FSI Interim Report – cut super costs, cut active managers

Financial System Inquiry – how do you cut the costs of super?

The interim report of the Financial System Inquiry runs to 460 pages, with 30 pages devoted to the efficiency of the super system. We’ll look at some of the main issues over the coming weeks.

The key observation is that there is limited price competition in super, and that the cost structure is high by international standards, implying that efficiency is lower than it could be. Is this right, and what are the options to cut costs significantly?

One of the oddities of the interim report is its choice of sources.

The assertions about cost structure rely on the recent Grattan Institute report, which suggests average costs for the Australian system of ~0.8% pa, compared to other similarly large systems at half that figure or less. But it’s a problematic comparison – the other large systems are overwhelmingly defined benefit systems – without the administration costs that go with managing member accounts – while the other defined contribution countries apart from Australia in the sample are tiny by comparison.

The report also refers to the Squam Lake Working Group in setting up an argument against high cost active management. This is a group of 13 American academics which conducted analysis on the causes of the 2008 financial crisis and policy responses – mostly relating to the banking system and its supervision. It produced a single, short paper in 2009 titled Regulation of Retirement Saving, which mostly discusses the disclosure of returns in defined contribution systems. It also notes that the default investment option should be diversified with “not excessive” fees with a limit of 2.5% pa, a figure Australia left behind long ago.

Disappointingly the report also trots out the claim of the Cooper Review that the combination of MySuper and SuperStream initiatives would result in a fee reduction of ~40%. The immediate impact of MySuper was in fact to increase fund costs, rather than decrease them, while SuperStream remains a series of increasingly large upfront costs and yet-to-be-determined benefits.

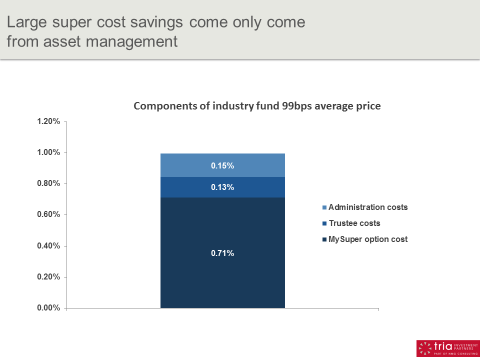

The practical problem with the otherwise laudable goal of cost reductions is clear from today’s chart, which decomposes the typical large industry fund average price of 99 bps for a $50,000 member in 2013. The vast majority of the cost structure actually relates to investment costs.

It’s a fair observation that the industry has largely failed to deliver economies of scale when it comes to administration. In our chart above, the administration cost of 15bps has been stuck at that figure for years. But equally, doesn’t matter how effective SuperStream turns out to be – it’s working on a cost base of 15bps. It could deliver savings of one third, and the entire cost structure would fall by only 5%.

Inevitably you keep coming back to investment costs, and if you want large savings, there aren’t that many options:

1. De-risk the portfolio and put it in cash, deposits, and bonds.

2. Switch from active to passive management.

3. Get out of alternative and unlisted investments.

4. Internalise active management.

Most of these will be seen as deeply unattractive by many funds.

De-risking conflicts with the long term objectives of most members. Most (albeit not all) funds strongly believe in both active management, and the benefits of alternatives and real estate, although they are starting to shy away from the most expensive categories. Smart beta is also benefiting from this trend, although at the expense of traditional passive as well as active management.

So beyond more use of smart beta, if funds are not going to abandon active management and their unlisted assets, that really just leaves internalization of those portfolios (it generally makes no sense for pure passive given the cheapness of external management here).

There’s no question that internalizing an active capability can be much cheaper than buying it externally; and it gives you 100% of its capacity too. But whether funds can handle the inherent risks and conflicts, and indeed identify sufficient high quality capabilities to internalize in order to make a difference to their cost structure – those are entirely different questions which are not so easily solved.