Surprise! Are managed funds back?

The financial crisis was not fun for Australian fund managers. They did it much tougher than their American and European counterparts, which did not have to compete with 6% term deposit rates. Everyone faced volatile equity markets, but with near zero interest rates, overseas investors had little choice but to seek out returns from growth assets.

Australian fund managers meanwhile were on a starvation diet of zero or negative net inflows, as money poured into term deposits. What limited money was flowing into growth assets was mainly going into high yield direct equities rather than funds.

The big question was what would happen when interest rates finally turned down. When the money started to come back out of deposits, would it return to managed funds? Or would it go direct, leaving the funds industry behind? Was this a really deep cyclical downturn for the funds, or a structural downturn as well?

That question is now being answered. It can be observed by looking at movements within wrap platforms where fund vs direct investing decisions can be made, which a number of Tria’s platform clients have kindly shared with us. Funds are back.

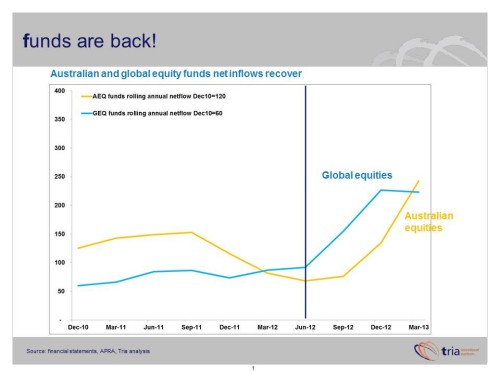

This can be seen in today’s diagram. This shows the change in rolling annual net inflows to Australian equity and global equity funds over 2010-13, averaged across our sample, and then indexed to the starting point (to maintain confidentiality). The vertical line was the date at which TD net inflows started declining, signalling the start of the rotation.

At December 2010, the annual net inflow for the Australian equity funds had an index value of 120, and global equity funds 60. By March 2013, those indexed values were 240 and 220 respectively, indicating that Australian equity fund net inflows had doubled, and global equity fund net inflows had more than tripled. For fixed income funds, the improvement has been even more dramatic.

This is great news for fund managers, which will (presumably) have seen these trends in their individual net inflow positions. The cyclical recovery is on, providing some desperately needed relief from recent conditions.

But it would be a mistake to declare victory and assume that conditions are reverting to those which prevailed prior to the financial crisis. A bull market would obviously help funds further. But the structural headwinds are still blowing, including:

– March of technology, allowing funds to be substituted by direct portfolios, ETFs, and other substitutes.

– Cost pressures, which encourage investors and advisers alike to replace funds with lower cost alternatives.

– FoFA, which evens the playing field between funds and non-fund alternatives.

A financial planner reminded me of this the other day, when he pointed out that replacing active Australian equity funds with a direct equity model delivered a substantial MER kicker, being the largest part of the portfolio.

So how does an actively managed fund hold its own in this environment? Sustained great investment performance always works of course, which Magellan can attest to, but regrettably, this is not something which can be delivered to order.

Some things can be delivered to order though, such as positioning funds around asset classes which are hard for investors to do themselves (international assets and fixed interest outside of deposits are good examples), or innovative approaches to asset classes vulnerable to disintermediation (such as some of the approaches to Australian equity income we have seen in recent years).

It’s a reminder for fund managers to do the controllable well while hoping for good performance to come through, and that innovation still pays.