The cost consequences of a regulatory merry-go-round

Regulatory change has been and always will be part of financial services – over the years around the world regulatory reforms have helped the industry improve how we serve our customers.

However, the sheer amount of regulatory change over the last five years is unprecedented, and the benefit of some changes is yet to be realised (think MySuper…). Even worse, the changes to the changes (which were then changed again or in some instances, un-changed) has inflicted a lot of time, cost and extra regulatory burden on the industry.

How much has it cost? Nearly three billion dollars!

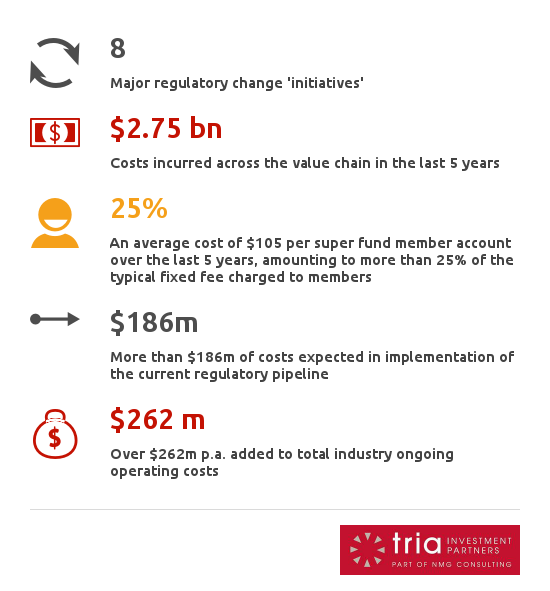

As part of research we undertook for the Financial Services Council, we calculated the industry will spend almost $3 billion dollars in meeting 8 major regulatory change initiatives (FOFA, MySuper, APRA Reporting, SuperStream, Life Industry Framework, Adviser Standards, FATCA / GATCA, and other Stronger Super changes (such as portfolio holdings and product dashboards).

Key findings of our research are:

No wonder so much of the industry say it is overwhelmed by ’reg change’.

Nobody is suggesting regulatory change wasn’t required – and won’t be required into the future. Financial services is a heavily regulated industry for good reason – and those regulations will continue to require adjustment. However, when making changes we must do so in the full awareness of the total cost of change – and the fact that ultimately those costs are substantially borne by customers.

Each and every superannuation member has effectively paid $105 for regulatory changes over the past five years – or 25% of their average account-keeping fee over the same time period. It’s no wonder funds are struggling to bring fees down.

The process

Calculating a total industry figure for change is not easy – each regulatory change has a different impact, and even impacts providers in a different way depending on their complexity and existing business structures.

Thanks to receiving data from a number of providers on actual costs they had incurred in implementing these major regulatory changes (and even their budgeted or expected costs for changes still in process), we were able to identify the major influences on the cost of each regulatory change. In addition, we could also attribute the total cost of across the value chain (ie advice, super, asset management and insurance).

This allowed us to calculate the total cost for each segment for each regulatory change.

The results

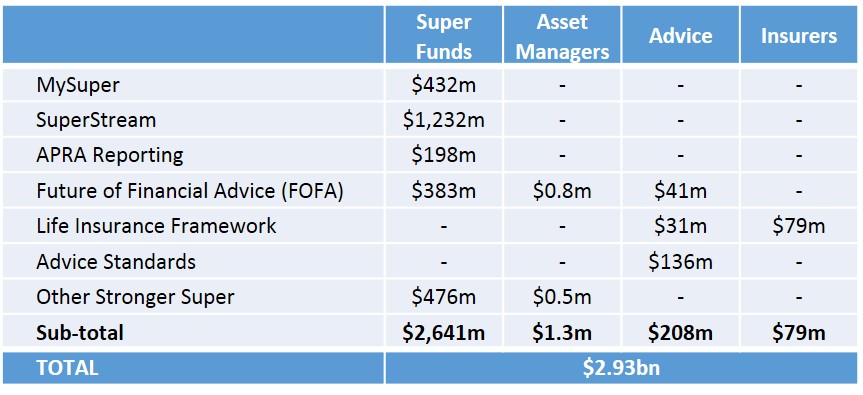

The cost (both incurred and budgeted / expected) of implementing these major regulatory changes per industry segment are shown in today’s table:

On top of these implementation costs, there are also ongoing costs of compliance. The industry will incur a higher annual operating budget of $262m per annum to satisfy ongoing compliance with these regulatory changes.

Outlook

Of course, many of these changes were necessary to continually improve practices in the financial services industry, and reflect the importance of managing Australians’ wealth.

Looking forward, there’s little respite in sight – given the ongoing uncertainty of the last budget’s proposed changes to superannuation rules (not to mention the devil in the detail with any proposal), they are not even included in these calculations. That means one thing for certain, regulatory change will continue well into the future.

However, looking forward, it would be beneficial if we could work with government and the regulators on creating a more streamlined approach to regulatory change. And in some areas, even consider deregulation. That would provide an opportunity for the industry to innovate and reduce costs to members. And that can make a big difference to member outcomes.

Never miss a Trialogue! Sign up to receive future Trialogues direct to your inbox.