NMG SmartAssets – Top Performer 2020

As the world continues to process the social and economic impact of the COVID-19 pandemic, we have taken a look at how our portfolios performed over the 2020 calendar year. We are pleased with the results, of our SmartActive and SmartPassive portfolios, which have outperformed peers across the Low Equity, Low – Medium Equity and High Equity categories, ending the year in 1st and 2nd place in each category, respectively. Read about our key drivers that led to our 2020 performance.

The dust has barely settled on a turbulent 2020 and the world is still processing the social and economic impact of the COVID-19 pandemic. We believe these conditions truly highlight an investor’s skill (or lack thereof). We are exceptionally pleased with the performance we have delivered to our clients over the past five years, and 2020 has been no exception.

Over the 2020 calendar year, the SmartActive and SmartPassive portfolios outperformed peers across the Low Equity, Low-Medium Equity and High Equity categories, ending the year in 1stand 2nd place in each category respectively.

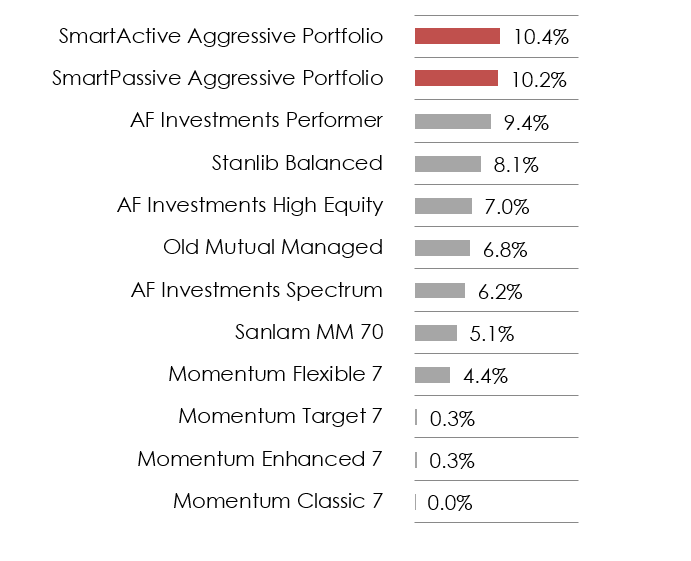

Alexander Forbes High Equity Multi-Manager

1 Year – Gross Return

(Source: Alexander Forbes survey and publishing data/fact sheet)

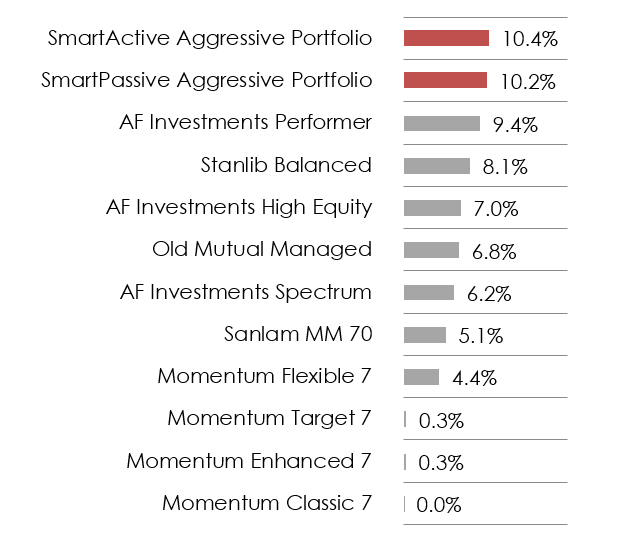

Alexander Forbes Low – Medium Equity Multi – Manager

1 Year – Gross Return

(Source: Alexander Forbes survey and publishing data/fact sheet)

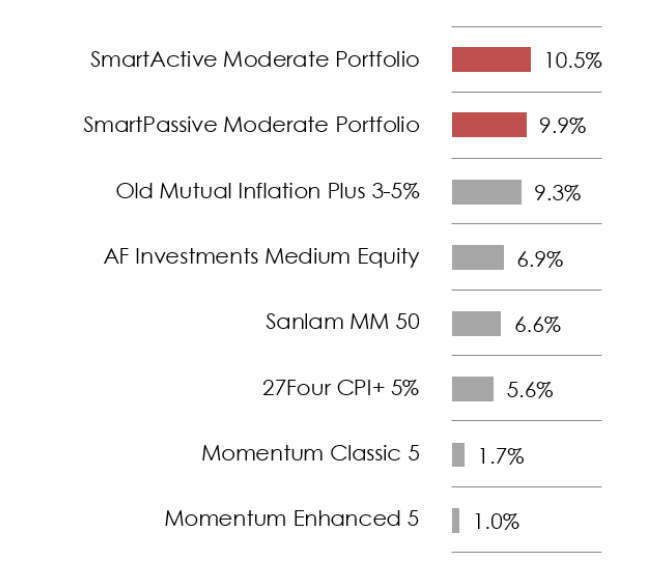

Alexander Forbes Low – Equity Multi-Manager

1 Year – Gross Return

(Source: Alexander Forbes survey and publishing data/fact sheet)

What were the key drivers of our 2020 performance?

Market-leading performance of the NMG portfolios was achieved via three key drivers:

- Optimal, long-term strategic asset allocations aimed at maximizing returns for the desired level of risk.

- Strong performance from our underlying active and passive managers.

- Tactical asset allocation decisions which contributed to out performance over the past 12-months, including:

- Reduction in exposure to local equities

- Higher exposure to local bonds – which outperformed local equities throughout the year

- Lower exposure to local listed property – one of the worst performing asset classes of 2020

- High exposure to international Equities which returned 22.8% in Rands via the MSCI All Country World Index. Within this offshore exposure, the SmartFund range had a high exposure to both the technology and health care sectors which performed remarkably over 2020.

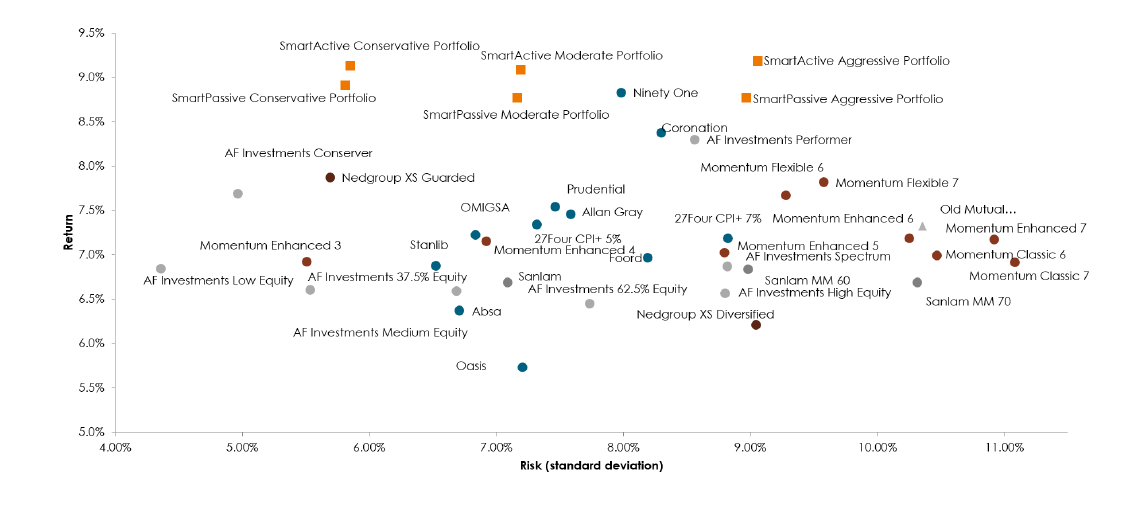

Longer Term Performance:

As proud as we are of our 2020 performance, investing is a marathon and NMG’s focus is on long term performance. The graph below shows that our portfolios produced more favourably, with superior returns for the level of risk, outperforming virtually all competitors.

Seven – year multi – manager scatter plot as at 31 December 2020:

Remaining invested for the long term

Remaining invested for the long term

Investing is an emotional activity. When investing over the long term, we know with complete certainty that there will be bad years with negative returns, but trying to avoid those difficult years by timing the market often destroys value. Most market timers get it wrong – 2020 being a prime example. Those who sold on news of the pandemic missed the rapid market recovery.

Maintaining a high-quality, diversified portfolio is the best protection against the bad years, but it is also important to remain calm and avoid knee jerk decisions during times of turmoil.

The information in this communication is for information purposes and is not intended to be detailed advice described in the Financial Advisory and Intermediary Services Act. The fund, administrator and trustees cannot be held liable for damage or loss suffered as a result of any action that you take based on the contents of this communication.