InsureTech Pioneers

June 2017 | Life Insurance

The redesign of the process for acquisition and risk assessment in life insurance is well underway. Reinsurers have made major contributions, and their latest innovations are at the cutting edge of InsureTech.

The original ‘trail blazers’

Automated underwriting systems (AUSs) represent the first meaningful wave of ‘InsureTech’ for the life insurance industry, the origins of which began two decades previously as an innovation by the reinsurance industry that proved to be ahead of its time.

Current usage

Over the last five years, and particularly in the last three, the industry has passed a tipping point: newly-developed systems have become far more capable and intuitive, and the range of competitor offerings has expanded significantly. The number of people engaged in underwriting automation has mushroomed over the same period, and work experience in this area is now highly sought after.

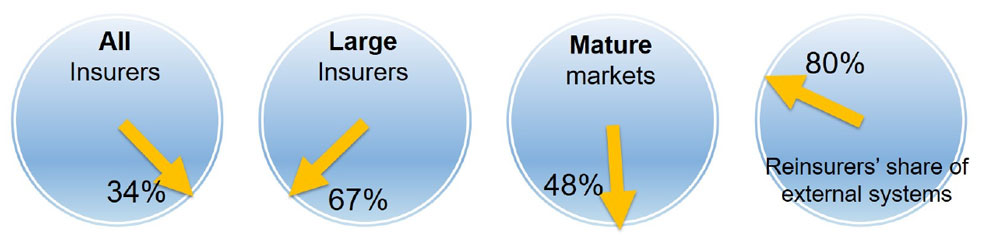

According to an NMG Consulting Study of approximately 1,500 life insurers globally, by the end of 2016 nearly 450 insurers reported the current use of an AUS, the definition of which ranged widely from simplified in-house constructions, through to the most sophisticated ‘fully-underwritten’ external offerings.

Reinsurers have capitalised on their first-mover advantage by re-platforming older systems; reinsurer-owned systems currently account for just over half of all installations, and 80% of installations sourced externally (which also include technology providers).

Penetration rates are higher in mature markets, where insurers are also more likely to make use of external specialist system providers, and where large insurers operating without an AUS are now increasingly rare.

Exhibit 1

AUS Penetration – Tale of the tape

NMG Consulting | Life & Health Reinsurance Programme 2016

Algorithm-derived decisions offer a level of compliance and consistency that humans cannot match, but AUSs are also a long way from their point of singularity. Reflexive question sets and algorithms have yet to cope with the most complex risk assessments – specifically, highly-substandard or financially-complex risks and those requiring in-depth medical evaluation, which systems currently pass on to an expert human underwriter.

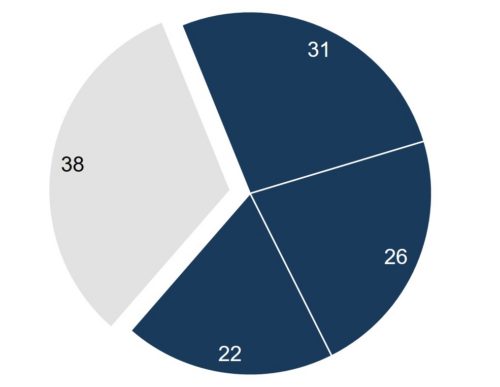

A boom in investment and take-up

The AUS portfolios of reinsurers are currently tiered between those that have broad coverage across markets, multi-country mandates with upwards of 50 installations, and those that have targeted regional success and single-country installations. Across 2015 and 2016 combined, reinsurers installed more than 100 new systems globally, dwarfing the efforts of any previous period. In-house builds by insurers were also numerous, although usually far less ambitious in scope. Technology vendors have also made headway in complex markets.

Exhibit 2

New Systems Installations by Reinsurers (2015/16)

reinsurer systems

accounted for more

than two-thirds of new

installations in 2015 and

2016 combined”

NMG Consulting | Life & Health Reinsurance Programme 2016

In general, more-recently developed systems have attracted higher satisfaction ratings from insurers, although the offerings available are increasingly diverse and don’t always compete on a like-for-like basis. This carries weight in the contest for new installations, noting that in mature markets, where the value of incumbency has fallen significantly.

So, what’s next?

The Cloud. Recent installations have generally been on an Enterprise basis; however, the emergence of competitors offering cloud-based solutions will provide insurers with additional configuration options. Lower implementation and operating costs may draw in many insurers that previously considered the level of investment required prohibitive. Larger insurers may feel that additional, purpose-built systems are warranted for specific products or distribution channels.

Acquisition. AUSs are also set to be increasingly repositioned as customer-centric new business acquisition platforms focused on growth rather than just underwriting enablement.

Data. Several reinsurers have already invested heavily in the capacity to support a smart sales environment, something not seen before in life insurance. Investment in business intelligence system modules will continue to grow, in some cases via specialist partnerships with technology firms. Smart distribution and assessment data will also flow through to pricing.

Distribution. Distributors – both digital and traditional – are beginning to see the benefits for systems installed directly in the front office, whether in support of their on-line or telephone-based propositions, or as comparative portals, or as a way of streamlining placement at the product level. There is significant scope for growth in usage.

| Prediction. The emergence of new risk assessment information assets in the form of structured data (particularly in North America) is shaping technology enhancements to integrate external sources such as pharmaceutical, credit, wellness and behavioural data. As such, we are at the beginning of a move to ‘continuous pricing and underwriting’ models, creating at some point a conceivable and practical application for AI in life insurance acceptance; several reinsurers are already investing in this area. |

“… the expression of

underwriting expertise in the form of technology has become an essential part of the service offering for reinsurers.” |

In summary

It seems more than safe to say that, at an eyebrow-raising 100+ implementations in the past two years, the expression of underwriting expertise in the form of technology has become an essential part of the service offering for reinsurers.

With these powerful technologies in their possession, unlike any time before, reinsurers have an opportunity to reshape their roles across the value chain, and participate in the much-needed process of transformation of sales and distribution in the life insurance industry, in the process helping it grow.

This certainly augurs well for the near-term demand for automated underwriting systems, continued investment in new data platforms, prediction and AI, and ultimately a growing symbiosis between human and machine.

Related reading on the evolution of life & health reinsurers: Becoming innovators

Our authors

Mark Prichard is the CEO of NMG Consulting (Sydney; [email protected]),

Jane Cheng is a Principal Consultant (Sydney) and Maryan Kim is a Consultant (Toronto).