AustralianSuper’s big HNW move

It has been a big finish to 2011 for Australia’s largest industry fund, and we’re not talking about the merger with AGEST, which will take the fund to a massive $50bn in assets.

As significant a milestone as this is, for us the big story is the launch of Member Direct, AustralianSuper’s latest response to the changing needs of its high value members, and the SMSF threat.

Member Direct replaces the ASX200 option, and allows members to choose from ASX300 shares, ETFs, and term deposits. It’s effectively a super wrap structured as an investment option within the existing fund, and although no managed funds are being offered, we understand that the technology is capable of doing so.

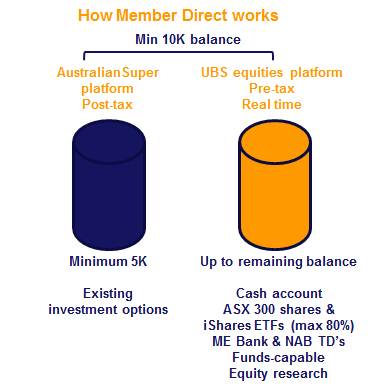

Member Direct is a premium investment option, not a stand-alone product. It’s open to members with a balance of at least $10,000, and the member has to place at least $5,000 into one or more of the existing AustralianSuper options.

Other constraints include a maximum of 80% in direct shares and ETFs (maximum 20% in any single share or unit), which means that at least 20% must be in other investment options or term deposits. In something of a marketing coup, iShares is the exclusive supplier of ETFs (for now) while term deposits are available from NAB and ME Bank.

Member Direct creates a hybrid product which fuses a pre-tax equity trading platform from UBS onto the existing tax-paid AustralianSuper multi-manager platform. The equity platform is a fully featured live trading platform, which works like ComSec and includes UBS equity research. The product is accumulation only at this stage with pension scheduled for the second half of 2012.

It’s a little clunky and being a hybrid, it is something of a compromise – it’s not particularly efficient to combine pre-tax and post-tax investments for example – and it will be interesting to see how the administration (split between SuperPartners and UBS) stands up if volumes ramp up. But we like the direction, it looks good online, and later versions will presumably improve on it.

Why is this development important?

– It’s the first attempt by a major industry fund to segment members with a different and sophisticated product offer. Few people realise that the top 10% of members often control 30% or more of fund assets. They’re highly vulnerable to retail and SMSF competitors. This is not about $10,000 balance members.

– It’s cheap at $180 pa. That’s 18bps on a $100,000 balance.

– It creates new opportunities for service and product providers. Overnight AustralianSuper has gone from a 100% institutional buyer to also being a distributer of equities, ETFs, term deposits, research, and more.

– It’s a sign of things to come. This is not the end – but for industry funds in particular, this development surely represents the end of the beginning.