Lots of robo, not much advice … part II

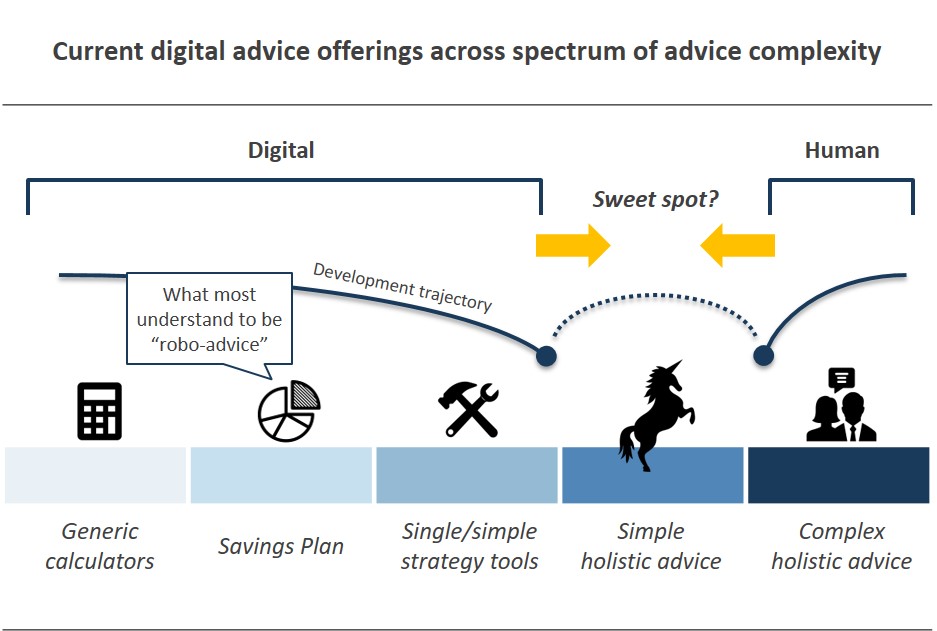

In our last installment, we discussed the current state of the digital advice landscape – an underwhelming plethora of discretionary investment and retirement income calculators that do little to solve for Australia’s advice gap. While investment in advice technology proceeds at pace, there is growing acceptance that there may never be a binary choice between robo OR human, and that the two can and should co-exist.

Because personal holistic advice involves emotional and subjective trade-off decisions, there cannot be one unequivocally correct answer in every case – we believe human intervention will always be necessary. A ‘unicorn’ therefore would be a digital offer that can successfully help users navigate these decisions in an objective and engaging way, such that a meaningful proportion of advice issues (relevant for Australians who can’t afford to see a financial adviser) can be solved in a self-guided manner.

So where to for digital advice innovation from here? We have seen two distinct development trajectories being pursued – on the one hand there is of course continuation in building out the sophistication of the current generation of calculators to increase the breadth of advice on offer, but on the other, we increasingly see propositions using technology to target advisers’ costs-to-serve. The theory goes that if costs can be lowered through greater efficiency and automation, personal holistic advice will become more affordable and therefore more accessible.

Current digital advice offerings

By far the most advanced players in pushing this development forward are financial planning software providers who are investing heavily in capabilities that algorithmically solve simpler advice problems traditionally modelled manually in an adviser’s back-office. Coupled with straight-through production of Statements of Advice (SoA) and automated execution, the hope is that advisers can generate compliant simple holistic or scaled advice at much greater speed and at a fraction of the cost.

Financial software providers (such as XPlan and MidWinter) are naturally best placed to win this race – codification of advice policies and taxation, superannuation and social security rules and regulations, and maintaining their currency are capital intensive pursuits in which they’ve had substantial head-starts. With such a significant barrier to entry, it is difficult to see how fintechs and asset managers who wish to expand the market for their discretionary investment offers into an adviser’s domain, can do so effectively on their own.

But this is by no means a fait accompli for financial software providers – in the near term at least, lacking any direct to consumer capability of their own, they are of course beholden to advisers’ propensity to use these emerging capabilities. Herein lies the conundrum: in a world where many advisers rely on their technical expertise to justify the fees they charge, would they be willing to change to a business model where that expertise is outsourced to a machine? In a post-FOFA world where adviser margins have been under pressure and advisers are increasingly focusing on higher net wealth segments, who will buck the trend and make themselves the McDonalds of the advice world?

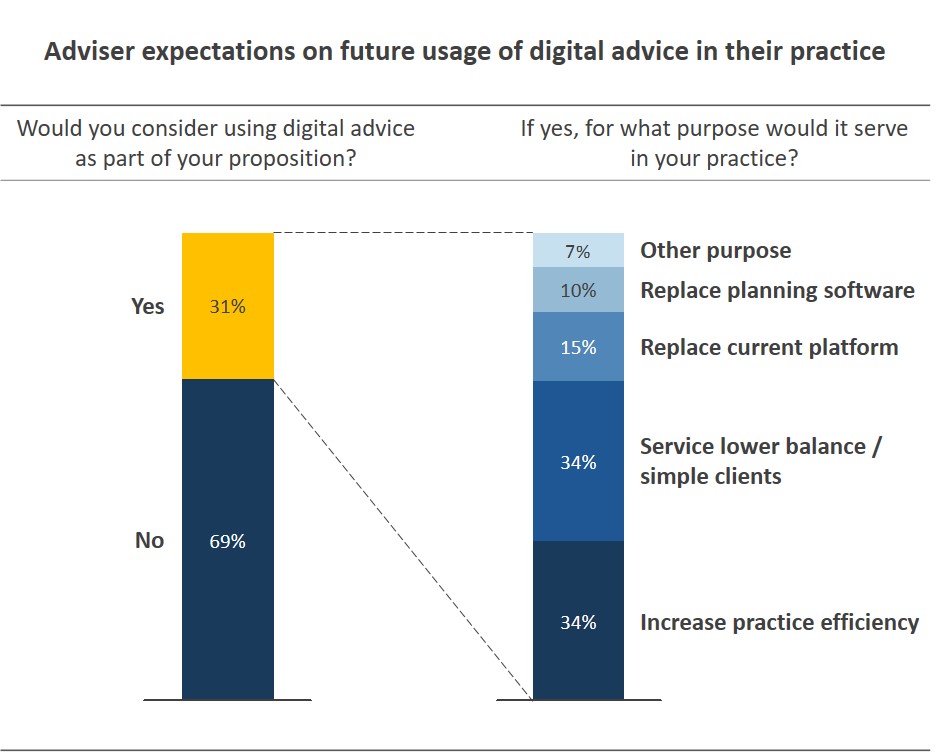

Current sentiment suggests that non-salaried advisers are still sceptical of emerging digital advice tools. As the chart from our Tria Australian Adviser Insights Program (2016) shows, only 30% of non-salaried advisers would consider using digital advice as part of their business, and of that only a third would use it to service clients with lower balances or less complex needs. Putting aside capacity constraints from the number of advisers in the market, there doesn’t appear nearly enough interest at present to materially diminish Australia’s advice gap.

Adviser expectations on future use of digital advice in their practice

(Source: Tria Australian Adviser Insights Program, 2016)

If working through advisers to solve Australia’s advice gap is not the answer either – at least until early adopters commit to technology enabled business models that focus on this segment – who can stand in for the unicorn while we wait?

Major banks have both the scale and relationships to tap into innovative financial planning software development, and the distribution network to reach a substantial proportion of Australians in the advice gap. The key for them is gaining access to conversations with these customers about advice. The cross sell opportunity is immediately obvious and not new – but it also goes without saying that the banks have an image problem in this area. Intense regulatory scrutiny may well continue to distract from efforts to crack this space, but given enough time, for those that partner well with the technological forefront in algorithmic advice, it could well be them.

But just as compelling in our view is the potential inherent in industry super funds. As their sole purpose is providing for people’s retirement, and given the positive regard with which most are held, they have a unique opportunity to have meaningful advice conversations with their members. With member bases that largely fall within Australia’s advice gap, and not having significant distribution networks of their own, we’d argue that they have a strategic imperative to solve for this first lest someone else reap the rewards of doing so.

So how can industry super funds put their hat in the ring? In our next instalment we will look at what it will take for funds to get ahead in the race to be Australia’s digital advice unicorn – stay tuned!

Click to read Lots of robo, not much advice … Part III

Never miss a Trialogue! Sign up to receive future Trialogues direct to your inbox.