Active managers are doing better than you think

The active/passive debate has been raging for years, fuelled most recently by research from the Grattan Institute (and subsequently seized upon by the Financial Systems Inquiry) focussing on reducing the cost of super as we discussed in an earlier Trialogue.

Our house view on the issue will come as no surprise to most of you: both active and passive investment strategies have their place. Without getting into the often passionate debate, it is clear to us that passive strategies cannot exist without active managers conducting price discovery through their research. In fact the more passive investors who invest according to a defined set of rules, the greater the opportunity that active managers will outperform. A share market dominated by index investors will be less efficient and create more arbitrage opportunities for active managers. So we think they actually co-exist quite happily.

Whilst we find ourselves somewhat uncomfortably on the proverbial fence, we do have a strong preference for the debate to be informed by accurate information. To this end, we’ve done some analysis on large-cap Australian equity funds. We have focussed on the funds we cover in the Tria Managed Funds Review – a cleansed data set covering the managed funds that matter in the Australian market (the surprisingly small-subset of funds that has >$50m in FUM).

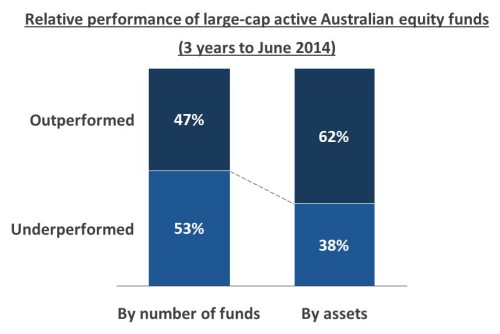

What this analysis shows is that it is true that the majority of large-cap, active Australian equity funds underperformed the index over three years to June – this is in line with most of the other stats that are published. However what it also shows is that investors (quite rationally) favoured funds that outperformed such that only 38% of the money invested in large cap Aussie equity funds was in products that underperformed. So almost two thirds of money in the active funds beat the benchmark after fees. We think that’s pretty good and is in stark contrast to most headlines you see on the subject.

There are a couple of other interesting take-outs from this analysis:

- Someone is picking up the underperformance slack from retail investors. Of course, everyone can’t outperform so if retail managed funds have done better than average, another group of investors have under-performed. So who could it be? It’s most likely the direct equity portfolios of SMSFs, large institutions investing via mandates or foreign investors.

- The analysis seems to show that big funds outperform smaller ones – this is in defiance of the popularity of boutiques and suggests that capacity concerns (in large caps at least) shouldn’t be widespread.

- Fund returns aren’t normally distributed – they are skewed in investors’ favour because funds that outperformed did so by an average of 2.6% per annum (after fees), whilst those that underperformed were on average 1.95% shy of the benchmark.

So whilst we maintain our position that passive strategies have a strong future we think it’s useful to understand that active managers have been adding value, too.

We’ll take a closer look at passive strategies in the next few weeks with a look at just how well ETFs are doing compared to their non-listed counterparts.