Managed Accounts – is the jigsaw now complete?

Managed accounts have been ‘the next big thing’ in the platform and asset management industry for at least a decade now, promising to revolutionise the way advisers invest in a more tax friendly, transparent and cost effective manner.

Australian Adviser Insights Programme, taking in the views of more than 200 independent advisers confirms the accepted wisdom – with almost 1 in 5 advisers indicating they expect to increase their use of managed accounts over the next 3 years.

Not withstanding that consistent feedback, managed accounts take up has still been frustratingly slow, with only ~$10b in separately managed accounts and another $10bn in MDA Services after all these years. Which begs the question – will it be different this time?

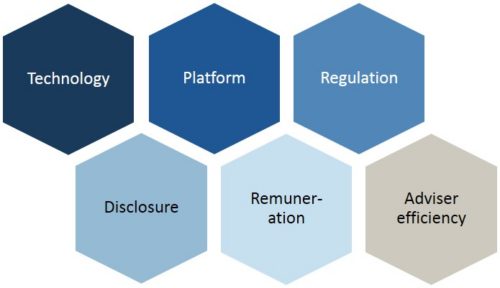

We think so. The adoption of managed accounts relies on six discrete pieces of the jigsaw puzzle coming together:

- Technology: Early managed accounts only offered Australian equities. This restricted the benefit largely to a tax efficiency argument, and saw limited take-up.

Now, technology allows the full range of investments and product structures – Australian and global equities, managed funds, cash, even term deposits and other direct fixed interest. Technology also allows intra-day trading, not just a single trade per day, which can impact on the outcome investors receive.

- Platform proposition: Managed account providers have shifted the typical platform proposition from helping advisers administer client investments to helping advisers and dealer groups manage portfolios.

A careful distinction, this has significant implications for platforms as they work out how to support advice firms creating portfolios, what they do with responsible entity functions, and how they respond to asset managers’ due diligence on their trading functionality.

- Adviser efficiency: With all the regulatory change over the last few years, advice businesses have remained focussed on compliance – few have had a chance to make sure their end-to-end process is as efficient as possible. Portfolio management, rebalancing and switching investments are areas ripe for improvement – all significantly improved with a sensibly designed managed account.

- Remuneration: Dealer groups have historically given away the intellectual property in their model portfolios. Managed accounts allow dealer groups to monetise this portfolio construction activity. Further, dealer groups are starting to act as quasi-institutional clients, negotiating fees (and even mandates) directly with asset managers, requiring platforms to support different fee arrangements with managers, and driving more margin to advice firms.

- Asset manager disclosure: Long feared, but often overstated, managers have been slow to adapt to the growing desire for more transparency in stock holdings. With super fund portfolio disclosures getting close, and more managers adopting structures that require full disclosure (such as ETFs and managed accounts) – the group of recalcitrants is starting to shrink.

- Regulatory certainty: The final piece of the jigsaw is the updated regulatory guide for Managed Discretionary Accounts. From our conversations, many advice groups had yet to finalise their approach, waiting to see what new guidance ASIC was going to give on managed discretionary accounts before making any decisions.

While not everyone will run a MDA, Regulatory Guide 179 completes the puzzle, and now gives all parties clear guidance on the different licencing requirements for all the different managed account structures.

With ASIC completing the jigsaw at the end of September, we now expect a lot more activity in managed accounts. Advice firms are keen to decide how they structure their portfolios – tailoring it to suit their advice approach, creating efficiencies for their advisers in managing portfolios (and changing platforms and asset managers, if required), and charging a new fee for a service they’ve historically given away for free.

Never miss a Trialogue! Sign up to receive future Trialogues direct to your inbox.