Flat insurance commissions: will it improve customer outcomes?

February 24, 2015

In the wake of FoFA, there is increasing acceptance that there will also be reform of retail life insurance commissions.

There is coalescence around a move to flat commissions, despite the lack of common ground between stakeholders. Insurance advisers lack a coherent narrative, while insurers’ views are polarised based on their experience. There are reform alternatives, but also a sense that the industry has missed its chance to advocate seriously for those alternatives.

Imposing a flat commission structure in an effort to reform adviser incentives and reduce industry-level lapse “costs” sounds sensible. But it’s not clear that this contributes to a goal of improving customer outcomes, nor what unintended consequences may result.

What’s the starting point for the customer?

- As we’ve highlighted previously, contrary to the popular view, Australians have considerably more life risk cover per head (excluding annuities and investments) than any other developed market.

- The proportion of premiums paid back as benefits is also materially higher than other markets, in part due to the low cost and capital efficiency of stepped premium and group life structures.

- The life industry worries about low consumer awareness and engagement, but there’s no evidence that increasing awareness results in higher take-up or better decisions.

- There are issues around risk ratings, premium patterns, older-age affordability / appropriateness and lapses, but it’s not obvious changing commissions will address these.

In our view, the customer has quite a reasonable starting place and the Australian life industry’s customer proposition is strong relative to other markets (at least for younger demographics). While life insurance is already a material spend for households, there are significant tax incentives, and plenty of channels to access it (advised, direct, group, inside super, outside super). That looks pretty good, particularly compared to health and general insurance.

So how much of a problem is upfront commissions, and do we get an improvement on the starting customer position if we move to flat commissions?

- Upfront commissions are in fact the norm in most developed markets, but they do raise concerns about adverse incentives.

- The data suggests room for improvement. Australia’s placement costs (initial commissions, marketing, sales and underwriting costs as a % of new business) are 25-35% across direct and retail life channels. While that’s not out of line compared to other markets, it does seem high given our tax incentives, and the fact that most people have group life cover.

While there may be room for improvement, there are some caveats.

Presumably clients want their advisers to be active in searching for lower prices and there should be some remuneration for doing so. We seem comfortable with insurers spending large amounts on marketing (another type of placement cost) to encourage consumers to switch every year, so is there really a fundamental difference?

It’s also important to think through the immediate and second round impacts of reform – all too often ignored by Government and regulators, which leave industry to clean up the mess.

This is particularly important because the flipside of a relatively good consumer starting point is a relatively difficult starting point for the retail insurers, in terms of both growth and profitability.

Australia’s unique focus on stepped premiums increases sensitivity to system change, and while group insurers have been re-structuring benefits and increasing prices substantially (because customers have been getting the better side of the deal), there have been no comparable moves in retail.

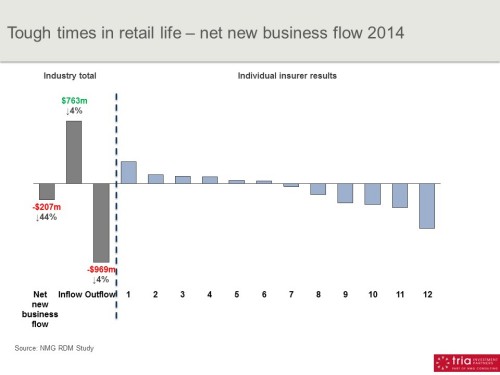

Today’s chart shows the challenging current position for the retail life industry. Customers ceased more premium than they bought in new business in 2014, resulting in negative net new business flow, a trend which is worsening over time.

So what does a move to flat commissions mean for the retail life industry?

No other developed market has attempted such a move, so there are no learnings to take on board. And while we don’t pretend to know all the answers either, here’s one scenario:

- Flat commission reduces adviser focus on life insurance, particularly older clients and complex cases (assuming such clients aren’t disposed to writing a large cheque for advice delivery).

- Over 30% of sales relate to >50 year olds, so less adviser focus on this demographic will hit volumes and non-commission acquisition costs.

- Flat commission at 20% implies a 5% or better reduction in pricing, plus some lapse and selection benefits; we should assume insurers price this through in an effort to gain market share and cover fixed costs.

- With new business now 5–10% cheaper than inforce business, this will drive a wave of switching from old policies to new, and from 10% trail to 20% flat, unless advisers are somehow prevented from being able to secure new pricing for existing clients.

- In practice impacts will vary enormously by book of business, ie the impact of commission change will affect an old, mature book of business very differently to a relatively new one with lots of new business.

In the long run, flat commission implies slightly lower pricing for retail life customers, and potentially lower lapse rates for insurers if risk advice capacity contracts. These are welcome improvements but essentially incremental, and not risk free.

The transition will exacerbate existing challenges for insurers which are already under pressure, and may defer real and necessary reforms to benefits, premium patterns, and risk processes. If this is not sustainable, customer benefits will be fleeting.

More generally, how flat commissions fit with broader policy objectives around advice quality, accessibility, affordability, and customer engagement is far from obvious. It sounds good, but the last thing we need is another catchy sounding regulatory reform which has not been properly thought through.