SMSFs’ compelling value proposition

Wealth industry executives sometimes struggle to understand the steady stream of their members to SMSFs.

In a recent ASFA debate of the Pros & Cons of SMSFs (click here for an edited version of the slides), we worked through the case for SMSFs, concluding that the SMSF value proposition can be irresistible, particularly to high value members, and it’s a value proposition which is difficult for collective funds to respond to.

We see four main parts to the SMSF value proposition:

– Regardless of how you want to invest your super, an SMSF probably lets you do it.

– If you want to track how your retirement income is progressing, an SMSF provides visibility and control.

– While SMSFs are expensive, particularly so at the smaller end, costs are falling.

– Paying tax is “optional”.

SMSFs use the same settings applying to all super funds – but the SMSF structure makes them easier to make the most of compared to a collective fund structure.

When it comes to investments, a bit over half of SMSF assets are invested conventionally, particularly in Australian shares and bank deposits. But essentially, SMSFs can invest in virtually anything.

Increasingly this means real estate, both the conventional (eg small commercial assets) and racy (eg Balinese property) – which given the ticket size, also often means gearing up. Other possibilities are extensive; for example SMSFs allow you to make investments in assets to support your business, or in personal interests such as collectibles. Bitcoins are now being discussed.

This is all possible because the rules about investment strategy have few requirements beyond having a strategy (it can be in your head, and you could change your mind daily) and reviewing it periodically. It is a world away from the investment menus of most collective funds.

The flexibility of SMSF investing is also a positive for tracking the progress of your retirement income. Hardly any collective funds report to members how their retirement income is coming along – most funds report account balance, return, and that’s about it. Members who won’t be cashing out also need to know how much retirement income their account is generating. The problem is that with most collective funds, you simply can’t tell.

But in an SMSF, you know what income stream your fund is producing – it’s on the tax return. You can see how that income stream is changing over time, its tax effectiveness, whether you need to contribute more, or adjust your portfolio.

When it comes to costs, SMSFs are still expensive, but getting less so. On average it costs nearly $1,000 to get started, and ~$3,000 pa to maintain, and that’s before investment costs. That doesn’t make sense for balances below $500,000, but the numbers will keep going down thanks to technology and competition.

Finally, SMSFs are a legal tax planning vehicle, the like of which we have never seen before. That is not to say that tax minimisation is the dominant purpose in setting up an SMSF, but it is definitely part of the attraction. SMSFs enjoy exactly the same tax benefits as collective super funds – but make them much easier to exploit, particularly in the accumulation phase, which today’s example illustrates.

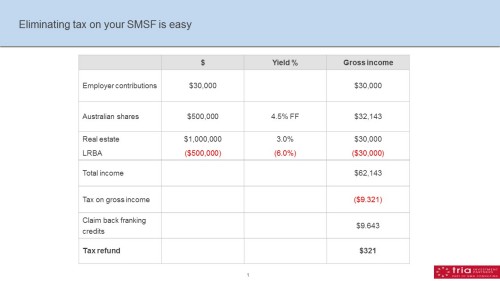

The example assumes:

– An executive making contributions of $30,000 pa to an SMSF with $1m in net assets.

– Half the portfolio is invested in Australian shares earning 4.5% pa fully franked.

– The other half is geared up to $1m via a limited recourse borrowing arrangement (LRBA), and used to purchase buy an investment apartment.

This SMSF has gross income of nearly $100,000 – including contributions – but will pay no tax:

– Interest on the LRBA is deductible, making taxable income $62,000.

– The tax bill of more than $9,000 is eliminated by franking credits of $9,600, producing a small refund.

And if the member refrains from selling assets until the pension phase, there will be no capital gains tax either. In other words, it’s possible to construct an SMSF which pays no contributions tax, no earnings tax, and no capital gains tax.

While none of this is news, seeing it put together can be exciting (or confronting, depending on your perspective). How does a collective fund compete with an SMSF pitch to their members consisting of “invest in pretty much whatever you want, pay no tax, pay less fees”?

Collective funds can compete with this proposition of course, although it’s not easy. This reflects why it’s not just high value collective fund members who find the SMSF value proposition appealing; increasingly, it’s mid-lifecycle members with relatively modest balances who are seduced too.