Fail grade: Stronger Super is pushing costs up, not down

Here’s a proposition. Does this sound an attractive project for super funds and their members?

– Have management teams spend two years on compliance projects instead of addressing member needs

– Spend ~$1 billion

– Watch another 100,000 members leave for SMSFs

– At the end of it all, deliver pretty much what you were doing before

That in a nutshell is the industry view of what Stronger Super has achieved so far, drawn from an interview program of senior fund executives across all major industry segments for last week’s ASFA conference.

It is not a pretty or positive assessment, but it’s a fair one. In terms of benefits delivered to members so far, Stronger Super is seen as a fail relative to the investment of time, cost and effort involved.

It’s important to appreciate the distinction with FoFA, as many people confuse the two. FoFA was the government’s response to the Ripoll inquiry, announced shortly before the final report of the Super System Review was lodged. Although a bit extreme in some respects, FoFA is an important and genuine reform, especially in terms of banning conflicted remuneration and inserting a best interests test for advice.

Stronger Super, on the other hand, emerged from what was to be a “renovation” of the super system, with its (somewhat unclear) goals being “increasing efficiencies, reducing costs and fees, and in turn lifting long-term rates of return” according to the Minister at the time, Nick Sherry.

The negative overview does not imply that there have been no benefits at all from Stronger Super. Our respondents pointed to a range of positives, including:

– Accelerates the deepening of institutions

– Better understanding of risk and risk appetite

– Extension of insurance to some uncovered member groups

– SuperStream will be good – if it works

– Should result in more consolidation

– Has forced retail to get to grips with default members across platforms

However, apart from SuperStream, these benefits are seen as incremental – an inadequate return from such a huge project. There have also been detrimental side-effects to the competitive position of the not-for-profits in particular.

One of the biggest gaps between promise and delivery has been costs to members. Stronger Super, and particularly its MySuper centerpiece, was launched to great fanfare of future windfalls to members amid suggestions that it could result in price cuts of up to 40% (for example as reported by the AFR on 2/8/10).

Now that many MySuper options have been released, this is a fairly easy issue to test. Have MySuper option prices fallen significantly relative to the default option prices which prevailed in 2010? Have they fallen at all?

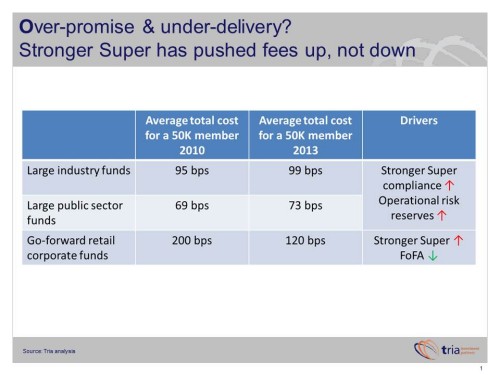

Regrettably the answer is no, as can be seen in today’s table. Tria has tracked effective fund prices to workplace super members since 2004, calculating the total cost for members, incorporating investment, administration, and trustee costs.

There has been a backdrop of increasing prices to members, particularly amongst industry funds, but 2013 has seen an acceleration. Rather than the price of the typical large not-for-profit falling sharply, or even at all, prices have in fact risen materially.

The major cause of price increases is squarely attributed to Stronger Super – project costs, permanent increases in cost structures (especially for risk and compliance), and operational risk reserves. Some of those may reverse, some won’t.

The exception is go-forward retail corporate funds, where prices have fallen dramatically. But this is not a win for Stronger Super. This is the impact of FoFA, which has unbundled adviser remuneration from product pricing. In the absence of Stronger Super, the price reductions would likely have been even larger.

But what about the potential of SuperStream to deliver the promised cost savings? Those prospects may be receding. The budget for SuperStream has already risen to a shock $500m, and on the basis of other recent major Commonwealth IT projects, it’s easy to imagine that bill also approaching $1bn.

in any case, the administration component of the prices in the table is only ~15bps. For SuperStream just to reverse the post-2010 price increases, it would have to reduce admin costs by ~25%. It would take a 90% reduction in administration costs to cut prices to members by 10bps vs 2010 levels (ie improve returns by a barely visible 0.1% pa). Superpartners and Link may indeed be factoring in a 90% cut in revenue due to SuperStream, but somehow we doubt it.