Global domination: only brave managers need apply

Asset management has all the conditions necessary to support strong global players. The features supportive of global business models (consistency in product definitions, cross-border demand for investment exposures, low barriers to entry) are all present, but when we segmented asset managers by their brand coverage, it’s clear that the supply-side is dominated by managers with brand presence in just a single (‘home’) market.

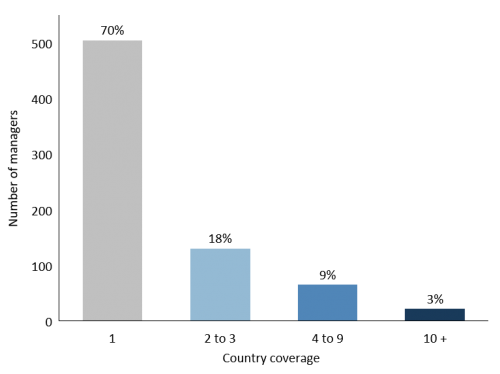

Figure 1: Institutional asset managers by country brand recognition (721 unique managers)

Our global asset management study reveals that only 3% of the 700 managers competing in the global institutional asset management market have established global brands1 [You can see the 21 institutional managers that meet that standard at the bottom of this article]. In addition, we estimate that these global brands manage 40% of world-wide contestable AUM, a disproportionate share, and 18 are also global retail brands2.

In the middle are approximately 200 ‘Aspiring global’ asset managers, which we have divided (in Figure 1) into those with brand profile in 2-3 countries (typically ‘close to home’ by geography or culture) and those cited in 4-9 countries (beyond home and adjacent markets). Aspiring globals typically have offices registered in many countries but have not yet displayed a global brand profile on our metrics.

So, despite a perfect combination of conditions, the asset management industry is crowded and highly domestic. And, we know that global franchises are attractive, providing the benefits of diversification, scale, access to growth segments as well as scope to differentiate through superior investment in knowledge, solutions and systems. International managers are also welcome in most countries and have top 10 brand positions in both institutional and retail segments in all countries except the US (see the chart below).

Figure 2: Number of international managers among top 10 brands in each country

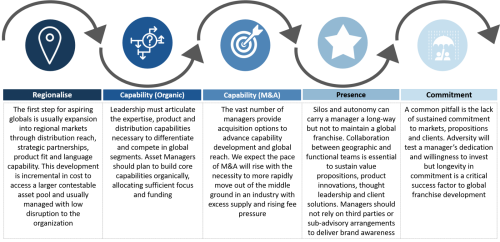

Given the apparent difficulty of building a global asset management brand, we analysed the segment of managers that are aspiring but struggling to advance their position to reveal five key conditions for asset managers developing their ‘global’ franchise:

Over and above these conditions, a cohesive international strategy is essential. Inputs to the strategy process include market specific characteristics (market structure, savings policy, regulation…), competitive forces and demand dynamics. Given the time to implement, we appreciate the international strategy should be adapted based on learnings and changes in internal capabilities and external settings.

While global status will deliver scale, diversity and differentiation, it is out of reach for most asset managers. For the minority aspiring to be global, we advocate learning from the mistakes of others and boldly tackling these conditions.

‘Global’ brands cited in the institutional market in 10 or more countries

Aberdeen Standard Investments

AllianceBernstein

AXA Investment Managers

BlackRock

Capital Group

Deutsche Asset Management

Fidelity

Franklin Templeton

GSAM

Investec

Invesco

JPMorgan Asset Management

Lazard

M&G Investments

MFS

Morgan Stanley

PIMCO

Schroders

StateStreet Global Advisers

UBS Asset Management

Wellington

Source: NMG Global Asset Management Study.

(1) Recognised in 10 or more countries.

(2) Our brand coverage findings in the retail segment are consistent with institutional. Our study gathered brand awareness feedback on over 1,200 retail asset managers with 77% of these managers cited in only their home market, a further 15% in 2 to 3 countries, 6% in 4 to 9 countries and 3% had brand profile in 10 or more countries.

Where to now?

Shape your thinking: The NMG Consulting proposition.

Our Library of Insights: Trusted by industry leaders.

Follow NMG Consulting on LinkedIn and be the first to read our latest insights and company news.