The World’s Leading Life Protection Markets

In Brief: Having fielded questions from clients and stakeholders for several years, we’ve eventually got around to producing a global index of total risk in-force for the world’s largest life insurance markets.

This analysis differs from all others, in that it is focused exclusively on the risk component of life products, meaning mortality, disability and critical illness (but excluding medical). A Global Life Protection Index would therefore seem a suitable name.

In markets such as Australia, South Africa and the UK, where NMG directly produces industry data and where risk and investment products are unbundled, these indices have proved relatively straightforward to develop. However, in markets where whole of life, universal and variable life products are still sold, and where we’ve had to work from industry data and our global reinsurance studies, we were required to develop a series of structured assumptions to derive sensible estimates.

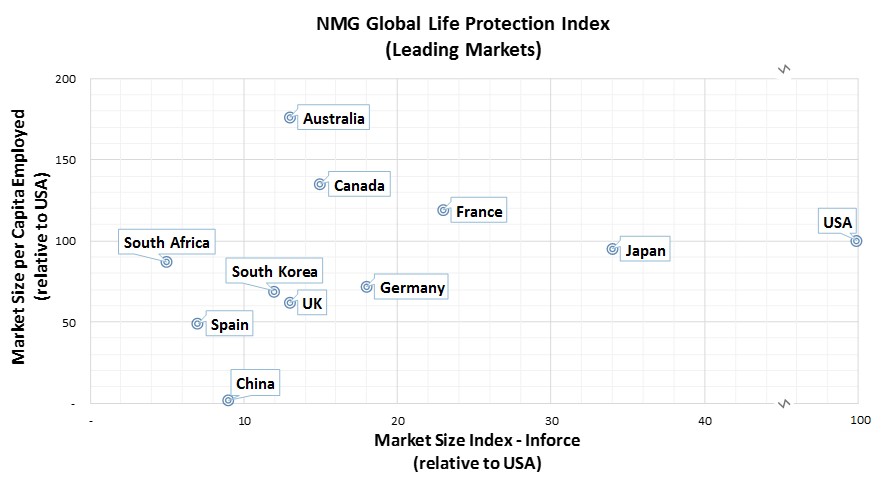

NMG Global Life Protection index

Perhaps the index positions and relativities will not come as a major surprise for many, but we nevertheless found it to be an interesting process as it:

- Demonstrated that it was in fact possible to make these estimates by drawing across multiple data sets (public and proprietary)

- Illustrated the size of the US market relative to all other markets, which in turn made it the obvious baseline for the “Market Size Index”. This despite well-documented concerns that inforce life insurance premiums in the US have been static for two decades, at a time of a rapidly expanding general population

- Clarified the wide variance in the relative importance of the group segment within markets: France, Canada and Australia have the highest share with group premiums approaching 50% of the total, while in Germany group insurance is marginal

We also created an index score per employed person (“Per Capita Index”), which provided an indication of relative penetration between markets:

- In the developed world, Australia and Canada had the highest Per Capita index ratings. Both have large group segments, as well as significant levels of living benefits coverage sold on an individual basis. Both countries have enjoyed consistent economic growth for extended periods, and in Australia life insurance premiums have doubled over the past decade. France, with a large group insurance segment, comes in third

- The US and Japan, the two largest markets, had essentially similar penetration levels per capita

- The United Kingdom was much lower than we initially hypothesised, given its innovation profile (use of reinsurance, business automation). Group premiums are relatively small in the UK, and sales of disability income on an individual basis are comparatively modest

- China is the only emerging market in the top ten in terms of market size. The degree to which it lags on the Per Capita Index indicates the long-term potential for significant growth in risk sales

- Finally, the innovative South African market finds its way into the top ten on the Per Capita index (being 11th on the Market Size index). Risk-aware employed and economically active South Africans are relatively well-insured, although substantial currency weakening in the last two years perhaps understates the relevance of the market in global terms

The first iteration of our indices offers what we believe are several valuable inferences:

- Group insurance is a very important mechanism to expand baseline coverage within countries. This is a clear gap in markets such as Germany and the UK

- Furthermore, the efficiency of group coverage in terms of the share of premiums paid out in benefits (versus individual insurance) means that countries with relatively small group segments lag even further behind on a claims-paid per capita basis (perhaps an opportunity for a new index in future)

- Australia’s success in expanding penetration illustrates that there is significant scope for growth even in mature economies by raising the productivity of existing distribution channels and addressing buyers that seek to purchase life insurance directly

- The scope for growth in risk sales in emerging economies is still enormous. This is noteworthy as only two of these leading markets offer a double-digit growth trajectory (in nominal, local currency terms)

Never miss a Trialogue! Sign up to receive future Trialogues direct to your inbox.