Low Cost Healthcare Solutions For Employers

Quarter 1 – 2015

Low cost healthcare solutions for employees – a minefield for the employer

If you are facing the dilemma of “what solutions are there for my employees who cannot afford medical scheme cover?” you are not alone. Many employers across South Africa, face the same challenge.

All medical schemes have to provide for the minimum package of benefits as per the Medical Schemes Act. This is called the Prescribed Minimum Benefit package and based on information from the Council for Medical Schemes (CMS) Report released last year, this package can cost anything between R500 – R800 per beneficiary – the average cost being R512.80. This cost is dependent on the risk profile of a particular option so we do anticipate that for low cost options the PMB cost is expected to be lower than the average for all medical scheme members.

If your business offers medical scheme cover, and let’s assume you are only looking at the costs of the employee, we are already talking about a minimum monthly cost of approximately R500 just for the PMB package – let alone optometry, dentistry and other additional day to day or hospital benefits. Let’s assume this employee is currently uncovered and earns a basic salary of R7300 per month.

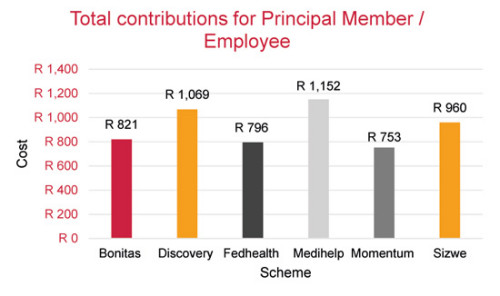

As a snapshot the monthly contributions for this employee on the different low cost options on different medical schemes will be as follows:

This equates to approximately 11% – 16% of this employee’s package.

This equates to approximately 11% – 16% of this employee’s package.

Alternatives to medical schemes

It is therefore no surprise that we have seen a mushrooming of different products (outside of the Medical Schemes Act) in order to provide a solution to employers for the uncovered employees. These products range from Occupational Health products to Short Term Insurance products and in some cases even a combination of insurance products.

Should the draft Demarcation Regulations be implemented as they stand at the moment, products that offer a combination of primary care services and hospital insurance will not be allowed in future.

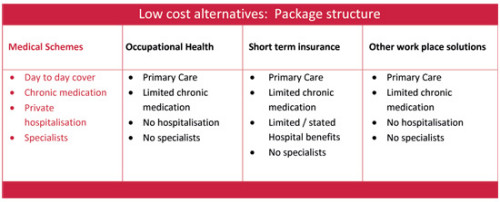

In essence, the package structures of low cost alternatives outside of a medical scheme differ from low cost medical scheme benefit options as follows:

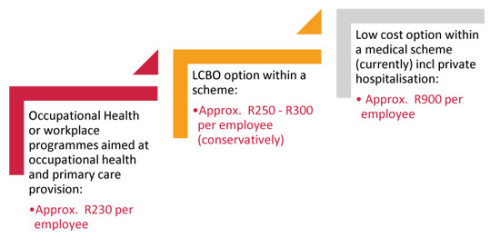

In addition, the contributions and subsidy implications are as follows:

From this we can see that there is no straight forward solution. Rather, there is a lot for an employer to consider and offering a low cost solution to your employees is riddled with complexities.

The Regulator acknowledges this and to this end, we have seen the Council for Medical Schemes (CMS) taking initiative to workshop the design of a Low Cost Benefit Option.

Low Cost Benefit Option – Council for Medical Schemes (CMS)

From the regulator’s perspective, the ideal would be to bring any form of a low cost solution into the medical scheme stable which can then also form a foundation for the roll out of a proposed National Health Insurance. However, the cost of the Prescribed Minimum Benefits package presents an automatic barrier to entry. The Regulator recognizes this and recently released a framework for the introduction of a Low Cost Benefit Option (LCBO) within medical schemes. Some principles to underpin a LCBO are:

– A partial departure from the current PMB requirement

– Contracted networks of primary healthcare providers

– Non health expenditure to be kept to a minimum

– Previously uncovered market to be targeted

– Community rating to apply UK EHIC services (same contribution irrespective of age or health risk)

Industry experts who presented at the recent CMS Indaba estimated these options to cost in the region of R250 – R300 per beneficiary per month but very importantly, this is dependent on measures to prevent potential anti-selection against these options, provider networks, etc.

It is envisaged that the LCBO will offer the following benefits:

- Day to day cover

- Limited chronic medication

- No private hospital cover

- No specialist benefit

Employer landscape

For you as the Executive, this minefield of trying to find a solution for your uncovered employees is going to become more complex and if I can be daring enough to risk a prediction of an employer’s options for uncovered employees, I think it will look as follows:

It is clear that the intention of the regulator is to bring those who are currently receiving healthcare outside of the medical scheme structure, into this environment.

It is clear that the intention of the regulator is to bring those who are currently receiving healthcare outside of the medical scheme structure, into this environment.

As a final thought, I need to state that whilst I am of the view that the LCBO is a great initiative, I am not convinced that the LCBO structure will be flooded with existing uncovered lives. In an environment where employers offer a Total Cost to Company remuneration structure or where they offer a subsidy, they may find it challenging to get employees to co-fund this. The competition for a LCBO is not against other healthcare solutions, but rather against transport fare, air time, groceries, etc. Often these employees would prefer an increase in salary rather than R100 towards medical aid. The success of the LCBO will be largely dependent on the employers’ willingness to pay for this cover on behalf of the employee in full.

As always, there is an open invitation for you to contact me on [email protected], should you wish to raise any matter relating to NMG Benefits or to the healthcare industry in general.

Until next time,

Toska Kouskos