SSFS – Australia’s quietest super achiever

Successes in Australia’s super system rarely go unnoticed, thanks to how much is at stake, and in no little way to how much ego is involved.

But a few slip under the radar screen. The rapid rise of Netwealth is one. Another, which is today’s topic, is State Super Financial Services (SSFS). Not much evades the radar of the Tria Super Funds Review.

You might not be familiar with the SSFS acronym but it has been around for some time – more than 20 years in fact. The fund was set up by the trustee of State Super NSW, the now-closed defined benefit fund, in order to serve members leaving the fund. This is an interesting DB fund in that it pays only lump sum benefits; ie there is no pension benefit as with last week’s case study, CSS.

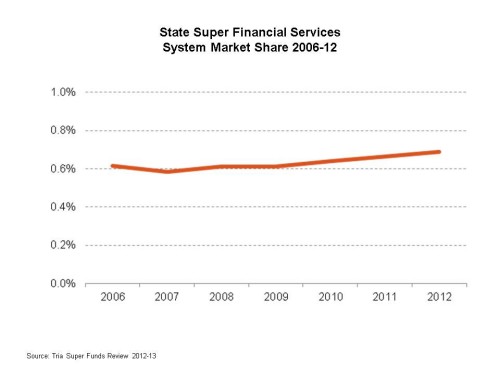

SSFS is now ~$11bn in AUM, placing it just outside the top 20, so it is no minnow. Indeed it’s about the same size as HOSTPLUS, yet you almost never hear about it. And as today’s chart indicates, it has been growing its system market share in the past few years at a pretty steady clip that many small to medium size funds would be more than happy with.

So what’s the secret? Does SSFS have a killer product?

Far from it. Actually, when you look at the SSFS website – www.ssfs.com.au – it’s hard to find any mention of products at all. When you get there, you find that:

– They have a super fund, an allocated pension, and a non-super investment fund – pretty standard stuff.

– All three products have 9 diversified and single sector options – again all pretty standard.

– Fees are actually fairly high – 140bps pa for Balanced and 150bps pa for Growth and equities.

– Performance is certainly competitive but doesn’t appear exceptional.

So this is not a product success story.

Perhaps not surprisingly, it’s a distribution success story. There are two parts to this

– In the 2012 year, SSFS had transfers in of $845m. By comparison, State Super NSW had outflows of $3.7bn. While we don’t know that all of the transfers in came from State Super NSW, we can assume that the vast majority did. This implies that SSFS captured over 20% of the flows out of State Super NSW. That’s not bad going, and in fact it’s probably better than it looks, as presumably not all outflows were available to be rolled over. So depending on your measure of success, SSFS is carrying out the job for which it was designed rather effectively.

– In addition, SSFS had member contributions of $445m, which is a rate of 4.8% of AUM. That’s more than double the large funds average of 1.9%. Average balances are high at nearly $200,000, nearly three quarters are pension members, and redemption rates are relatively low. This is a valuable membership.

SSFS is winning valuable members, getting them to top up their accounts after capturing them, and is retaining them successfully into retirement. There’s some very interesting stuff going on here.

SSFS is classified as a retail competitor, and is a competitor that retailers should probably have a closer look at given the nature of the membership. It’s also an important case study for the large not-for-profits contemplating how they are going to retain their members in the coming decade.

It’s encouraging in the sense that a proposition based around intimate knowledge of the fund, education, seminars, and fund-provided financial planning can clearly work. It’s scary from the perspective of the resources required to make it work – SSFS has 130 financial planners alone. Not only is that a multiple of what most large NFPs can field at present, it clearly comes with a large price tag – one of the reasons why this is not a low cost offer.