Rehabilitating UK equity release

Almost a dirty word following mis-selling incidents, equity release in the UK has experienced something of a renaissance in recent years. 2016 saw lending increase by 34% to pass £2bn for the first time, and Q3 2017 surpassed £800 million – the first quarter exceeding that figure and an increase of 18% on the previous year.

This indicates a market expanding beyond £3bn pa. In the context of an overall UK mortgage market of ~£1.3 trillion pa, equity release is a drop in the ocean, but we see plenty of rationale and runway for further growth. In a system short of organic growth, equity release has re-emerged as a small but fast growth niche category.

Historically, equity release sales have been consumer led:

- Aspirational (including at retirement) – releasing equity to make home improvements or to go on that one-in-a-lifetime holiday.

- Debt-led – using equity release to clear an outstanding mortgage; for others it’s to pay down other debts (eg credit cards, personal loans). For some it’s to simply help with paying regular bills.

- Inheritance / “Bank of Mum & Dad” – including helping their kids/grandkids get onto the property ladder.

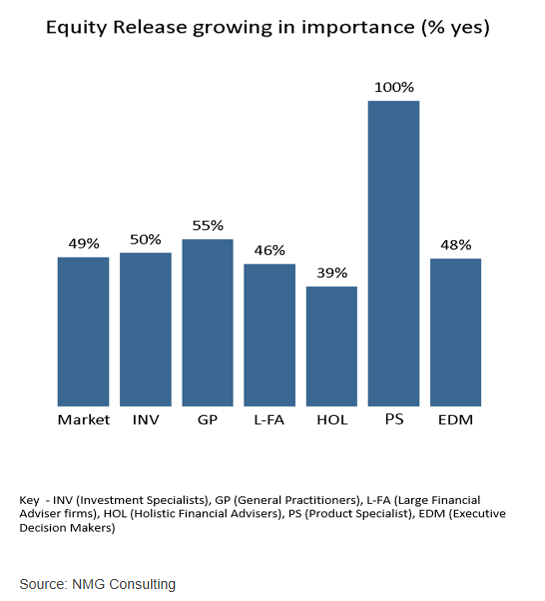

NMG’s annual study of the UK retail wealth market also highlights the recovery of equity release with advisers. Nearly half of the advisers we interviewed expect equity release to increase in importance in their financial planning process, albeit often from a small base. Equity release has a valid part to play when assisting a segment of clients with their long-term financial requirements.

Figure 1: Equity release growing in importance for advisers

The standout adviser segment is the product specialist – firms previously focused on annuities, and which following pension freedoms have had to adapt to the substantial reduction in annuity demand. Equity release has been a logical move for them.

At the heart of the long term growth prospects for equity release is the gap between the income needs of retirees and yield potential of their non-housing assets available for investment:

- Sufficiency – many individuals simply don’t have large enough pots when they retire to fund an adequate (let alone comfortable) retirement, an issue likely to be exacerbated in a DC environment unless additional contributions are made.

- Account exhaustion – while pensions freedoms has improved the flexibility to draw down on pension capital and generate a higher level of retirement income at retirement, the flipside is the risk of exhausting the account prior to end of life.

- Aged care costs – although the UK Government backed away from the proposal to require larger contributions to funding long ?term care, many of the advisers in our study believe it is only a matter of time until public finances demands such initiatives.

As demand for equity release has increased, the market has responded – mostly in productive ways:

- Category brand improvement – this is a category with a tarnished past image of customers ending up owing more than they borrowed. Contemporary products have friendlier customer features including a no negative equity guarantee (NNEG), and the right to stay in their home for life, or until they need to move into long ?term care. Equity release is now a tightly regulated, advised-only distribution product, and the two largest advice firms in the market have also invested heavily in promotion to lift awareness.

- More supply – annuity books were often used to fund equity release lending; with the fall in annuity sales these funding lines are drying up. This has encouraged entrants with different funding (including L&G, Santander), and vertical integration by distributors into product manufacture (including Age Partnership and Key Retirement Solutions with Pure Retirement and More2Life respectively). Asset managers and pension funds are also starting to look at funding equity release to achieve relatively attractive, low risk yields (eg RailPen and One Family). All of this results in an improved market for consumers.

- Better prices – the low-interest rate environment has made equity release more attractive to consumers, with rates available at 4-6%. While some still see these rates as high, a growing number of consumers are attracted, especially given the availability of fixed rates.

This represents a serious rehabilitation of a product category which should have a much bigger role in UK retirement planning given the miserly level of the state pension. But there’s a still a long way to go until equity release moves from a niche to the mainstream. In part 2 NMG will explore the drivers and barriers on that journey.

For more information, contact:

Ralph O’Brien, Senior Consultant (London; [email protected])

Where to now?

Shape your thinking: The NMG Consulting proposition.

Our Library of Insights: Trusted by industry leaders.

Follow NMG Consulting on LinkedIn and be the first to read our latest insights and company news.