ING Living Super: a first look at “no fee” super

David Hartley, CIO of Sunsuper, is well known for his critique of the cost agenda of MySuper, which I will summarise as “If you want low cost, I can give you a zero cost portfolio today – I’ll just invest it all in bank deposits”.

Deposits have no explicit management costs, but generate plenty of margin for the institutions gathering them. When generated by a super fund, deposits may prove “stickier” than standard online savings accounts, and therefore even more attractive.

This idea can be observed in ING Direct’s new Living Super product, the key benefit of which is described as the “first Balanced option available to all Australians with no administration, contribution, or management fees”. ING Direct is the promoter and Trust Company is the trustee and issuer.

So how does it work? Today we look at the investments and fees, and ignoring potential revenues from insurance and elsewhere. There are four investment options:

– Safe: cash and term deposits of 3 months – 2 years, described as “no fees”

– Smart: the no fee Balanced option described

– Select: 9 diversified and single sector options

– Shares: a trading platform which gives access to ASX200 shares, ETFs, and LICs.

There is also a Cash Hub where the investor must keep at least 1% of their account balance.

Let’s work backwards.

The Shares option is very similar to AustralianSuper’s Member Direct, and is even priced the same at $180 pa. So that’s attractive. But you can only have 50% of your account in the Shares option, which gives you a hint of the business model here.

The Select options are predominantly passive options, with growth assets managed by SSgA, and the cash balances by ING Direct. They attract a management fee of 25bps, plus an administration fee of another 50bps up to a maximum of $1,000. So a balance of $200,000 in the Select option would be paying ~75bps. That’s not exactly cheap for passive.

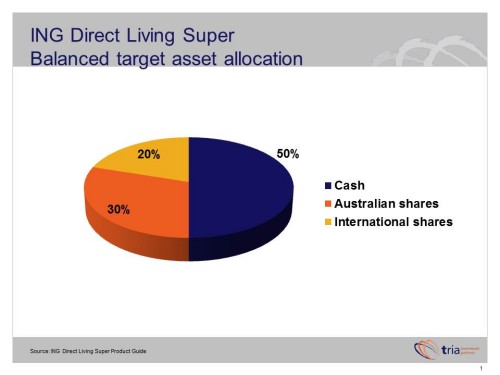

The Smart (Balanced) option indeed has no fees as described. It has a target asset allocation as per today’s chart – 50% cash, and 50% growth assets managed passively by SSgA. The key aspect here is that the cash appears to be fully allocated to ING Direct deposits. Rates are the standard ING Direct rates (well, the rate that applies after the introductory bonus finishes, currently 3.75% pa), but there’s no diversification of providers.

But let’s get past that objection. There’s no fee and presumably SSgA is not managing the growth assets for nothing. How can this be? This looks like a whole of value chain story:

– While there’s no management fee revenue, there will be revenue generated inside the ING Direct bank. A ballpark method of calculating how much is to look at ING Direct’s net interest income margin, which we estimate is ~140bps.

– So this means that elsewhere in the value chain, ING Direct is making ~70bps (50% x 140 bps) from net interest income, from which it needs to pay SSgA.

– Assuming fees of 10bps for SSgA, this leaves ING Direct with a revenue stream of ~65bps for the Balanced’s options assets to pay themselves, Trust Company, and other suppliers.

Net net to ING Direct? Perhaps 50bps, similar to the Select options. All back of the envelope estimates of course, but overall it’s not a bad revenue result from an investment product with a headline of no fees.

The Safe option (and the Cash Hub) works in the same way, except that all assets are placed with ING Direct deposits, so the value chain revenue potential of assets in this option is potentially more than twice as good.

So to summarise, while the Shares option is another welcome low cost D2C super shares wrap, Living Super has been structured so that at least 50% of an account is funnelled into the Safe, Smart, and Select options; and in general terms ING Direct appears likely to make 50bps or more on these assets, either directly or elsewhere in its value chain.

It’s low price super (well mostly) but not exactly low revenue, and as such another powerful example of the benefits of vertical integration of banking and wealth.