Why do I need to be insured?

Article by Pierre van Zijl (NMG Personal Wealth)

Article by Pierre van Zijl (NMG Personal Wealth)

As Financial Advisers, we often experience resistance from clients when recommending life insurance. However, have you ever asked yourself the questions: “What would happen to my family if they no longer received an ongoing income as a result of my death or disability?”

I was reminded of this question after two recent experiences within the last 12 months. Both of these cases were new clients with a spouse and dependents. In the first instances, I had attended an information gathering session with this client and was preparing his comprehensive Financial Needs Analysis in anticipation of our second appointment. Before I could complete my needs analysis, I received a call from the clients wife informing me that he had passed away.

In the second instance, I had presented my findings to the client but he was mulling over whether or not he could afford the cover. Before he could make up his mind he suffered a severe stroke which left him uninsured and disabled. I think of these individuals often and wonder, who will look after these clients and their families? Could I have done more to convince this client of the urgency of the cover?

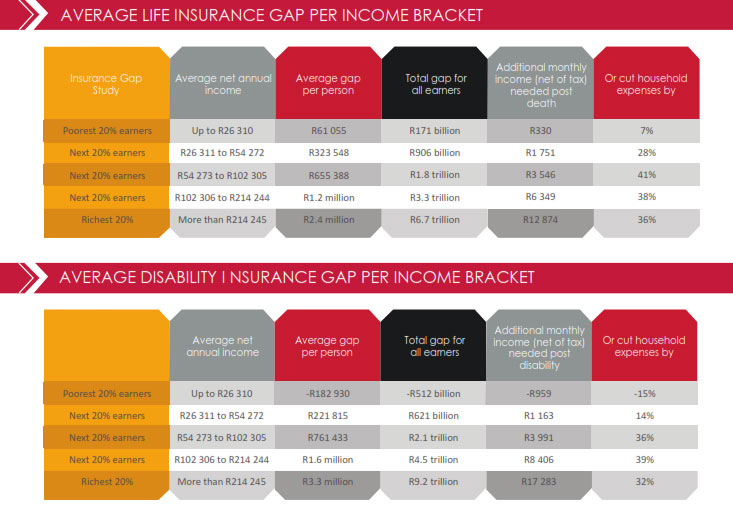

The latest ASISA (The Association for Savings and Investments South Africa) South African insurance gap (2016) Survey aims to quantify the insurance gap by considering the financial impact on South African households of the death or disability on an earner in the household.

The statistics confirmed the need for more insurance for South African families. This report focusses on the average shortfall of Life and Disability cover within South African households.

The statistics reveal, among others, that the current shortfall faced by the top 20% of income earners in South Africa for Life cover is R2.4 Million per person, and Disability cover of R3.3 Million. These families will need to cut their monthly expenditure by 36% after Death, and 35% after Disability to sustain their standard of living, due to the loss of their bread winner.

What most people do not realise, is that Life and Disability Cover should be taken by an individual to cover outstanding debt and to provide their family with a monthly income should they die or become disabled. One should review the amount of cover they have as their circumstances change.

What the ASISA report also showed is the additional amount that the average individual needs to spend to be comprehensively covered. On average on 4.2%. more than their current spend.

With the festive season around the corner, and many families taking their vehicles to auto service centres for tune-ups before they hit the road for their December holidays, please do not forget the importance of ensuring that you have sufficient cover in place before you leave for your well-deserved rest.

Please feel free to Contact Us, for your financial health check and to answer the question, “where will my next income come from?”