New: Tria launches Super Funds Review

Today marks the launch of the Tria Super Funds Review – our brand new research guide to the business metrics that matter in superannuation.

Designed for superannuation competitors and major suppliers, particularly senior management, boards, and strategy groups, the focus of the Review is competitive positioning and performance, rather than investment performance and features.

The Super Funds Review is an exciting and long scheduled expansion of our existing Tria Industry Fund Review. The Industry Fund Review responded to the needs of industry funds and their major suppliers for market and competitor information which allowed them to benchmark their progress.

Market developments mean that segment boundaries have become blurred, and traditional definitions less useful. So we’ve responded again. The Tria Super Funds Review takes the metrics established previously and applies them to all entities with more than $1 billion in super AUM. This lets us do two key things:

– A single view of all 81 large competitors regardless of type.

– Make fair comparisons between different types of competitors, such as AustralianSuper and Colonial First State, or QSuper and Sunsuper, or BHP Staff and RIO Tinto Staff. Or whatever combination you are interested in.

The Review is 136 pages – 55 pages of industry analysis, including maps of the total market, impact of M&A, market share tables, net inflow rankings, insights and trends, and a profile page for all 81 competitors in our large fund universe. More information, sample slides, and subscription information can be found at: http://www.triapartners.com/content.php?article=content/Research%20Products&type=NTI=.

M&A impact in super

There’s a surprise in every research project we undertake, and the Super Funds Review has been no exception.

One of the big learnings is the extent to which M&A has reshaped the super landscape, and indeed how dependent some competitors have become on M&A to fuel growth in a difficult market environment.

It’s easy to forget how many names have disappeared from the market in recent years. These range from minnows such as CueSuper at $350m which merged with NGS, to monsters such as St George, which brought ~$20bn of super assets with it when acquired by Westpac, and AXA which delivered similar additional scale to AMP.

While much of the M&A action has been at the retail end of the market, it is far from just a retail story. Merger activity has been vigorous in the industry fund segment, led by AustralianSuper, and even government funds have joined in, via the unforeseen merger of Health Super with First State Super.

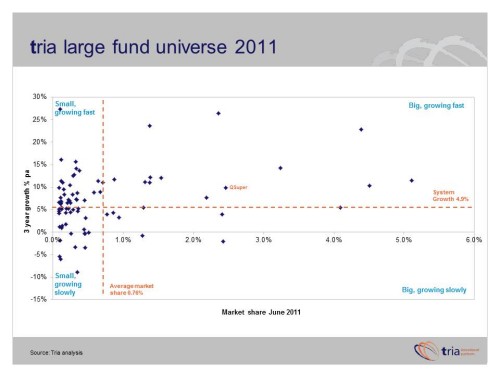

Our market map (an unpopulated version of which appears above), shows that many large competitors have recorded strong growth rates over the past 3 years. But there is more to this story. Drill down into underlying growth – the organic growth generated by net inflows – and some of the numbers are less impressive. Some big competitors are struggling to keep up with system growth, with the risk being that market share gains obtained via expensive M&A exercises might gradually leach away.

For those competing in super, and major suppliers of services, we believe the Super Fund Review will be an essential resource for the metrics which matter, and the key insights and trends in the industry landscape.

For asset allocation and portfolio trends, fund manager market share, and other investment issues, look out for the forthcoming Tria Australian Institutional Review. The Institutional Review is designed primarily for asset management firms serving the Australian market and is coming soon.