Lots of robo, not much advice … part 3 – ‘incremental advice’ paving the way for personal advice in industry funds

Since our last instalment, where we discussed the industry developments targeting the ‘sweet spot’ of self-guided, simple holistic digital advice, Tria formally adopted our parent’s brand, NMG Consulting. Now moving from a brand we’d like to think was known for its expertise in the Australian wealth management industry, to one just as mature and respected in the same and adjacent fields, was a natural next step – and for our many clients, we hope they see it’s just business as usual.

But what happens when the reverse is true? When you have an existing brand yet you want your customers to see you in a completely new light, and to come to you for a service they never thought to ask you for before?

Industry funds are grappling with this very conundrum – as successful superannuation accumulation vehicles, not-for-profits continue to dominate. But once members approach retirement, those that can afford to see advisers, do so, and they almost invariably end up leaving their fund.

Industry funds have been active in their response; there are well established intra-fund advice models. Outside of this, the ability to provide personal holistic advice to members is far less well developed because of the sheer lack of scale and coverage that funds have in this area. Even if the growth rate of advisers servicing industry fund members were to double from today, by 2020, one such adviser would still be expected to cover some 2,000 pre-retirement and pension members per year. Efforts by funds to offer this service so far have had mixed success as boards debate whether to insource or outsource the function, how to charge members, and how to avoid even the slightest association with vertical integration.

Faced with such an existential crisis over the provision of holistic advice, funds therefore have been slow to promote the offer. They know it’s good for members and the fund, but are worried about how much it costs to provide. Consequently, member interest in approaching their fund about it remains low (they just don’t associate their fund as being able to help them with anything outside of super), so they continue to seek it elsewhere, or worse, don’t seek any advice at all because they can’t afford to.

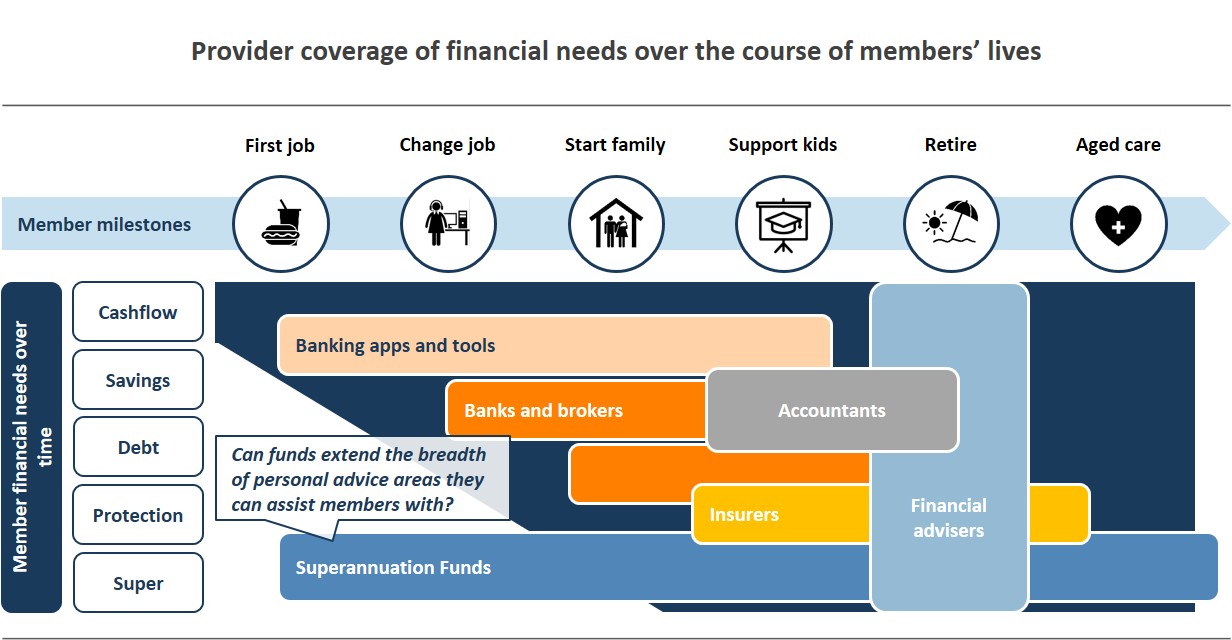

So what does this all mean for digital advice? Whilst there will be a continued and vital role for face-to-face personal advice, it is only through early engagement that funds will be able to build a pipeline of member interest in seeking retirement advice, and so establish themselves as the natural provider for it. And that is where digital comes in to play. As the diagram below shows, as members approach retirement and begin planning for it, several competing voices will already be vying for attention and will have been speaking to members about their finances – quite naturally, their super fund (despite perhaps being the most substantial guardian of their wealth) becomes a bystander in the mix.

Digital advice is the game changer. It can help funds get a head start on the conversation – instead of focusing on intra-fund and single-issue advice, funds should be thinking about what we have termed “incremental advice”. If funds gave their members the ability to deal with cashflow, debt management, or protection and insurance needs, as and when relevant, but always couched in the context of long term financial health, how different might member perceptions of their fund be? Would members be more likely to turn to their fund for advice at retirement? We think so.

The benefits to the fund are many – member engagement and satisfaction to name a few – but possibly most importantly, should members seek face-to-face holistic advice later in life, the fund has a fighting chance of being the first provider they turn to.

And the good news is that the ability to digitally provide incremental strategic advice is not, in fact, a unicorn. Providers like Decimal and Map My Plan for example, offer end users the ability to self-service a range of individual advice areas and strategies in an additive sense. Although both stop just short of implementation, as singular systems, they maintain the sum of the parts of the advice that a user has sought.

We recognise that investing in the infrastructure to support digital advice is a long-term play. But in seeking the services of technology providers, perhaps funds can take a leaf out of the books of the major banks. Several are making portfolio plays in fintech by taking stakes in a range of start-ups they see as having mutually beneficial successes. But regardless of the journey to get there, industry funds simply can’t afford to treat personal holistic advice as a service they only provide when asked. If funds embrace all that digital advice can offer today, even without a unicorn in sight, they can provide the platform for materially addressing Australia’s financial advice gap.

Never miss a Trialogue! Sign up to receive future Trialogues direct to your inbox.