MTAA RetireSafe – how do you distribute a complex product?

Can a not-for-profit – or anyone for that matter – successfully distribute a complex retirement income product? Just to make things more challenging, is it possible to distribute such a product directly to super fund members moving into the pension phase?

The track record of these types of products is not especially encouraging. For every success such as AMP North’s protected products, there’s at least one product development disaster (defined as large investment and small flows) such as ING Money for Life.

MTAA Super is putting these questions to the test. MTAA Super is a mid-sized industry fund which has emerged from significant performance issues during the financial crisis, and board / management team turnover which followed it. With that recent history, RetireSafe is a relatively bold move.

So let’s have a look. RetireSafe is a new guaranteed pension product, some of the key features of which are:

– Aimed at members aged 60+ with $50,000+

– Provided via an insurance policy from MetLife

– Lifetime income stream

– Potential for upside in payments if market experience is favourable

– Capital access

– No investment choice

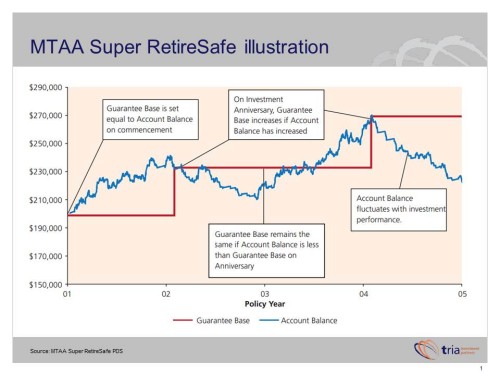

Annual income is calculated as the Guarantee Base (the initial investment in the first instance) x the Income Rate of 4.5%, which is paid until death, even if the account balance falls to nil.

The Guarantee Base is reviewed every year. If the account balance has risen above the Base, the Guarantee Base ratchets up (it can’t fall unless a withdrawal is made) and therefore the income stream rises too.

What are the chances of the account balance rising? Hard to say, but we suspect not great. For a start, there are income payments coming out, plus fees and expenses of ~2.5% pa. The investment return probably has to be ~7% pa as a minimum for the account balance to rise.

This should be possible in years of good returns. The investment strategy (keeping in mind there is no choice) appears to be a diversified mix of mainly Australian assets – shares, fixed interest and cash. The PDS is not very clear on this, and then goes on to say that the mix could be anything from 100% equities to 100% cash. So it’s hard to say how it is likely to perform at any particular point in time, though like many guaranteed type products, it is trend following – increasing equity exposure as markets rally and cutting exposure as markets fall.

It’s not easy to understand and that’s actually the simple part. This is a complex product. Really complex.

Here’s an example. Although the Guarantee Base part of the income formula cannot fall, the Income Rate (the 4.5% multiplier) is only guaranteed for 5 years.

After 5 years, the Income Rate is also reviewed each year and can be adjusted up or down by 0.5% each year within limits. But it’s possible for the 4.5% rate to fall as low as 3% (ie income can be cut a third). This is quite possible given that one of the triggers for a cut in the Income Rate is if the RBA Cash Rate is below 4%. It’s now 2.75%.

RetireSafe is also an expensive product:

– Guarantee fee 1.25%

– Metlife management fee 0.70%

– Metlife investment fee 0.22%

– Expenses 0.35%

That tots up to slightly more than 2.5% pa. That does not include any costs relating to advice.

Speaking of advice, MTAA Super recommends that prospective investors seek advice from a financial adviser. MTAA’s advice model is outsourced to Superpartners’ FEAT phone-based general advice, which links to personal advice from Industry Funds Financial Planning (IFFP).

RetireSafe demonstrates some of the challenges of developing innovative retirement income products. The products are often complex and expensive. The benefits can be hard to communicate and may come with caveats.

It’s dangerous to put these products in the hands of members in the absence of advice. But as Money for Life demonstrated, the distribution challenges can be profound even for an issuer with huge resources and a large adviser force. For a fund without a significant dedicated advice business, the barriers to success are daunting.