When will the super system reach maturity?

When will Australia’s super system reach maturity?

This is an important question for management teams across the industry, whether working for a super fund, an asset manager, or a service provider.

What does maturity mean anyway? In a typical industry, it refers to the top of the industry “S” curve, where revenue growth has slowed to single digits, but is not yet falling.

At the recent FSC Conference, CEO John Brogden argued that the system would not reach maturity until a member had gone through the accumulation phase having enjoyed the 12% rate for the entire period. Given that the SG won’t reach 12% until later in the decade, on this view the system doesn’t reach maturity until around 2065.

But that view, and forecasts of a super industry growing indefinitely, depend on the fact that super is not a typical industry. Unlike most other industries, super enjoys a growth floor thanks to investment returns on the existing stock of assets – without industry participants doing anything.

What most industries think of as growth, is for super the additional growth derived from net inflows. For super, the overall industry AUM growth rate is currently ~10% on average, comprised of:

– Investment returns net of fees and tax – say an average of 6.5% pa

– Organic growth (member driven net inflows as a % of assets) – about 3.5% pa

Take away investment returns, and the growth rate of super is not exactly crash hot – and yes, that includes compulsory contributions. Indeed, on that view, you might argue that the super system has reached maturity already.

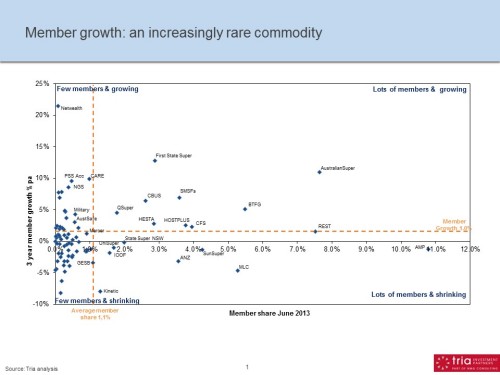

Today’s chart offers a new perspective. Based on a suggestion from Kate Andrews of HESTA, this takes Tria’s map of the super universe (which plots all 80 large funds by share and growth of AUM) and recuts it by members. That is, who has the members and are fund memberships growing?

This view of the system is even more sobering than the organic growth rate of AUM.

Three year member growth in the system has been only ~1% pa. It has largely ground to a halt – pretty much every Australian of working age (and many retirees) is in the system, and while the working age population is still growing, that is being offset by account consolidation. So member numbers are not growing.

A couple of things are very stark.

Firstly, it’s notable that few entities are located in the top right quadrant, enjoying above average market share of members, as well as growth in members. The stars here are AustralianSuper and First State Super, but part of their superiority is thanks to large infusions of members from fund mergers.

Other participants which come up well on this view are the SMSF segment, BTFG and CFS amongst the retailers, and some of the major industry funds. It should be noted that this is an entity view, which can potentially conceal individual products doing well but being cancelled out by other products with shrinking customer numbers. That said, this is quite a wake-up call when achieving member growth of 3% pa is a great result.

You can still grow revenues if your model is based on % of assets – the case for the retailers and a few not-for-profits. But growth becomes largely dependent on investment returns; ie equity returns. The business metrics may look great when the market is up, but it’s cloaking underlying weakness.

For most not-for-profits, the challenge is different – the only way you can grow revenues (other than increasing fee levels) is to take members from someone else.

Secondly, although not individually labelled, it can be seen that there are a large number of smaller funds with memberships which are static or falling. Many of these are not-for-profit funds with revenue models consisting primarily of dollars per member per week.

This means there is a large chunk of the super industry (by number of funds) with static or falling revenues. The only way such funds can respond to rising operating costs and the need to develop products and services for members is to increase fees – potentially significantly. That’s not a strategy you can pursue forever.

When does the super system reach maturity? With member growth at 0-1% pa and organic AUM growth at 3-4%, in some ways we’re already there.