DC pensions: growth is coming; what about revenues and profit margins?

In our launch edition, we looked at how big increases in minimum contribution rates for DC pensions are likely to produce a DC pensions flow opportunity of >£20bn pa by 2019.

Thanks to the structure of auto-enrolment and member inertia, fast growth in DC pension assets is largely assured. By 2020, we estimate there will be an additional £65bn stock of DC pension assets, a figure which will continue to grow rapidly in the absence of policy changes.

But fast growth does not necessarily mean a profitable market given:

- Cap on total charges (for the default) of 0.75% pa.

- Aggressive pricing by competitors seeking to win market share during staging phases.

- Large not-for-profit competitors in NEST and The Peoples’ Pension quoting representative prices of ~0.5% pa.

- Many small schemes and member accounts, which will be unprofitable for some time.

- Long term capex requirements in technology, products, engagement and assistance.

At a high level this looks daunting; recent consolidation activity is a signal that scale will be a pre-requisite for achieving good outcomes for members, employees, and shareholders.

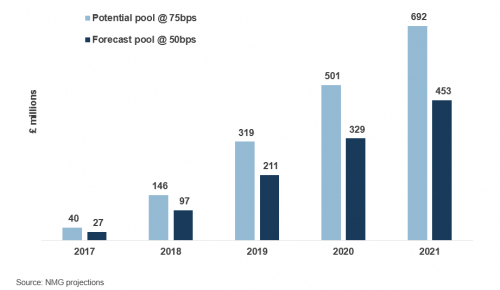

AE will create a significant revenue pool. At the cap of 0.75%, the potential 2020 revenue pool is ~£500m, but this figure will not be realised given there are already multiple price points of ~0.5% or below. If the weighted average price settles at 0.5%, we estimate a revenue pool at ~£330m.

DC pension revenue pool projected uplift due to AE contribution increases

Can this revenue pool produce acceptable profit outcomes for a for-profit competitor? It depends on what trade-offs you have available and are prepared to make.

From the selected price point, two main classes of expenses have to be funded:

- Operating expenses (including employer and member administration).

- Asset management expenses (which might be vertically integrated or external).

At the default price cap of 0.75% pa, a profit margin of ~20bps is readily achievable:

| Price | 0.75% |

| Desired profit margin | ~0.20% |

| Operating expenses | 0.15-0.25% |

| Asset management costs | 0.30-0.40% |

Keeping operating expenses under control while account balances are small is hard. But 0.75% should allow for this, and a reasonable investment fee budget – enough for a diverse portfolio including active managers and even some exposure to alternative investments.

Drop the price to 0.40% and it’s much harder to make the numbers add up. A stumbling block is the limited flex in operating expenses – scale efficiencies are available, but tend to be incremental. But assuming a bottom-end figure for operating expenses, the numbers now look something like:

| Price | 0.40% |

| Operating expenses | 0.15% |

| Asset management costs | 0.05-0.15% |

| Desired profit margin | 0.10-0.20% |

The real pain is inflicted on asset management, with the fee budget falling by more than half, to figures which can only really be achieved by a largely or entirely passive portfolio. But potential profit margins also take a hit.

In this environment, not-for-profit competitors have a significant advantage. Their target profit margin is zero, which all things equal, means for a lower price point for similar quality, or superior quality for a common price point.

But not all things are equal of course. For-profit participants may become more efficient and achieve lower costs, or may be able to utilise benefits of vertical integration. Alternatively, they may take a more segmented pensions approach, choosing to target larger employers, and / or members with more complex needs (usually later in the lifecycle) when both are more profitable.

Where default prices settle in the longer term, and the implications for revenues, will depend on further regulatory action and the evolving nature of competition in the category.

A reduction in the price cap to 0.5% pa has been mooted, although in our view this is not necessarily in the interests of members. Competition has been focused on employer operating model and price, but as staging recedes, DC pensions become business as usual, and schemes start to review, we see more scope for competition based on a broader measure of outcomes, including performance and quality. Our value-for-money research has highlighted that members generally value quality attributes over lowest price.

It’s also notable that after 25 years of compulsory DC pensions in Australia, even the £50bn+ not-for-profit funds do not position on lowest price – rather they aim to deliver an optimal net proposition, featuring additional spend on investments and assistance (in particular) which delivers members a multiple in terms of value delivered.

Where to now?

Shape your thinking: The NMG Consulting proposition.

Our Library of Insights: Trusted by industry leaders.

Follow NMG Consulting on LinkedIn and be the first to read our latest insights and company news.