Retail lapse rates: what are we missing?

The life insurance industry is already battling rising lapse rates and claims, declining sales growth and sub-hurdle returns on capital. The release of ASIC’s review of retail life advice, and particularly the surveillance findings, will lead to further soul-searching – even if the surveillance was not random but targeted AFSLs and practices with the highest activity levels (something the media coverage seems to have missed).

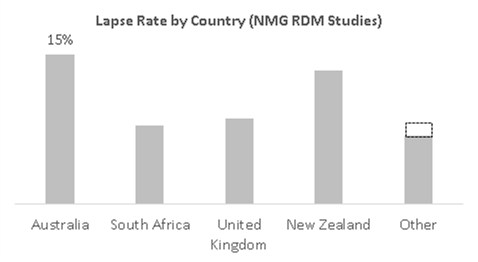

We don’t seem to be any closer to consensus on the causes of the run-up in retail lapse rates in Australia (from 12% in 2008 to 15% in 2014, and higher excluding platform-linked), much less the appropriate response. There is a continuing media focus on adviser ‘churn’, which we presume means re-broking of policies for commission, with no benefit to the client. But ASIC’s report doesn’t mention churn, and while it exists at the margins we can’t find any evidence in our analysis of industry lapse dynamics (by channel, by AFSL and by duration) that churn is a material contributor to the run-up in lapse rates since 2008.

Perhaps it’s time to look beyond the Australian market and experience, and consider additional factors. The chart below compares retail life lapse rates in IFA/broker channels for Australia, South Africa, the UK and New Zealand (we have also considered lapse rates in the US and Canada).

What does a market comparison tell us about the factors most commonly cited as contributing to the increase in lapse rates?

- Commissions. Australian initial rates of 110 – 115% are lower than the UK and NZ. In North America, commission rates on pure term are less than 100% but calculated on higher first year levelised premiums where we calculate on lower age-based premium. In South Africa, broker commissions are capped at 85% but advisers are shifting to ‘aligned’ or agency models offering higher effective initial rates. Incentives matter, and it’s hard to argue high initial commission with limited clawback will not tilt activity toward selling, including re-broking. But international markets with comparable or higher commissions have lower lapse rates, and our lapse rates have increased while commission levels have been stable.

- Distribution alignment. Australia has higher institutional alignment than comparable markets, and lapses are generally lower in other markets where non-aligned brokers dominate. But Australian lapse rates are higher for non-aligned than aligned, and for aligned than bank (something that isn’t well publicised) and aligned channels have grown faster than non-aligned over the period when lapse rates have increased.

Perhaps we need to consider factors that don’t seem to get as much attention in Australia.

- Product structures. We’re the only major market (sorry, NZ) that sells non-contracted age-based stepped premiums. Other markets sell contracted level or hybrid premium patterns, where the client effectively pre-funds and loses out if they lapse early. The Australian product is more customer-friendly, flexible and easy to sell, but it’s general insurance with life insurance commissions and accounting – dangerous stuff.

- Insurance penetration levels. Australia has arguably the highest level of mortality and morbidity insurance penetration in the world – by any objective global standard Australians hold a lot of risk benefit, and the industry has worked hard to raise awareness. This may explain recent dynamics, particularly given the accelerating demographic shift to pre- and post-retirement and in the context of unique premium patterns that are expensive at older ages.

- Group insurance. We have the largest group risk sector in the world in per capita terms. Over the past 10 years we have seen unprecedented expansion of accessibility (courtesy of open-offer industry funds) and benefits in the context of pricing that must now be considered irrational; group risk became a substitute for retail at least for younger lives.

Proving causation is difficult, perhaps impossible. But if we sell a product that is prone to high lapse rates, maybe what we’ve seen since 2008 is just an unwind of the structural factors that held lapses down? We can see that from 2006 – 2008 younger demographics began to take advantage of expanding group cover and opt out of retail, just as older demographics retained cover given the reality of longer working lives and debt loads. If the demographics of the retail life pool shifted (fewer younger, more older lives) that would explain higher premium lapses and higher claims, particularly as the post-GFC crunch hit affordability.

This leads us to a factor that international visitors to Australia often ask, that gets no local attention at all:

- Unrealistic assumptions. The current debate is premised on lapse rates being too high, but maybe the problem is that our expectations are too low. Insurer pricing assumptions remain below current experience; perhaps it’s time to adjust assumptions in line with current experience and reflect not in profit but in re-pricing through to the system.

That sounds extreme, but perhaps we focus too much on lapse rates (and on looking for a single cause or a silver bullet solution). Look back far enough and tied agency channels that pushed a single carrier on a ‘sell and forget’ basis had very low lapse rates, albeit with implications for customer outcomes – presumably no one is advocating for that outcome.

What is clear is that insurers cannot continue to fund the current level of initial costs (commission and other) on the current product structures and with lapse rates at or close to current levels. We need to identify how to re-balance this equation, without radically reducing the flexibility and saleability of life products, or willingness of advisers to sell insurance, or pricing out all but the healthiest customers (all of which are evident in other markets). Let’s hope that the industry can shift to a more balanced debate along these lines.