Retail insurance – high hopes and how to realise them

One of the interesting data points of the 2012-13 Tria Super Funds Review is that while net inflows have been holding up in dollar terms, they are increasingly concentrated. 80% of industry net inflow goes to just 20% of the competitors.

For the other 80% of competitors, net inflows are getting hard to come by. Some retail super players are now in net outflow (to the benefit of the SMSF segment in particular).

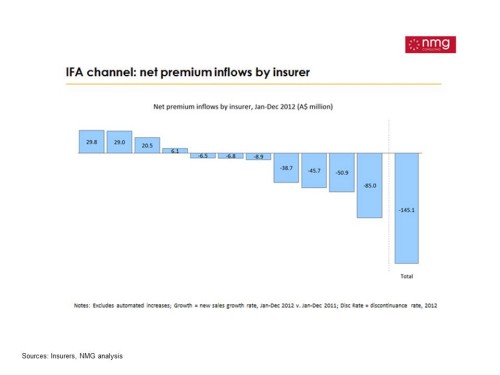

In this challenging environment, insurance has been seen as something of a growth saviour, and anecdotally there has been increased focus by financial planners on client insurance needs. So is insurance indeed picking up the slack in super? Not yet. Today’s chart shows that the retail advised life insurance industry actually faces similar challenges to its big super cousin:

– Most retail life insurers are seeing negative net “flows”. The premiums attributed to policies which lapse or are cancelled are exceeding the premiums attributed to new policy sales.

– The retail advised segment as a whole was in net outflow in full-year 2012, with the situation likely to be exacerbated in 2013.

So is the retail life segment growing? Yes – and no. Life insurance premium growth is a function of a combination of factors:

– CPI inflation: benefits and premiums on inforce policies increase by an amount each year ( typically 2-5% pa).

– Ageing: premiums on inforce policies step up each year, as the insured gets older.

– New business sales: new policies sold each year add to the total number of policies and premiums.

– Policy lapses: equally each year some in-force policies lapse, reducing the number of policies and premiums.

In 2012 the net of retail new business sales less policy lapses was (substantially) negative. What saved the situation was the combined effect of CPI and age-related increases on existing in-force policies, delivering overall positive growth of ~8%.

So yes – total premiums in retail advised are growing, but only by extracting premium increases from a largely static policyholder base. The number of insured did not grow, nor did the amount of cover held by the average 35 year old (in real terms).

Can we expect growth to improve? Is there really a big under-insurance problem out there waiting to be addressed? When you pull the issue apart, it’s not as simple as that conclusion:

– Our view is that past growth of 8-9% in retail advised premiums has been mainly driven by the ageing of the population. More people in older demographics have remained employed (and in debt) for longer and continued to pay premiums.

– Furthermore, they are not being added to in net terms: more people in younger demographics have deferred buying property and have preferred to gain insurance via compelling group cover in their collective super funds.

– This would explain (a) the observed growth in age-based increases over the last 6–7 years, and (b) the recent growth in lapse rates.

– Retail customers have an expanding range of insurance products available via a range of channels. While growth in retail advised insurance has been subdued, other segments (notably group insurance, credit-linked and direct insurnace) are growing faster.

Contrary to popular perception, life risk or protection insurance penetration in Australia is already high by global standards, when an apples with apples comparison is made between countries. In Australia almost all insurance sales are pure risk protection, while in most other markets, the data includes insurance-based savings, investment and annuity products which inflate the penetration statistics.

So where are the growth opportunities? The real opportunity is in areas of genuine underinsurance – notably in developing products relevant to the fast growing, increasingly wealthy older demographics. Those are the types of initiatives which can bring the Australian insurance industry into line with international norms on insurance composition and premiums per head. Expect to hear more about that topic, in future Trialogues.