Days of tax exempt pension divisions are coming to an end

In the wake of the Commission of Audit and leading up to the 2014-15 Federal Budget, much focus has been on the affordability of Australia’s public pension arrangements – despite the growth of Australia’s super system to $1.6tn, 80%+ of the population is expected to retain access to the public pension, even over the long term.

With the Government on the hunt for Budget revenue measures, if I was the Treasurer, I would be looking at the declining taxation yield from super and asking how this could be increased. The obvious, and easily implemented answer, is to increase super fund earnings taxes, starting with bringing currently tax-exempt pension divisions into line with the accumulation divisions at 15%.

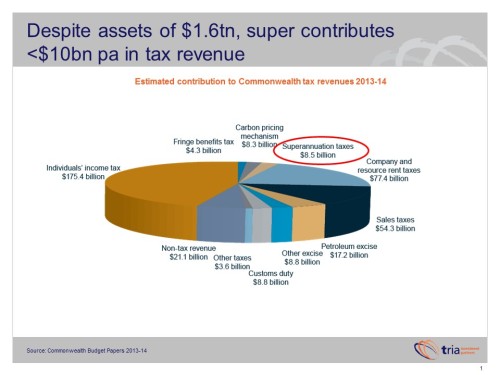

As today’s chart shows, super does not produce much of the Commonwealth’s revenue – $8.5bn of a projected $388bn revenue pie for 2013-14. That’s just 2.2%. It looks like an underperformer from a revenue perspective.

Even more concerning is the declining tax yield from super:

– On average system assets of $1.6tn, revenue of $8.5bn is a taxation yield of 53bps.

– Just prior to the financial crisis, the budget estimate was $8.3bn – so super tax receipts have gone no-where in some time.

– But back then, average system assets were $1.15tn – producing a taxation yield of72bps.

In other words, super now produces nearly 30% less tax revenue per dollar of assets than it did 6 years ago.

That does not look like a sustainable situation. How best to pluck more feathers from the goose with a minimum of hissing?

The usual demand is to reduce the tax advantages that high income earners enjoy on concessional contributions; ie a 46.5% tax rate payer gets a 31.5% tax break on their concessional super contributions (but only 16.5% if they earn over $300,000).

But this makes less sense over time:

– Concessional contributions are capped at $30,000 in 2014-15 – the maximum tax advantage enjoyed by a high income earner will be $9,540. Most alternatives call for at least a 15% concession to continue, so as things stand today the amount available to be clawed back is probably under $5,000.

– Different contribution tax rates for different members will be an implementation challenge for super funds, taking the system back to the much criticized days of the Howard-era super surcharge.

– Flows are becoming less important to the growth of the super system compared to stock effects. Organic growth is falling and the majority of system growth is now the movement of its existing stock of assets.

The more obvious answer is therefore the super fund earnings tax rate, currently 15% in the accumulation division but zero in the pension division. The effective tax rate is materially lower thanks to reduced capital gains taxes on long term gains, but mostly because of refunds of franking credits on Australian company dividends. This often results in a negative tax rate in pension divisions.

The no-brainer measure is to lift the pension division earnings rate from zero to 15%:

– As the system matures into the pension division (already around one third of assets), an increasing proportion of assets are becoming exempt from tax. This measure brings ~$500bn of assets back into the tax net and could add up to $5bn pa in additional tax revenue (albeit before behavioural changes).

– It’s very easily implemented – no more visible to members than accumulation phase taxes are now.

– It addresses the spread of tax arbitrage strategies between the divisions, such as not selling assets until the member reaches the pension phase – thereby permanently avoiding capital gains tax.

Of course, it’s easy to imagine more painful measures. Why stop at equalizing the 15% earnings tax rate? Why not 20% across the board? Or the Government could do something radical like denying super funds access to franking credits, which would lift the effective tax rate significantly. If that seems hard to imagine, think again. UK pension funds also used to enjoy the benefits of dividend imputation, but it was withdrawn without notice in their 1997 budget.