Streamlined insurance distribution: a digital success story with lessons for wealth

The UK has a vigorous and innovative insurance industry which often leads its wealth and asset management peers in delivering customer value. The growth of streamlined insurance specialists using the digital channel to cost effectively distribute products and assistance is a notable success in its own right, and provides lessons for wealth and asset management.

Streamlined insurance specialists are life insurance brokers and advisers offering underwriting and policy application to the customer via non-face to face channels, both digital and otherwise. In the UK, two main business models have emerged:

- Remote referral specialists: specialist brokers, referred by comparison websites and affinity partnerships, managing the end-to-end fulfilment process for their partners, including more complex cases and those customers seeking advice.

- Remote digital specialists: remote brokers and advisers generating their own leads online.

The streamlined distribution model has been growing at ~20% pa while the traditional face-to-face model is essentially stagnant, with growth rates of <5% pa. The rapid growth of the streamlined model is partially driven by technology improvements which have favourably altered supply dynamics:

- Development of auto-underwriting systems such as UnderwriteMe: allows streamlined specialists to fulfil straight-through insurance policies.

- Adoption of the non-F2F model: simplifies underwriting and servicing process to drive down provider cost.

On the demand side, as we have seen in many other industries, there is increasing willingness of customers with straightforward needs to research, select, and purchase simpler products online, with or without assistance. This is accompanied by growing demand for a fast and friendly user experience and customer journey to support the process.

These supply and demand dynamics are driving the growth of aggregator marketplaces where this process can be performed in one place, and consequently also driving sales of simpler products such as standalone level term assurance. This particular product accounts for more than 50% of sales via the streamlined channel, but only ~20% in the traditional intermediary channel.

As more providers in the market make the strategic decision to participate in the streamlined channel, the ability to achieve financial sustainability and ultimately attractive returns on investment becomes more significant. At this stage, remote referral firms are better positioned by leveraging their partners’ competitive advantages:

- Aggregators have customer brand awareness which generates large volumes of digital leads, most of which are passed on to remote referral firms.

- Remote referral firms are achieving higher lead conversion through upfront discounts offered by aggregators.

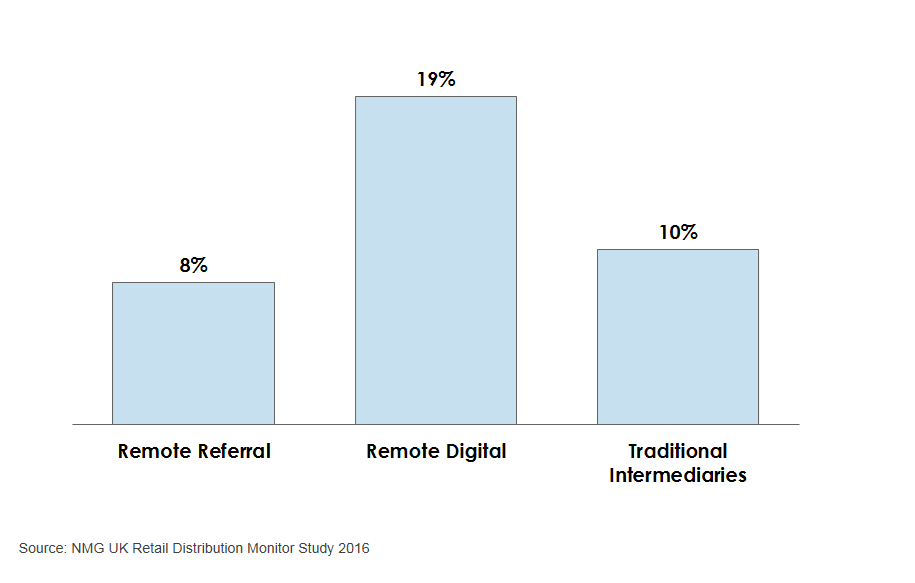

- Remote referrals have better persistency than traditional intermediaries due to lower premiums and lower exposure to adviser review (see today’s graphic).

These are attractive characteristics which highlight the appeal of channel participation.

LAPSE RATES: STREAMLINED VS TRADITIONAL INSURANCE CHANNELS

The remote digital specialist model, on the other hand, is yet to demonstrate financial sustainability. The model also has its appeals:

- Remote digital firms manage the end-to-end customer journey and pay no commission or fees to aggregators.

- They clearly own the customer relationship through the lead generation process and can actively engage in outbound marketing.

- Policies have a higher average case size due to advisers’ ability to cross/up-sell.

However, this is undermined by:

- Lapse rates are around double those for peer channels.

- Competition from aggregators, which are typically much larger, have greater customer awareness, better financial backing, and more ability to target propositions to the customer.

We have started seeing remote digital firms (eg LifeSearch) migrating from the remote digital specialist model to the referral model, and we expect to see more firms following this path.

With its strong alignment to customer preferences and the capability needs of aggregators, the growth outlook for streamlined insurance distribution channel and remote referral specialist model remains strong over the medium term.

In the longer term, the threat of vertical integration looms. If volume reaches a critical proportion of aggregator sales, aggregators may build internal assistance and fulfilment capabilities (as seen in motor and home insurance). This is unlikely to destroy the channel, but may narrow it to customers needing higher levels of assistance.

This is an approach which makes similar sense in wealth (including pensions) and asset management. A material proportion of customers want to self-serve; where they have simpler situations or need basic assistance, the digital tools are increasingly available on the supply side to facilitate this, at scale and in a cost-effective manner.

This will never remove the traditional protection advice channel, but it is an expensive professional service that many customers do not want to pay for. Over time it will likely shrink in relative terms as digital channels mainstream customers, and advice is increasingly matched to those customers with larger and more complex needs.

For more information, contact:

Ree Chen, Consultant (London; [email protected])

Ralph O’Brien, Senior Consultant (London; [email protected])

Where to now?

Shape your thinking: The NMG Consulting proposition.

Our Library of Insights: Trusted by industry leaders.

Follow NMG Consulting on LinkedIn and be the first to read our latest insights and company news.