Tria’s fearless industry forecasts for 2013

For our final Trialogue for 2012, we’ve pulled together a selection of the Tria team’s industry themes for 2013. In no particular order, here they

– Mayan calendar proves to be wrong – so you will need to actually deliver on your FoFA and Stronger Super programs. The trick is to do so with an eye to your strategy, not just from a compliance perspective (Lucy).

– In the wake of new regulation, many planners leave the industry, forcing funds and asset managers to consider other channels. Combined with the effects of advancing technology, there is rapid growth in new advice models and direct distribution of super and investments (John).

– The industry finally starts to get to grips with understanding members and intermediaries. A vintage year for segmentation (Andrew).

– Flows into growth investments finally recover as the Wall of Money cracks. Falling term deposit rates force retail investors into higher yielding equity and property investments, while the growth of pension assets creates lots of opportunities for income-focused product development (Oliver & Richard).

– That said, the shift of investor preferences towards the online, direct, and listed for efficiency continues, meaning that unlisted funds need to be well differentiated to survive and prosper (Mark).

– 2013 Federal Budget measures implement Recommendation 18 of the Henry Report. This sees the super contributions tax altered from a flat 15%, to an employee’s marginal tax rate less 15% (so high income earners effectively pay 31.5%). Savings are used to fund the NDIS and other spending programs (Andrew).

– Regulatory measures are finally proposed to rein in the excesses of SMSFs. Gearing into residential real estate and other high risk strategies are banned (Andrew).

– Industry profitability bottoms out as growth assets recover, boosting revenues, and benefits start to flow from cost cutting programs of the past few years (Chris).

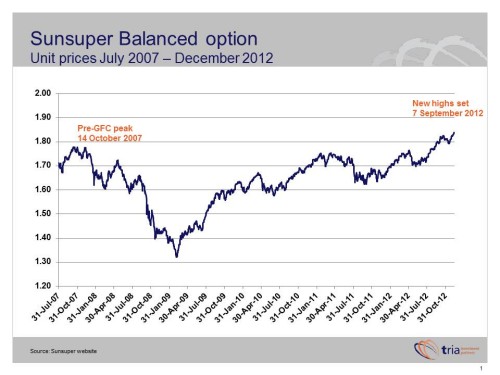

And for those of you seeking a (positive) sign, here’s one – and illustrated by today’s chart.

– Prior to the financial crisis, the unit prices of the diversified defaults of major super funds peaked in October 2007. Unit prices then slid before falling sharply as Bear Stearns and Lehman Brothers collapsed in late 2008.

– Those October 2007 unit prices created a high water mark that started looking unbreachable. But many major funds quietly passed their high water marks in the second half of this year, and are now as much as 10% above those levels. We’ve used Sunsuper as our example, but it’s certainly not the only one.

– It has been a long 5 years, but unit prices are now at new highs – even though equity markets remain well below their 2007 peaks – demonstrating the effectiveness of diversification and reinvestment.

This means that for super fund members making regular contributions (and non-super investors for that matter), there is now a great dollar cost averaging story that should reward investors well into the future. That’s the sort of good news we need to put in front of our customers in the new year.