Revenue Realignment

Topics in 401(k) Distribution: Fourth in a Series

TPA firms which administer 401(k) plans live mainly on 401(k) billed service fees, that’s not startling information. What is perplexing is that after growing steadily for years, the share of TPA firm revenue associated with these fees has declined slightly since 2016.

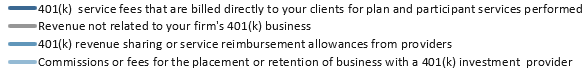

In the nine years to 2016 401(k) billed service fees rose to 67 percent of TPA firm revenue from 58 percent, only to drop back to 62 percent this year. 401(k) revenue sharing or service reimbursement allowances from providers as a share of revenue flat- lined at 11 percent beginning in 2012; commissions or fees for the placement or retention of business with a provider have remained in the three to four percent range over this interval. So what’s up is the share of firm revenue not associated with 401(k)—from 19 to 24 percent since 2016.

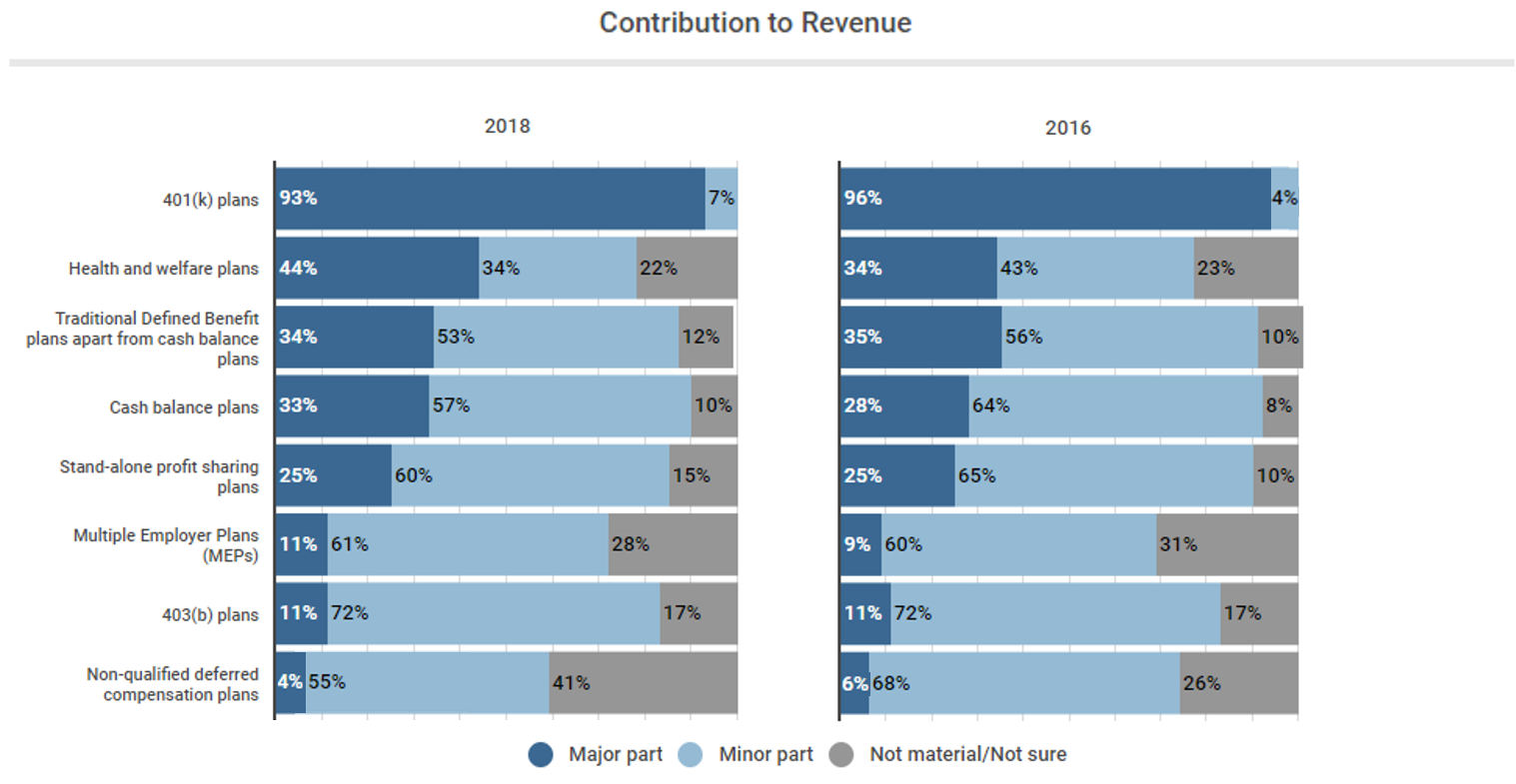

Although only about one in five 401(k) TPAs also administer health and welfare plans, this revenue stream appears to be driving the change. Considered a major source of revenue by only 21 percent of 401(k) TPA firms as recently as 2012, health and welfare plans are seen as a major revenue source by 44 percent of TPA firms today. Most other revenue sources are about as important today as they were six or even two years ago; in this context health and welfare plans really stand out for their growth.

One other conspicuous shift in TPA firm revenue—a 15 point jump in the proportion of firms which consider non-qualified deferred compensation plans not material (or aren’t sure).

Ever cautious, TPA firm owners may be hedging their bets on the future of the 401(k) business. But they can probably relax: 61 percent of 401(k) advisors recommend most frequently a TPA interface or completely unbundled 401(k) service model—both of which require TPAs.

Third Party Administrator studies were launched in 2004 by Brightwork Partners LLC; Brightwork was acquired by NMG Consulting in 2017. Findings are based on TPA studies 1-6; the research is conducted by telephone, typically among a representative cross-section of 250 or more TPA firms which administer 401(k) plans. TPA 6 (October, 2018) is available for immediate delivery.

About NMG Consulting

NMG Consulting (https://nmg-group.com/businesses/nmg-consulting/) is the leading multinational consultancy focusing solely on investments, insurance and reinsurance markets. NMG works with financial organizations to shape strategy, implement change and manage performance. NMG Consulting has approximately 100 employees spread across offices in Sydney, Perth, Singapore, Cape Town, Kuala Lumpur, London, Toronto, Kansas City and Stamford. The firm was established in 1992.

For more information

Merl W. Baker, 203.487.2000; [email protected]