Toska Kouskos Talks Low Cost Medical Schemes

Low Cost Benefit Option (“LCBO”) Framework Approved by

Low Cost Benefit Option (“LCBO”) Framework Approved by

the Council for Medical Schemes (“CMS”)

Your scheme may launch a Low Cost Benefit Option on 1 January 2016!

With mounting cost pressures in the healthcare space, we have seen a mushrooming of different products [outside of the Medical Schemes Act (‘the Act”)] to provide a solution to employers for the uncovered employees. These products range from Occupational Health products to Short Term Insurance products and in some cases even a combination of insurance products.

From the regulator’s perspective, the ideal would be to bring any form of low cost solution into the medical scheme stable. Earlier this year the Council for Medical Schemes (“CMS”) facilitated an Indaba where various industry role-players presented and discussed a framework for the introduction of a Low Cost Benefit Option (“LCBO”) within medical schemes.

On 3 September 2015, the CMS released the principles and guidelines for schemes to prepare their business plans in order to introduce LCBOs effective 1 January 2016.

Schemes have to apply to the CMS for exemption in terms of some provisions in the Act to have a LCBO registered. Exemptions will be granted for 24 months and schemes need to apply for exemption in respect of offering the Prescribed Minimum Benefits and broker remuneration.

Who can be members of a LCBO?

Membership to a LCBO is restricted and only the following members can participate in the LCBO option of their medical scheme:

- Members whose income is below the tax threshold. Currently the tax threshold for 2015/2016 is R6 137 per month or R73 650 per annum.

- Only in exceptional circumstances will the Council allow a scheme to limit the LCBO membership only to a group of members or an employer group. Individuals therefore have to be accepted.

- Also, only in exceptional circumstances will the Council grant a LCBO exemption limited to a specific geographical area where the scheme have contracts in place with networks of providers.

No late joiner penalties can be imposed to members who join a LCBO. However, when the member wants to upgrade to one of the other options, the scheme may impose waiting periods except when the change is as a result of a change in employment, which is standard. What is not standard is the provision that a scheme may not impose a waiting period where the upgrade is as a result of a change in the member’s circumstances resulting in increased affordability for the member.

Benefit Design of a LCBO

The Council has defined a mandatory package for schemes to introduce when they obtain exemption to launch their LCBO option. Schemes may add additional benefits but no LCBO will be registered until the following mandatory benefits are included:

- 5 Consultations per beneficiary per annum: This must be delivered through a network of GPs, Nurses, pharmacies and clinics. A Pre- and Post- natal programme should be included.

- 1 out of network visit per beneficiary per annum

- Preventative Healthcare: This includes cholesterol, blood glucose, blood pressure tests, HIV counselling and testing, TB screening, Pap smears and a few other examinations and vaccines.

- Acute and Chronic medication: To be delivered via the network and subject to an acute and chronic formulary as provided for by the CMS

- Pathology: Basic pathology, subject to referral from the network of providers

- Radiology: White and black X-rays and ultrasound scans, subject to referral from the network of providers

- Optometry: 1 eye test per beneficiary every 24 months; 1 pair of single vision spectacles and standard frames every 24 months, subject to referral from the network of providers. .

- Dentistry: 2 consultations for basic dentistry per beneficiary per annum, subject to referral from the network of providers

- Emergency road transportation, subject to referral from the network of providers

In addition, schemes have to demonstrate the nature of their formularies and network provider arrangements as the CMS will not allow schemes to use the State as the default network provider for a LCBO package. In addition, no co-payment or deductible will be accepted and claims need to be paid at 100% of the negotiated tariff.

Importantly medical schemes that offer a LCBO are still required to maintain the solvency ratio.

Non healthcare expenditure will be monitored by the CMS and they will decline exemption where the non healthcare expenditure is unreasonably high. Broker remuneration for employer groups is limited to 3% of contribution income. Broker remuneration for individuals range from 5% to 10% depending on the contribution of the individual per member per month (up to a maximum of R25 per month).

What are the challenges and what does this mean for the employer?

The aspects that probably pose the biggest challenge for medical schemes, in terms of registering a LCBO, are:

- The scheme cannot impose late joiner penalties but only limited waiting periods

- The scheme cannot limit this product to groups exclusively. Individual anti-selection can therefore occur with high risk individuals joining a LCBO option without having any late joiner penalties imposed. We already see a high degree of anti-selection in low cost options in schemes and we expect that with more lenient underwriting and lower contributions, this will continue in the LCBO space.

- The fact that the LCBO membership and reserves form part of the solvency requirements. With solvency being the accumulated funds as a percentage of contributions, it is expected with membership growth of a new option, that the solvency will be under pressure. At the CMS Indaba, schemes appealed for the LCBO framework not to be subjected to the current solvency requirements.

- Industry experts who presented at the CMS Indaba estimated these options to cost in the region of R250 – R300 per beneficiary per month but stated that it was dependent on measures to prevent potential anti-selection against these options. I would think that with the relaxed underwriting measures and individual nature of the product, the cost of these options will be higher than initially anticipated.

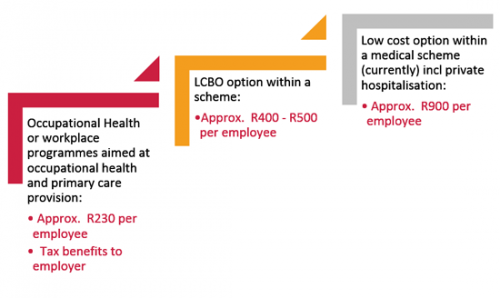

For any Executive, the minefield of trying to find a solution for uncovered employees is going to become more complex and as before, I predict that employer’s options for uncovered employees will rank, as follows:

As stated before, whilst I am of the view that the LCBO is a great initiative, I am not convinced that the LCBO structure will be flooded with existing uncovered lives. In an environment where employers offer a Total Cost to Company remuneration structure or where they offer a subsidy, they may find it challenging to get employees to co-fund this. The competition for a LCBO is not against other healthcare solutions, but rather against transport fare, cell phone air time, groceries, etc. The success of the LCBO will be largely dependent on the employers’ willingness to pay for this cover on behalf of the employee in full.

As always, there is an open invitation for you to contact me on [email protected], should you wish to discuss this matter in more detail or alternatively any matter relating the healthcare industry in general.

Until next time,

Toska Kouskos