelessly changed the rules to allow pretty much anything to be geared up.

– Another part is that self-directed investors, an important SMSF segment, tend to like real estate as an asset class. But the ticket size of real estate is too big for many SMSFs. The use of gearing brings it within reach of the SMSF mainstream.

– And there are some powerful tax incentives, despite getting only a 15% tax deduction within super, compared to perhaps 49% outside (come the new financial year).

Tax incentives in favour of gearing arise because of the potential tax arbitrage between the accumulation phase, taxed at 15%, and the pension division, which is tax exempt.

This makes buy-and-hold a desirable strategy. The idea is to buy quality assets – blue chip shares and property for example – in the accumulation phase, and avoid selling them until the pension phase. The SMSF pays 15% earnings tax on dividends (prior to applying any franking credits) and rent distributions during the accumulation phase, but because the capital gain is not realized until the tax exempt pension phase, capital gains tax is deferred forever.

Gearing up takes the idea a step further, because of the incentive to convert taxable income into capital gains on which tax might never be paid. Gearing in super (which generally means an SMSF in the case of individual investors) allows the following:

– More assets can be acquired – a larger block of shares or a bigger property.

– Accumulation phase income is reduced or eliminated – thanks to interest expense

– Franking credits and other tax advantages can be preserved or magnified

– A larger tax exempt capital gain can be achieved (assuming the strategy plays out), by selling down in the pension phase

It’s completely legal, but another force which means the prospect of the SMSF segment pulling its weight in terms of paying tax will keep receding. It’s another reason to equalize tax rates by imposing the 15% accumulation phase earnings tax rate on the pension phase too.

Taxing pension phase earnings would see SMSFs again make some contribution to tax revenues (there’s no fundamental reason why the pension phase should be tax exempt). It would also remove some of the undesirable distortions you see in investment strategies and structuring, such as increased gearing, when tax arbitrages exist.