Future of ISAs – a tax shelter for high income earners?

In our last edition we looked at the narrowing of the ISA market, in particular the divergence of the Cash and Stocks & Shares markets. Cash ISAs sales have fallen sharply in terms of both the number of accounts and value. Stocks & Shares ISA sales on the other hand, have been largely flat in accounts terms, but have growing strongly in value terms.

The forerunner of the ISA product was the Personal Equity Plan (PEP), introduced in 1986 with the intention of democratising equity investment across the population. PEPs became Stocks & Shares ISAs in 2008, and the annual contribution allowance has been progressively increased from the PEP’s original £6,000 to the ISA’s current £20,000.

So to what extent has the original intention been achieved? The assessment is mixed:

• The biggest pools of contribution volumes are coming from those earning under £100,000

• Those taking most advantage of ISA benefits earn more than £100,000

This shouldn’t be a surprise. As NMG’s new Consumer Wealth Study confirms, relatively few people have significant savings capacity, and the current ISA contribution limit of £20,000 is not far below the UK’s average individual income.

Chart 1 shows that after the contribution limit jumped to £15,240 in 2016, the average Cash ISA contribution stayed in the £5-6,000 range. As a result, the average Cash ISA investor’s use of their allowance has declined, reaching a low of 26% in 2018.

USE OF ISA ANNUAL CONTRIBUTION LIMIT

Source: HMRC, NMG analysis

The prospects of the Cash ISA category were damaged by the introduction of the Personal Savings Allowance in 2016-17 which cannibalised its advantages for many basic rate taxpayers – these had accounted for over 50% of Cash ISA sales. In the absence of a significant rise in interest rates, Cash ISA metrics are likely to keep heading south.

ISAs are becoming a Stocks & Shares story. Stocks & Shares ISA investors have responded to increased contribution limits, with the average contribution now over £10,000. The average Stocks & Shares ISA investor’s use of the allowance has remained in the 50-60% range – they make twice the use of the allowance compared to Cash ISA investors.

Who are the roughly 3 million Stocks & Shares ISA investors? These are valuable customers; identifying and attracting them is critical for ISA providers.

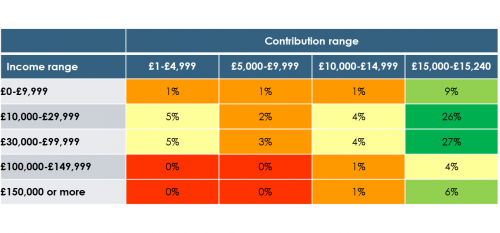

At first glance they look like middle income earners. Chart 2 allocates the 2015-16 Stocks & Shares ISA sales by income bands and contribution ranges.

• The biggest contribution pools came from those earning £10-99,999 and contributing at or near the maximum

• This is evenly split, which means that a quarter of the Stocks & Shares opportunity sits with relatively low-income earners and another quarter with above-average income earners

• Only 12% of Stocks & Shares ISA contributions came from those earning more than £100,000

S&S ISA SALES £’000S BY INCOME 2015-16

Source: HMRC, NMG analysis

But there are a lot of people in the £10-99,999 income range – around 30 million. It’s not quite needle in a haystack, but while most of the contributions are coming from people in this income range, it’s a low proportion, as Chart 3 demonstrates.

PROPORTION OF INCOME BANDS CONTRIBUTING to S&S ISAs 2015-16

Source: HMRC, NMG analysis

• A quarter of the Stocks & Shares opportunity may be coming from those earning £10-30,000, but less than 4% of that segment is participating

• Even for £30-100,000 segment the figure is only 8%

• For the smaller number of higher income earners, however, the Stocks & Shares ISA participation rate soars – to 19% for those earning £100-150,000, and 28% above £150,000

As pension allowances become less generous over time, we see scope for those higher income participation figures to grow further. There are fewer people in these segments (still around 1 million) but if you can find them, they are much more likely to be ISA contributors, or prospects.

ISAs are a narrowing market in more ways than one. The market is increasingly about Stocks & Shares ISAs, and this has become a product category of most interest to high-income earners. That has important implications for providers targeting this market.

ISA providers would also be well advised to broaden the market – a tax-advantaged product with relatively little usage by the mass market is one which will be on the radar screen of a revenue hungry Treasury and future Labour government. The industry has a strong incentive in ensuring that ISAs keep the faith with their origins and do not become characterised as a high-income earner tax shelter.

For more information, contact:

Andrew Baker, Partner (London; [email protected])

Charles Lake, Senior Consultant (London; [email protected])