Platform fees: the new frontier

The way platforms charge clients has been undergoing steady (if not disruptive) change as the large providers have established scale positions and the battle to be an adviser’s ‘lead platform’ has escalated. Most wrap platforms have now incorporated fee caps (setting the administration fee at zero beyond a particular FUM level) and family/account aggregation (combining multiple accounts to reach the fee cap, or to assess which fee tier is charged).

Make no mistake – both of these initiatives have been enormously margin destructive for those re-pricing back books.

On the flip side we have seen the aggressive re-entry of wrap platforms into extracting asset management margin share. Whereas this was previously captured by shelf space fees and rebates (pre-FOFA), the latest iteration sees the platform setting up their own funds and appointing asset managers as subadvisors to manage the underlying assets (normally at a lower price to customer than the manager’s own flagship products, and with a substantial margin share to the platform operator). Along with cash, asset management margin is again becoming an important driver of revenue for platforms, albeit only for those that have scale and are growing.

And most recently, we’ve seen BT fire a long-awaited salvo in the platform scale war by setting a relatively low FUM based admin fee of a flat 15bps capped for balances over $1m and a flat fee depending on the level of investment choice required (sure it’s not the entire fee but it is the headline!). The less obvious impact of this move is that there is no longer much (if any) space in that rate card for licensees to take a cut. In our view, there is now a new ‘naked’ price for platforms.

The introduction of a very explicit and low FUM-based fee begs the question: ‘is this the new benchmark?’

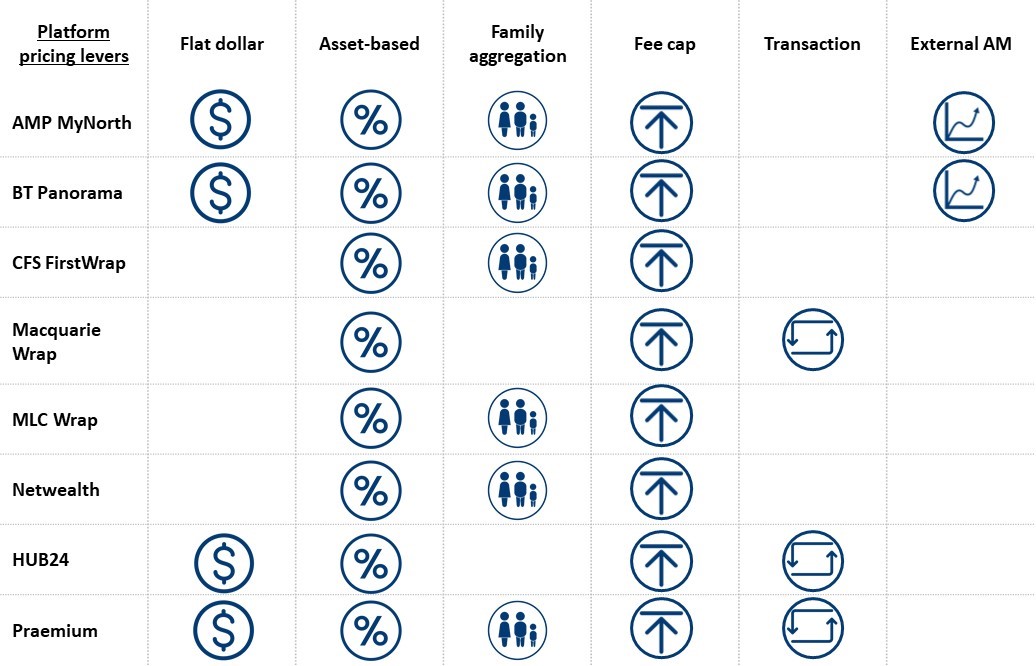

We think it isn’t that simple – the platform pricing landscape is still fairly complex and providers are pulling vastly different combinations of pricing levers, as shown in today’s graphic.

There are still several options open to platforms to structure their pricing and revenue model. As we see it, absent any radically new pricing models there are six key levers available to platforms:

The thing about having so many levers to pull is that there is no single price benchmark platforms should target. Each provider will necessarily make its own decisions on how best to employ these pricing levers and position their product towards their own target segment (ideally whilst avoiding adverse selection). For example, BT’s full panorama menu’s fixed fee of $540pa and variable fee of 15bps works out at a total of 69bps for balances of $100,000 and 20bps for balances of $1 million (and cheaper thereafter), and is therefore likely to be more attractive to higher balances.

Where to from here?

Several factors will drive future pricing of platforms:

• The cost of running a platform is closely linked to the number of customers, so we expect to see more extensive use of flat fees.

• Platforms will listen to investor feedback and reduce transaction and other complex fees (which are currently receiving additional focus due to the growth in managed accounts)

• Any race to the bottom on administration fees will see platforms looking to asset management to recoup some of the lost revenue

Ultimately, this will result in even more complex pricing (& platform revenue models). It will also require advisers to undertake a more complex assessment to determine the total cost of a platform for a given client’s circumstance. Never has there been a better example of how best interest duty will require much more considered assessment of platform alternatives in deciphering what it all means for a client and identifying the best option (potentially over several years and changing circumstances).

This is the start of a new platform frontier – platforms deciding how and where to compete, and ensuring advisers know where their platform is best positioned to suit their clients. As platforms pivot their pricing strategy and pricing becomes more differentiated , a new question arises: can advisers defend a position of using one platform for most clients, or will they be required to use many in order to satisfy best interest obligations?

All icons from the Noun Project: ‘dollar’ by Joe Pictos, ‘percent’ by Ker’ls, ‘family’ by vectoriconset10, ‘arrow’ by Kyle Dodson, ‘transaction’ by Jemis mali, ‘chart’ by Frederick Allen

Where to now?

Shape your thinking: The NMG Consulting proposition.

Our Library of Insights: Trusted by industry leaders.

Follow NMG Consulting on LinkedIn and be the first to read our latest insights and company news.