Press Release: ‘New insurance regulations pose challenges to companies’

Matthew Maguire, Partner Two of NMG Consulting said that recent changes in the Sri Lankan regulatory landscape have resulted in companies having to think more strategically about their underlying business, and the consequences from a risk based perspective.

Speaking at the NMG Consulting networking reception for its clients at the Colombo Swimming Club to celebrate its 25th anniversary, he said that this has led to a “step change” in the ways companies approach their business.

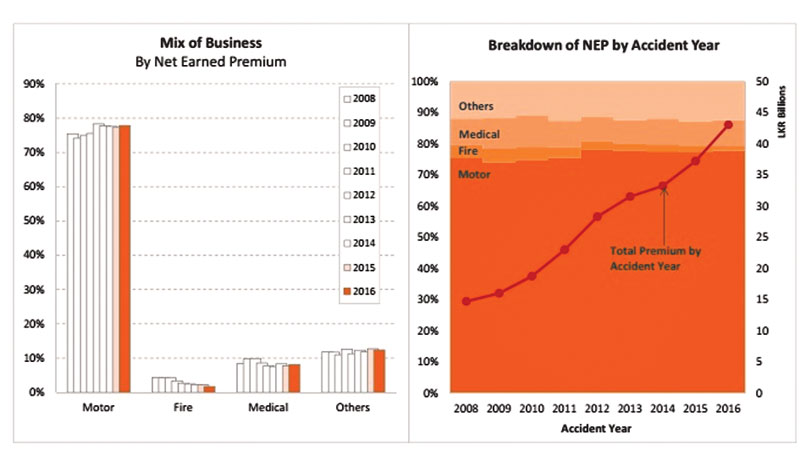

Maguire said that while the motor business continues to dominate the industry, the results for the industry will depend upon the experience of this class. With the ongoing regulatory changes following the “Full Implementation” of RBC, companies are more closely scrutinizing their return on capital and how they want to participate in the industry. This is already apparent following the M&A activity seen over the last two years.”

Maguire said that while the motor business continues to dominate the industry, the results for the industry will depend upon the experience of this class. With the ongoing regulatory changes following the “Full Implementation” of RBC, companies are more closely scrutinizing their return on capital and how they want to participate in the industry. This is already apparent following the M&A activity seen over the last two years.”

To address the increasing challenges and requirements in the market NMG has strengthened its team in Colombo covering account management and technical services, including Big Data analytics.

NMG also partners with technology vendors to provide their clients in Sri Lanka.NMG Consulting is part of the NMG Group, a privately held company, focused exclusively on non-banking financial services and wealth management. NMG Group has 1,000 employees, spread across offices in 18 cities, on five continents and was established in 1992. NMG Consulting has been providing advisory services to the Sri Lankan market almost since its inception.

However, over the last 10 years the scope of services has expanded and NMG is now the largest supplier of general insurance actuarial advisory services in the market. The team currently calculates the value of reserves required for 12 of the 15 general insurers in the country as well as providing strategic advisory services to banks and conglomerates.

Partner, Roshan Perera in his welcome address said “We focus on three industries: investments, insurance and reinsurance, with our business spanning across three core practices – strategy, management, and actuarial. We’re unique in the fact that our advice is backed by decades of detailed research conducted by our insights team.”

Perera said “In addition to the consulting business, NMG has two other core businesses, NMG Benefits – an employee benefit consulting and administration business in Southern Africa, and NMG Capital – a private equity business investing in entrepreneurial financial services entities”.

NMG Consulting’s actuarial team in Malaysia and Sri Lanka has supported this business with Big Data analytics.To address the increasing challenges and requirements in the market NMG has strengthened its team in Colombo covering account management and technical services, including Big Data analytics.

NMG also partners with technology vendors to provide their clients in Sri Lanka.The NMG Group has 1,000 employees across offices in 18 cities in five continents.

For the full article, please see the the Daily news