Do Medium Advisors Deserve More Respect?

Topics in 401(k) Distribution: First in a Series

For almost as long as Brightwork has segmented 401(k) advisors by the share of their practice income deriving from 401(k), providers have ignored Medium advisors (20% to < 60% of income, 29% of advisors) and focused instead on 401(k) specialists, or Heavy advisors (60% or more, 27% of advisors). But should they?

The arguments for neglect are compelling. Although only slightly more than a quarter of all 401(k) advisors, Heavies hold 52% of the AUM in the channel and account for 50% of asset sales. Their average 401(k) book is north of $200 million, almost twice that of Medium advisors. And they are vastly more likely than Mediums to sell larger plans, especially of the $10 million and up variety.

So what’s not to like? Maybe not much and maybe not for long, but for the past few years the share of asset sales associated with Heavies has been drifting down and the share associated with Mediums has been drifting up. The explosive growth of “pure” RIAs in 401(k) distribution is surely a contributing factor. Relative newcomers to the channel, these almost-completely-fee-based RIAs are likelier to be Mediums than Heavies and are likely to have smaller books of business. At 24%, their share of the channel has tripled in less than ten years.

Surprisingly, Mediums sell almost as many plans (18.9 in the past three years) as Heavies (22.4), although their activity is concentrated below $3 million (Heavies outsell Mediums by substantial margins from $3 million and up). Also noteworthy: Mediums are disproportionately resident in wirehouses, more than double the proportion of Heavies.

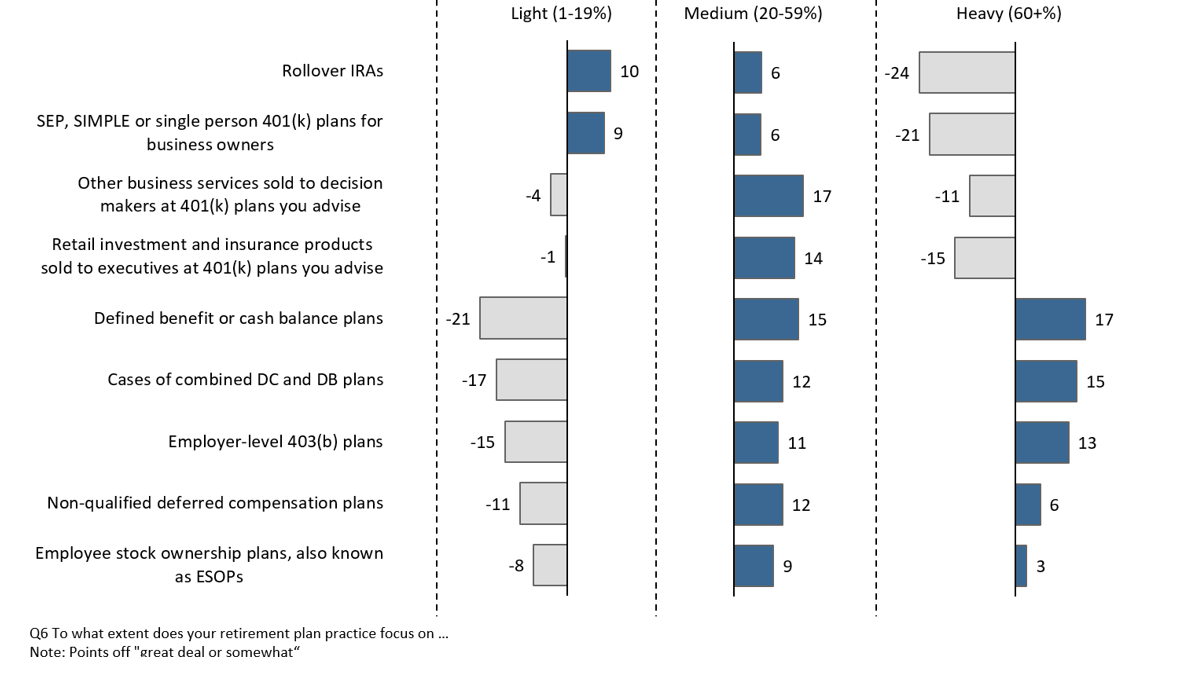

Medium advisors are still trying to be all things to all people; Light and Heavy advisors know better

So who are these Mediums, what do they want and how can adventurous providers open a dialogue with them? A first step is to recognize that Mediums are still feeling their way in the complex world of institutional retirement. Unlike Light 401(k) advisors (<20%) who focus on rollovers, SEPs and SIMPLEs but blow off institutional products–or Heavies who focus strictly on institutional products but blow off retail business (especially rollovers)–Medium advisors are still trying to be all things to all people. They’ve committed themselves to building a 401(k) practice but they haven’t quite cut the ties to their retail past. As Heavy advisors demonstrate, that baggage has to go before Mediums can achieve much success.

That done, Mediums probably deserve more respect.

About the Research

Retirement Services Intermediaries studies were launched in 2000 by Brightwork Partners LLC; Brightwork was acquired by NMG Consulting in 2017. Findings are based on selected RSI waves carried out between 2005 and 2017. These studies are conducted by telephone, typically among a representative cross-section of 600 or more advisors deriving income from 401(k) plans. RSI 12 is scheduled for delivery in mid-2018.

For more information, contact:

Merl Baker, Partner, Quantitative Research, Insights (Stamford, CT; Merl.Baker@NMG-Group.com )

Where to now?

Shape your thinking: The NMG Consulting proposition.

Our Library of Insights: Trusted by industry leaders.

Follow NMG Consulting on LinkedIn and be the first to read our latest insights and company news.