Preferred Provider Programs: Beyond Compensation?

Focus on Retirement Plan TPAs

Institutional retirement services firms that partner with local and regional TPA firms have long used preferred provider programs to attract and build loyalty among the most attractive TPAs. Do TPAs care? Which program components do TPAs value most—and least?

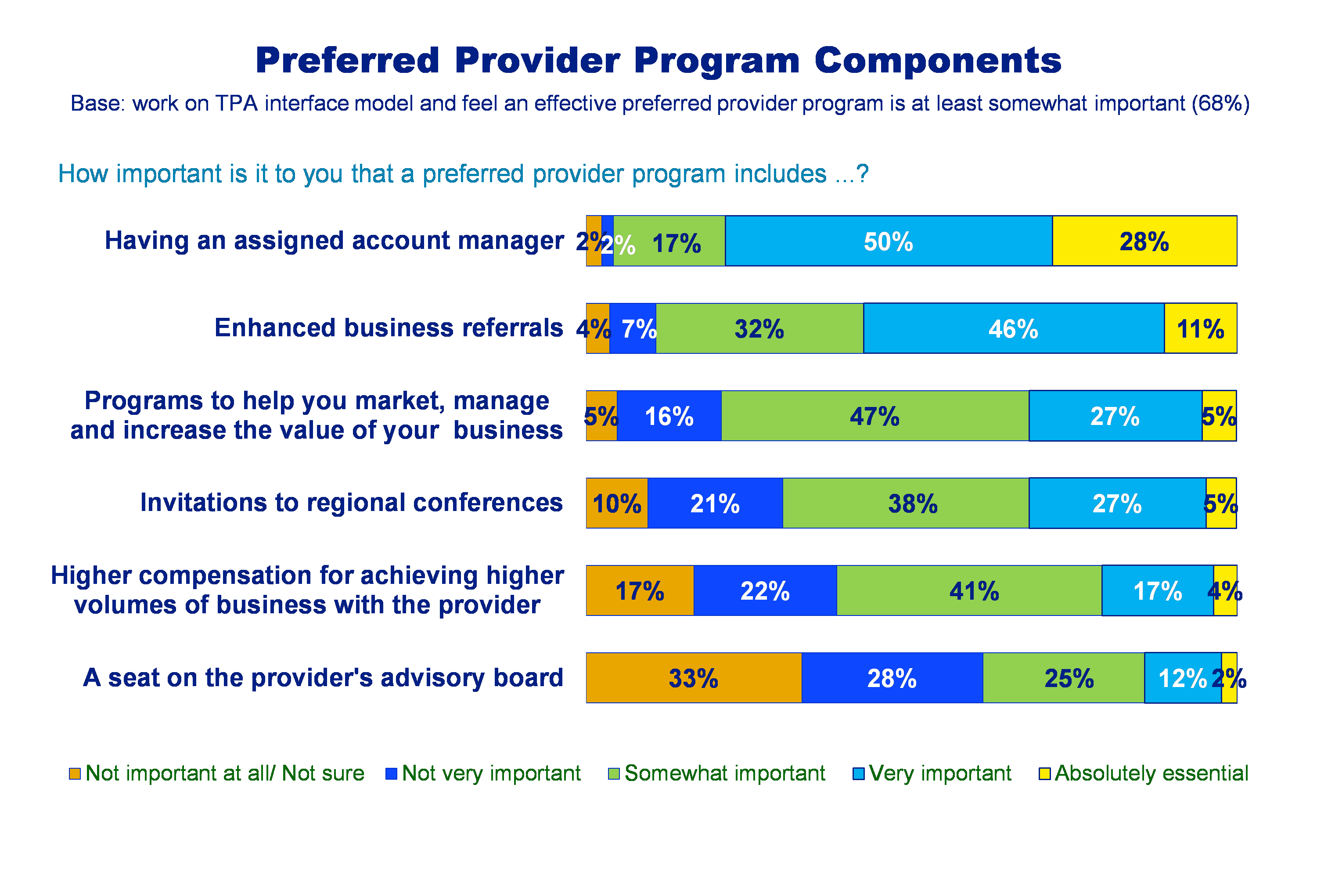

Our new New Brightwork research shows that TPAs in fact do care: nearly 80% of TPAs feel that an effective preferred provider program from their institutional partners is at least somewhat important. But they attach vastly different weights to different components of these programs. The winners are “having an assigned account manager” and “offering enhanced business referrals.”

By contrast, getting higher compensation for achieving higher volumes of business with a given provider and a seat on the provider partner’s advisory board are much less important.

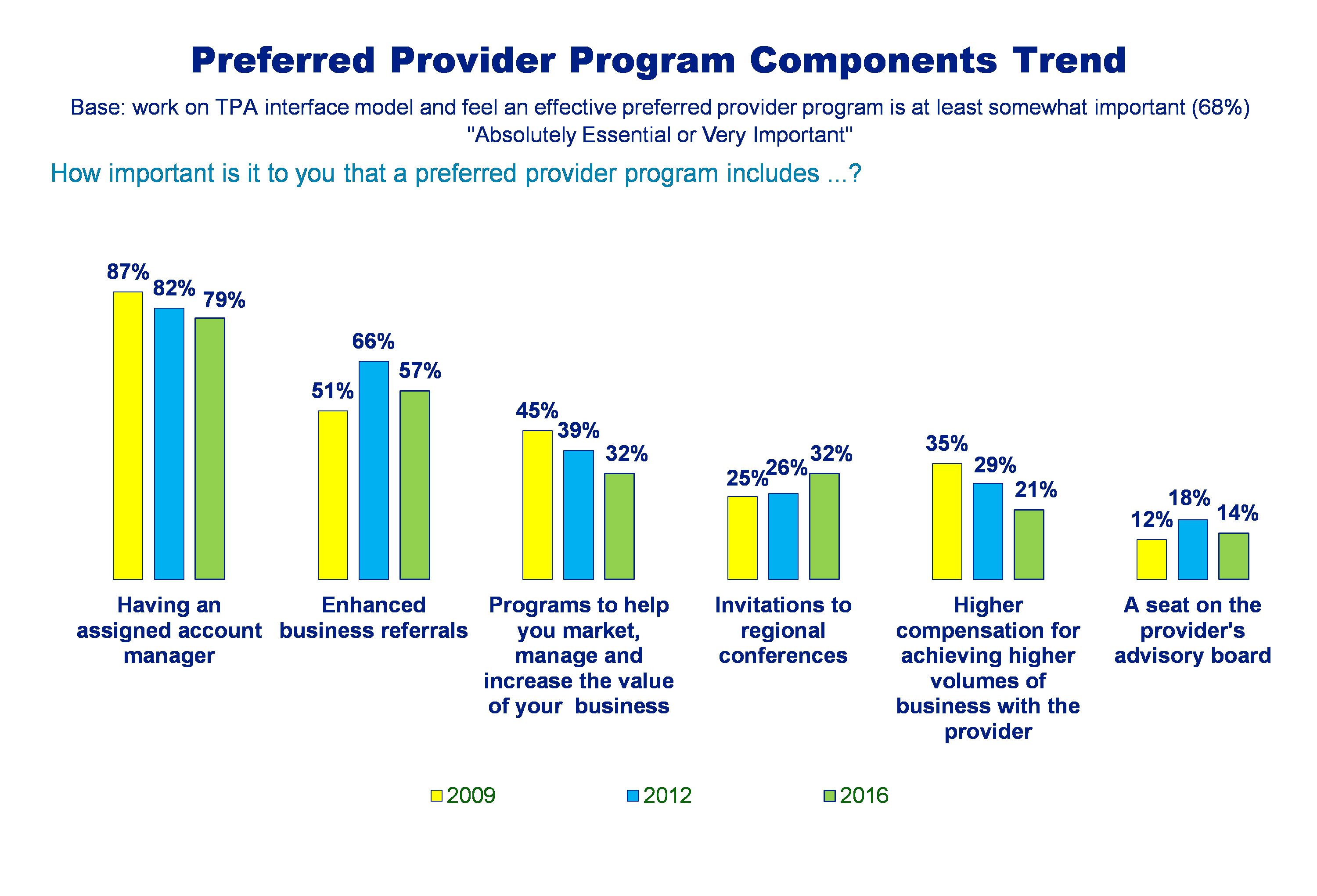

“Programs to help you market, manage and increase the value of your business” and receiving “higher compensation under a provider’s revenue sharing formula for achieving higher volumes of business with that provider” are declining in importance. Higher standards of fee transparency appear to be taking their toll on what for some providers are expensive components of their preferred TPA partner program.

About the Research

These findings are based on telephone interviews with a representative cross-section of 250 owners or senior executives of TPA firms which administer 401(k) plans. Completed in February, 2016, this is Brightwork’s fifth TPA study since 2004.